The market has already lost over a total of over 34 billion dollars since June of this year. To understand what is happening, I believe the best way is to go back in time and learn about history.

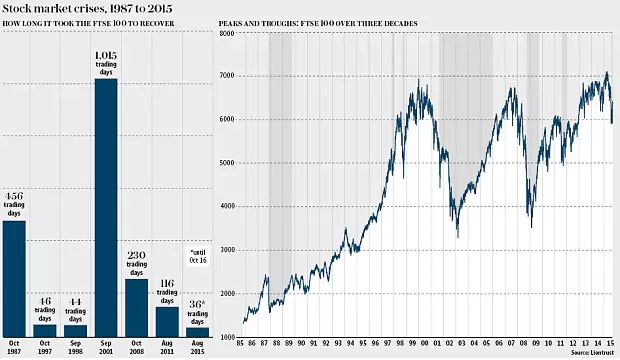

This is the stock market from 1987 to 2015. The data is organized by LionTrust, a fund manager . The chart shows you what the stock market look like throughout the last 30 years and how many trading days was needed for the market to recover after each crash.

Here is a list of market setbacks shown on the graph:

Program trade crash - 1987

Asian crisis - 1997

Russian crisis - 1998

Tech Bubble - 2000

Global financial crisis - 2008

Greek debt crisis - 2011

China’s “Black Monday” - 2015

Tech Bubble

The one that I'm going to mention is the Tech Bubble. To make sure that we are all on the same page, here is a quick definition of what a bubble is. A bubble takes place when market participants drive the prices of the market above their actual value.

The Tech bubble, also known as the dot-com bubble, occurred around the year 2000. Around that time, there was a huge amount of interest in internet-usage. Investors were eager to invest in anything internet related with a “.com” suffice in its name. Large amount of money were thrown into it, which drove the stock prices up tremendously.

Many of the personal investing occurred during the boom. The amount of technology companies rose from 1,000 in 1995 to 5000 by the year 2000. At the height of the boom, many dot-com companies became public companies through the initial public offering, also known as the IPO. Many investors were grabbing every new issues they can. In 1999, there were 457 IPOs, in which 117 doubled in price on its first day of trading. The IPOs allowed the companies to raise a substantial large amount of money before they have ever made profit or realize any material revenue. (Does this ring a bell for anyone? This sounds similar to all the ICOs that’s been coming out.)

Bitcoin bubble in 2013

At the start of 2013, the price of bitcoin was around $12. It then soared to $1,242 per bitcoin, resulting in a 10,250% gain. However, after hitting the year’s high, the price dropped $28% in less than two weeks hovering around $961 per bitcoin. It then continues to gradually decrease in price until it was around $250.

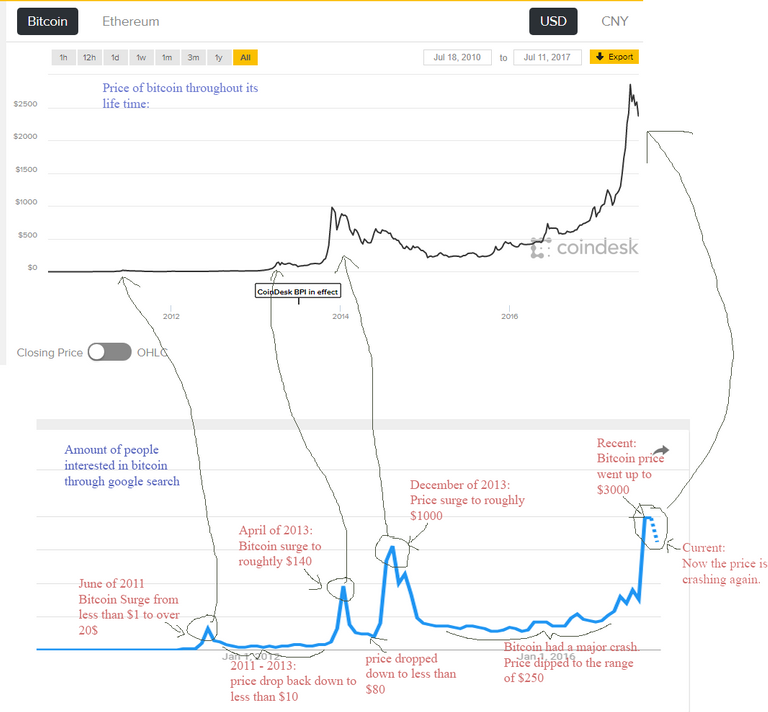

Comparing google trends and price of bitcoin

The first chart shows the price of bitcoin through its lifetime and the chart beneath it is the amount of bitcoin interest via google search. Take a good look at it, I labeled the events that occurred throughout the years and you should also be able to see the correlation between the two charts.

This last chart is the total market capitalization. Just another visual to show the correlations between google search trends and the cryptocurrency market cap.

From what I see, whenever there is a huge increase in price, interests generates quickly from all over the world. This is expected since people are drawn to where the money is. However, whenever the market is driven by too much greed, it is only a matter of time before the market comes crashing down. People are just throwing in money trying to catch the train, this is very unhealthy and is a huge warning sign. Looking at the dot-com bubble of 2000 and past bitcoin bubbles, history is telling us that we are very likely in another bubble.

Source:

http://www.telegraph.co.uk/finance/personalfinance/investing/shares/11931489/Thirty-years-of-stock-market-crashes-and-the-signs-they-were-coming.html

https://www.forbes.com/sites/kitconews/2013/12/10/2013-year-of-the-bitcoin/#7d7cfafd303c

http://www.investopedia.com/features/crashes/crashes8.asp

https://en.wikipedia.org/wiki/Dot-com_bubble

https://coinmarketcap.com/charts/

http://www.coindesk.com/price/

https://trends.google.com/trends/explore?date=all&q=bitcoin

We're not in a bubble, says Charles Schwab: http://www.schwab.com/public/schwab/nn/articles/Where-s-the-Next-Bubble

Thanks for that,really enlightening piece.

It's always nice to see what other people think. Thanks for sharing

I think this aint no bubble at all my friend.

It is merely a much needed market correction.

Overal we are still 100's of percents up from lets' say the beginning of this year.

If you look at the total max. marketcap of the whole crypto-sphere which was ~112 Billion at the last height point.

This a fraction of what the total is being traded in stocks,bonds,derivatives etc.

It is bound for at least a 10x increase over the next 5-10 years being carefully optimistic.

This crypto industry is still very young and immature,current correction has to do with ICO's converting capital to fiat to do real world business,causing so called dumb money to fud out,also especially with the 1st Of August deadline .

They will be back later when smart money have strengthened positions, prices soar again and institutions on the sidelines now are reasurred the market is maturing, start to play the game.

Then serious bubbles will start to develop if there is no regulation in place.For now enjoy discounted prices,millionaires will be made again soon.

Yes I agree, this is a very much needed market correction. The market is indeed still very young

Congratulations @notrodta! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPAll of those bubbles lost Max 50%. We've lost more. I feel the bleeding is near completion. 150, maybe.

Things like that are usually really hard to predict. In my opinion, the best thing to do is just to be patient and stay alert

best to stay on the sidelines and look for a new entry point, although if the stock market goes, EVERYTHING follows suit

Well this may be or not be the case might as well crypto being used as a save haven from the debt based bloated fiat economy..