On Feb. 28th, just before March came in like a lamb, I and quite a few others attended the Blockchain Law & Regulations Meetup. Thanks to some foreknowledge of the York University maze, I got there on time.

The room was partially full at the time I got there. Unsurprising, as the topic is topical. In the middle of the session, one of the panelists passed on the news of the SEC crackdown on blockchain ICOs. It's the first time I ever heard breaking news in the middle of a seminar.

Before Othalia Doe-Bruce started the session, we saw a presentation on BlockchainHub and the services it's offering. BlockchainHub, associated with York University, is the organizer of a whole series of meetups. They describe themselves as a "Community of Blockchain Professionals" who support "Education, Research & Commercialization." The meetups are only part of their activities as Canada's first blockchain innovation hub.

Once Ms. Doe-Bruce got the seminar rolling, the room filled up. The announcement had billed three speakers. It was a treat to see four.

Aaron Grinhaus: Dearth And Taxes

The first panelist was Aaron Grinhaus who heads up his own boutique law firm carving a niche out in blockchain legal services. He's currently offering legal advice for ICOs as well as tax advice and other services.

The first part of his presentation dealt with that ole debbil taxes. He explained that the CRA (Revenue Canada) currently considers transactions in cryptocurrency to be barter. In Canada 'money' is defined by what Canada law says is legal tender, and cryptocurrency is not so defined. So, from a tax standpoint, paying for your dentist appointment with Bitcoin or SBDs is legally equivalent to paying for it by fixing your dentist's backyard deck.

As for buying and selling cryptocurrency, it's treated either as a capital gain or as ordinary income if you treat the coins as inventory : buying, selling, turning over your capital in doing so. One example is day trading or spread-trading; another is mining, over and above mining as a hobby. From what little I know of the tax system, CRA's treatment is common-sensical in that the revenooers looked for close analogies and applied them to cryptocurrency.

Later in his presentation, he brought up an issue not many had thought of. He distinguished utility tokens from securities tokens. The latter, as we all know, are being scrutinized by securities regulators. As the SEC subpoena swoop showed, they're movin' in.

Utility tokens, on the other hand, are token that are designed to be used as spending instruments and/or as payment instruments on a platform. They're exempt from securities regulations, just as regular money or rewards-points are. On the other hand, they might be subject to sales tax because they're digital goods or pre-payment for digital services. This hasn't happened yet, but Mr. Grinhous foresaw it.

As mentioned above, he gives legal advice on how to structure ICOs to avoid crackdown. He didn't say so explicitly, but the trail was blazed by Ethereum. Set up an offshore company to home the crypto's code and intellectual property, then license it to an onshored entity that issues and administers it: this is now standard procedure. He said that a crypto has a good chance to be treated as a utility coin if its software engineers build the working platform before announcing the pre-sale, as doing so makes it clear that the token's there to be used. He also said that (free) airdrops are very unlikely to be treated as securities, but they could be treated as dividends (especially if they're recurring instead of one-offs.)

If there's a risk of an ICO being treated as a security, it has to be funded the good old-fashioned way: through private angel investing or a group of high-net-worth accredited investors. That's what comes with applying analogies.

He ended with his predictions for this year, which were: greater enforcement, a greater number of class-action lawsuits, possibly new legislation, and the tightening up of interpretation. He did say, as did the rest of the panelists, that the regulators in Canada were pretty open-minded about cryptocurrency and his potential, and were not censorious.

He also cautioned that there was a dearth of clarity right now, to the point where any real legal advice has to rely heavily on the facts of the individual ICO, coin or endeavor.

Ana Badour: Through The Patchwork

The second presenter was Ana Badour, a partner in the Financial Services Group of McCarthy Tétrault. Consistent with her J.D., she took a more academic approach to the subject. But she also told us about the Ontario Securities Commission's OSC Launchpad, which aims to streamline regulatory compliance for up-and-coming fintech initiatives as well as cryptocurrency ICOs.

Although she said that regulators tended to be open-minded, she was well aware that cryptocurrency was neither fish, fowl nor feathered. Bound as they are to already-defined categories, regulators don't quite know what to make of crypto. (This is standard: civil servants take their cues from legislation. As of now, there's no legislation defining crytocurrency.) As a result, several kinds of law potentially apply: securities laws, privacy laws, consumer-protection laws, contract law, and of course anti-money laundering laws (AML.)

She said that AML laws are the most onerous. I can sure think of one Steemer who found this out.

She offered a different take on the privacy issue. For most of us, Bitcoin is sorta pro-privacy and coins like Monero and ZCash are flatly pro-privacy. When I saw her bullet list of topics, I thought she was going to discuss the possible legal hazards of Monero, ZCash and the others. Instead, she explained that transparent-ledger cryptos like Bitcoin could run afoul of EU privacy protections. For example, the immutability of the blockchain means that the Bitcoin network cannot comply with a "Right to be Forgotten" edict. Right to be forgotten requires censorship: censorship for a benevolent purpose, true, but the mechanism of implementation is censoring. This could cause problems down the road if the EU, Argentina or some other government issues an order for so-and-so to be "forgotten" by the blockchain ledger.

She also explained a bit about OSC Launchpad stressing that it's been put in place to help entrepreneurs get a fintech project off the ground. She did caution that going into this regulatory sandbox requires frequent consultation with the regulators.

She also informed us that the Bank of Canada has been playing around with blockchain technology, but is quite skeptical about it. As you'll find out later, the current head of the Bank of Canada doesn't think much of cryptocurrencies.

Katherine MacLellan: The Surprise Presenter

As mentioned above, the meetup featured four presenters instead of the adverted three. Katherin Maclellan was the surprise. She used to work for the Tapscott Group, but is now the Technical Writing Director for BlockTheory.

She stressed the global nature of cryptocurrency and the jurisdictional issues. As we know, crypto is truly global but sovereign governments are national, or supranational in the case of the EU. This opens up opportunity for domiciling yourself is a more friendly jurisdiction. She talked up Estonia's e Residency initiative as a good example of a government offering residency services to a global player. She went into enough detail to convince me that she herself signed up. She certainly liked it.

Amy ter Haar: Bringing Law To The Blockchain

The final presenter was Amy ter Haar who's President of Integra Ledger. She aims to bring blockchain technology to the law, starting with blockchain-registered identification.

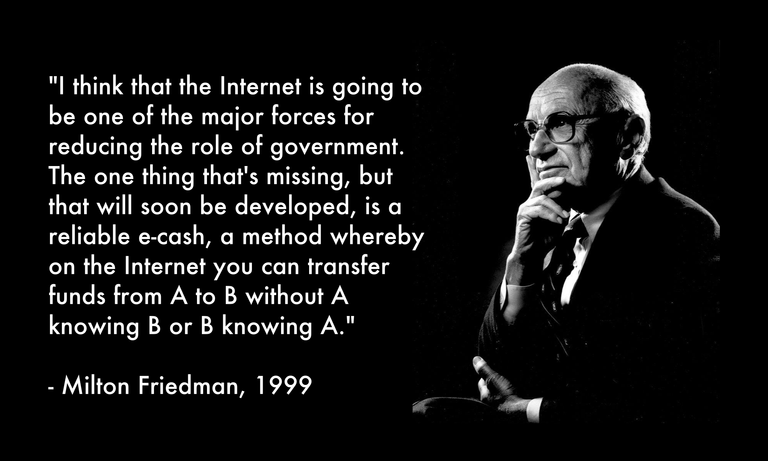

Of the four presenters, she was the most enthusiastic about the blockchain; she also seemed to be the most sympathetic to libertarianism. She started off her presentation with a 1999 quote from Milton Friedman:

How's that for prescient! (Quote-image from here.)

She also showed a clip from a CNBC interview with Stephen Poloz, the current Governor of the Bank of Canada, which made clear that he's on the FUD side of the divide. She had trouble configuring the Apple system to broadcast the sound, so she at first relied on an auto-subtitler that tried to translate his words into rolling text. It was funny how the subtitler sometimes mangled his words: a few of the mistranscriptions looked like Freudian slips. :)

A Busy Panel

After Dr ter Haar was done, all four presenters for a panel session moderated by Globe and Mail reporter Alexandra Posadzki.

There were lots of questions, which showed that the audience really connected with the subject matter. All of the panelists hoped that government will officially recognize (utility) cryptocurrencies as money. All of them stressed that the regulators were generally open-minded about blockchain, although the SEC is aggressive. They elaborated on the consensus view that regulators don't quite know what to make of crypto.

What I found interesting was a dog that didn't bark. None of the panelists, and none of the questioners, anticipated new legislation to authorize a new regulatory agency devoted specifically to regulating cryptocurrency. That kind of legislation might have Hail-Mary odds, but it is a possibility.

Conclusion

This post is a long one, which reflects my own interest in the meetup. It was packed with information and the audience clearly showed that they were listening and learning. I don't have much of a baseline to judge, but it was up-there as meetups go.

One interesting aspect of it was that all the presenters except Mr. Grinhaus were women. That's become quite a trend in itself: women are moving into the blockchain space in droves. As evidence, there are two upcoming Toronto meetups specifically devoted to women and the blockchain; each has gotten a lot of signups.

I'm glad I went, and I wish y'all were there too. To keep this post to a reasonable length, I had to resort to the cutting-room floor. I'm not faulting them, but it's a shame that Blockchain Hub didn't video-record this meetup and post it on Youtube.

Or DTube. ;)

Thanks for reading.

Any thoughts on blockchain regulation? Please leave 'em below!

I guarantee that all answers of mine on the subject will be amateurish and unreliable. :-)

I had been told different about crypto taxes in Canada but i am glad to be mistaken. :)

Yeah; it's essentialy common-sensical.

Thanks for the comprehensive report. While paying taxes is never fun, if an asset is taxed, that inevitably lends some legitimacy to it. And if governments collect substantial revenue from the taxation of an asset class, they are less likely to ban those assets.

Recently it was announced that Coinbase was going to have to surrender account information on about 13,000 customers who conducted at least one bitcoin transaction worth at least $20,000 between 2012 and 2015. It was still possible to buy bitcoin in 2013 for less than $100. I'm sure Americans who bought large amounts of bitcoin and other cryptos using bitcoin during those years on Coinbase are sweating bullets if they didn't pay their income taxes. Paying back taxes, interest and penalties is not going to be pleasant.

That's a really good point; thanks for making it. Ties in well with the secret reason why the U.S. did away with Prohibition: the federal government (and state governments) wanted the tax revenue that came with legal liquor. This knowledge is what's behind the 4/20ers slogan, "Legalize, regulate and tax."

Again, a good point. Hiding ain't the same thing as exempt.

Interestingly, the hard-core HODLers won't be dinged because tax isn't assessed until you sell. But they have been put on notice.

As for Americans, the IRS has this to say:

Thanks for adding those guidelines. I'm sure American readers will appreciate it..in a certain way. ;)

Really meetup is needed for us to gather knowledge from different experience of different person. Your educational post about crypto currencies really helpful for us. Its also motivational, thank you.

Cryptocurrency is really going places and i'm sure very soon the government would accept it as a means of exchange. Especially with the determined and dogged people ready to make crypto a wonder, you guys are wonderful, and your labours, i pray shall be rewarded soon.

jumm interesting.... good post. it is like a advice