The Impulse Indicator system of investing tries to spot when a trend in price changes speeds up or slows down. It's designed particularly for fast-moving markets, which should make it interesting for crypto investors.

At the same time, its signals are very simple: red to sell, green to buy, and something else (usually blue) in between. This makes it very easy to judge how to act.

Thank you, Dr Elder

The system is credited to doctor, psychiatrist and trading teacher Alexander Elder, who was born in Leningrad, grew up in Estonia, jumped ship at 23 in Africa and received political asylum in the United States.

The system is explained in his book Come into my trading room.

Two indicators: EMA and MACD

The Impulse system uses two indicators. You don't need to know in detail what they do, but the Web has good explanations.

An exponential moving average EMA (which gives more weight to recent changes) and a common indicator which measures how the price is converging or diverging from the moving average (MACD).

Calculating from the two indicators

Using the EMAs from two periods, one short (12) and one long (26) enables you to produce the MACD, by subtracting the "slow" EMA from the "fast". From the 9-period results from the MACD analysts produce a histogram.

If the EMA and MACD are both higher than the previous period, the impulse (+1) is colored green. If both are lower, the impulse (-1) is painted red. Otherwise it is 0. Fair enough.

If the average is going up and the price is rising faster, you buy. In the other direction, sell.

What was the result?

I ran a test for three months of 2019, from April to July, when bitcoin prices rose from $4113 (on kucoin) to a maximum closing price of $12,355 on 29 June 2019 and then fell back to $10,769.

I finally had 65 days of crypto prices for BTC to score.

The Impulse Indicator is designed as a guide. But how often was it a guide to prices next day?

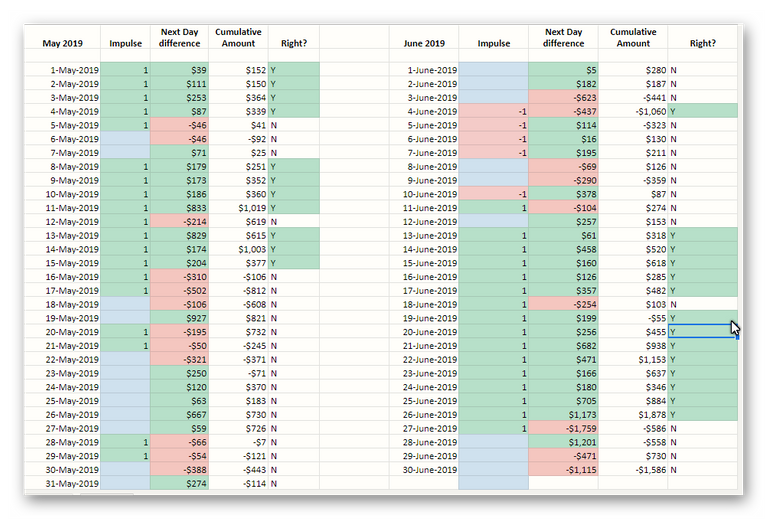

These are the results from May and June 2019:

What counts here is when the impulse color matches the next column, indicating the difference in the BTC price for the next day.

Don't be impulsive

Very few times, some 20 plus, the impulse indicated the right way to go: see the Right? column.

It is hard to see that this takes the professional approach of hesitating to invest and being quick to sell. And less than 50% right is not enough. A coin toss would produce better results, over the long run.

Cumulatively, on 30 June you would have lost $1586, as against $730 ahead on 29 June or $1878 better off on 26 June.

But on 27 June, following the Impulse Indicator, you would have been $586 down.

Interpretation

Whatever the results with stocks, on bitcoin the Impulse's performance suggests that previous trends have little to offer in predicting the likely price in the coming days.

Other factors are at work, and to judge from analyses these are largely "whale" operations by big operators exercising control over the market to "pump and dump" tokens. These may be investors. They may also be "miners", seeking to cash in on the bitcoins they have created, a further stimulus to volatility.

Volatility

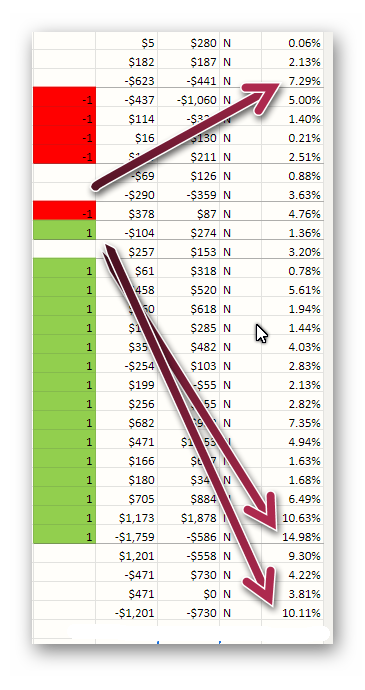

(see previous figure for column identifications)

In my two months of results, volatility — in this case the difference from the day's closing price with the next day's (not a full measurement of price volatility over the day, I agree) — went up to 14.98%, for 26 June, negatively, in three days of extreme volatility compared to the daily average of 3.85%.

Other days of high volatility, however, were surrounded by low ones, giving credence to the view that whales rather than "retail investors" (ordinary punters, more likely around 26 June) were responsible.

Very true. The sudden impulsive decisions may impact the market which will later impact your own investment!

Congratulations @nusefile! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!