Summary

Modern Portfolio Theory doesn't work with cryptocurrencies.

In a cryptocurrency portfolio, it's all about managing risk.

As the cryptocurrency space matures, more high level allocation models will become relevant.

Why Modern Portfolio Theory doesn't work with cryptos

Aside from the obvious (that Cryptocurrencies are not companies, they're just software and the network of people involved), MPT asks the portfolio manager to make some basic assumptions.

We are able to estimate the likely return of an asset (to compare it to the likely risk and determine the efficient frontier)

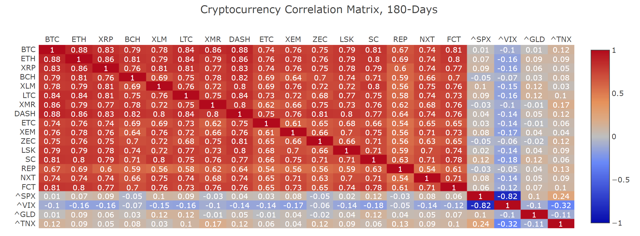

We look for assets that are not highly correlated to reduce risk

Both of these are a big problem for cryptocurrencies, because the probable return is somewhere between zero and 100x, and nearly every cryptocurrency in the top 20 is highly correlated with Bitcoin (at least for now).

Another great article by Hans Hauge over at Seeking Alpha, link below

https://seekingalpha.com/article/4205809-modern-cryptocurrency-portfolio-theory

Good article ! subscribed to you and I hope for a mutual subscription