Some of you may be familiar with the Bitcoin Value Indicator; the attempt at placing the current price of bitcoin somewhere on a spectrum that ranges from high to low, in order to identify possibly buying and selling opportunities in the long term.

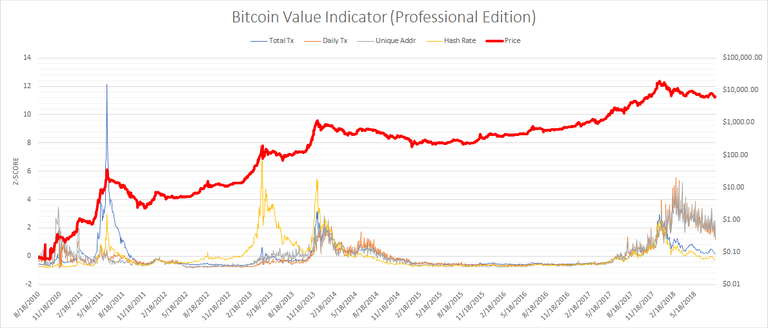

What you're looking at here are four metrics from the Bitcoin network charted with the Bitcoin price over time. The price is on the right Y-Axis in log scale. The four metrics are in standardized Z-score, plotted on the left Y-Axis. The four metrics are daily transactions, unique addresses, hash rate, and total transactions. Each has a high correlation with the log price of bitcoin.

High Z-scores indicate that the price of bitcoin has grown faster than predicted. Likewise, a low Z-score means that the network is growing faster than the price. As you can see, when Z-scores have spiked in the past, it's been a great time to get out of the market. When they have been low, it's been a great time to get in.

As you can see, even though the price of bitcoin still appears to be higher than three of the four BVIPE metrics thinks it should be, we now have one metric below average, and a second one flirting with zero on the Z-score scale.

Predicting the absolute bottom or top of a crypto bubble is not possible. However, using tools like the BVIPE, I think we can get somewhere in the neighborhood.

The bottom may soon be in folks!

You can see the full article by clicking on the link: https://seekingalpha.com/article/4200738-bitcoin-buy-etf-rejection-dip

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://seekingalpha.com/article/4200738-bitcoin-buy-etf-rejection-dip