Hello again, today I want to share with you a portfolio investment I did with cryptocurrencies. So let start with the basics… What is an investment portfolio? An investment portfolio is a mix of assets like stocks or bonds or another kind of financial asset that has as an objective to minimize risk and maximize returns through diversification.

This is achieved by diversifying risk, this mean that you assign your money in different assets and not only in one asset which could be very risky. In other words, diversification allows the investor to reduce risk without reducing the portfolio expected return.

All these concepts come from what is called the portfolio perspective which refers to evaluating individual investments by their contribution to the risk and return of an investor’s portfolio.

Some other concepts you may want to be related to are:

• Variance: According to Investopedia, the variance is a measurement of the spread between numbers in a data set. The variance measures how far each number in the set is from the mean.

• Standard Deviation: Is the square root of the variance and also measures risk or volatility.

• Covariance: Is a measure of how 2 assets move together. It ranges from negative infinity to positive infinity.

• Correlation Coefficient: It is the result of dividing the covariance of 2 assets by the product of the standard deviations of those 2 assets. It ranges form -1 to +1. A correlation of -1 means that the assets have perfect negative correlation which means that the movement of 1 asset results in the exact opposite proportional movement in the other asset. Vice versa for a result of +1 that would be a perfect positive correlation of the 2 assets.

• Portfolio Expected Return: Is the expected return of a portfolio taking into account the weights and the returns of each one of the assets that conform the portfolio.

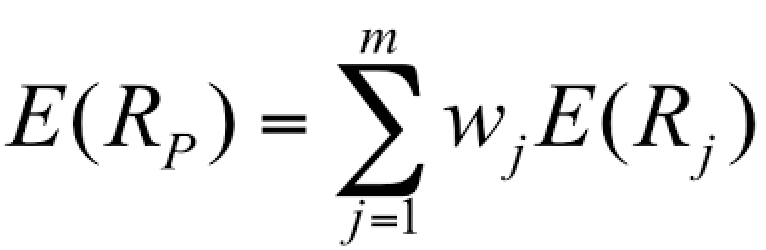

The formula for the portfolio expected return is the following:

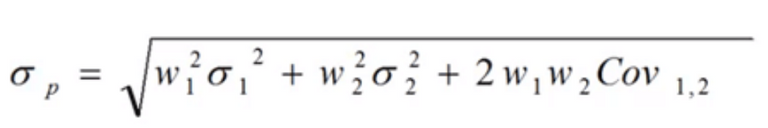

The formula for the Variance of the portfolio of 2 assets is the following:

where:

W1: Weight of asset (1)

(1)^2: Variance of asset (1)

W2: Weight of asset (2)

(2)^2: Variance of asset (2)

Cov1,2: Covariance of asset 1 and 2

So now that we have talked about some basic theory, I want to explain how I create this portfolio. The portfolio is composed by four cryptocurrencies: Ripple, Stellar, Litecoin and Transfercoin.

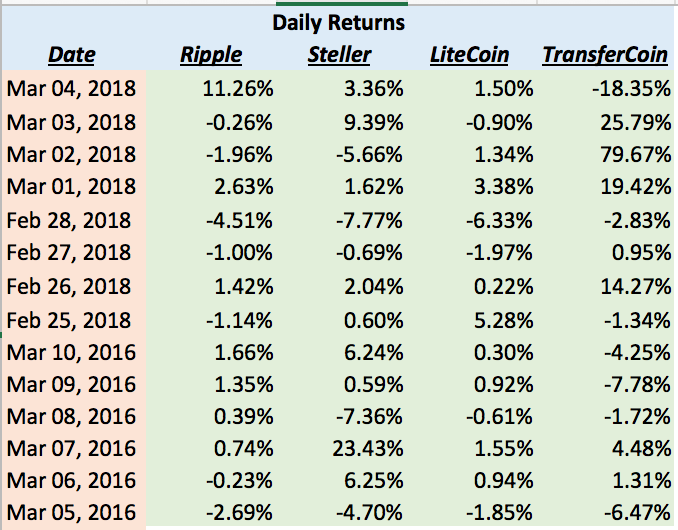

For this analysis I used the historical data of each of these 4 cryptocurrencies of 2 years (730 days) from March 4, 2016 to March 4, 2018. One of the reasons I chose these assets is because I needed to use the same data and not all the cryptocurrencies started at the same day or the same year so some are younger than others.

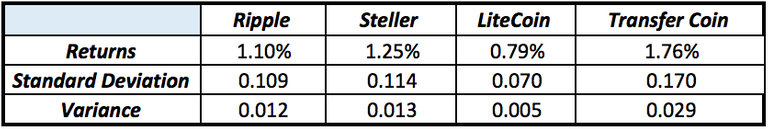

After getting all the closing prices and their respective returns for the 730 days, I calculated the average daily return of each cryptocurrency and the standard deviation.

*Remember that these are average daily returns.

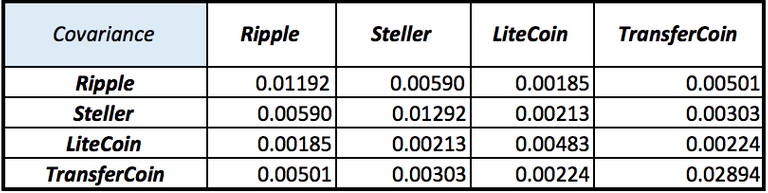

After calculating the returns, I calculated the Covariance for each one of the assets and the results were the followings:

Note: The covariance of the same asset is equal to the variance of that same asset.

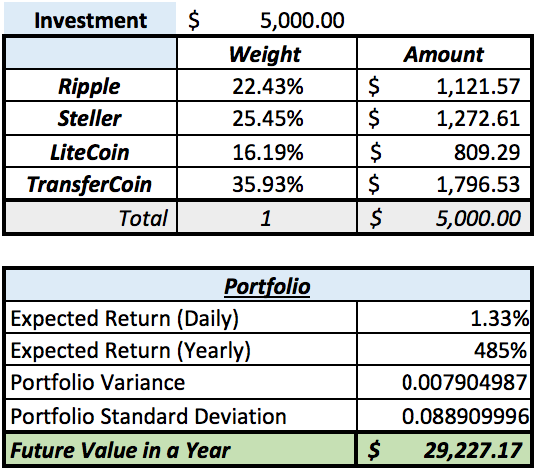

Once I had these results I started to randomly assign the weights and the amounts of investment for each one of the cryptocurrencies in the portfolio in order to calculate the Expected Return of the Portfolio and the Variance. Note: I used a theoretical amount of $5,000 USD as initial investment.

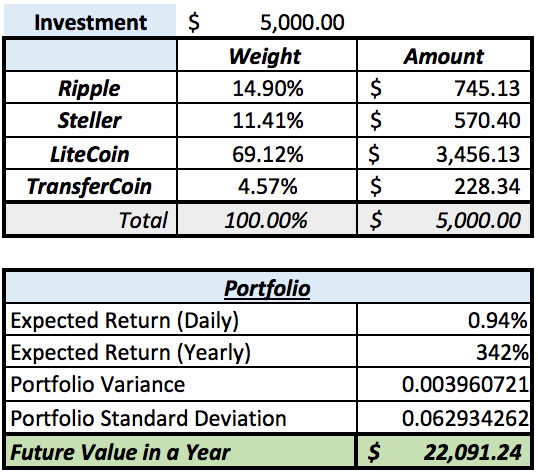

In order to find the weights where the risk is minimized and the return is maximized I used Excel’s Solver application. Using Solver, the optimal solution was this…

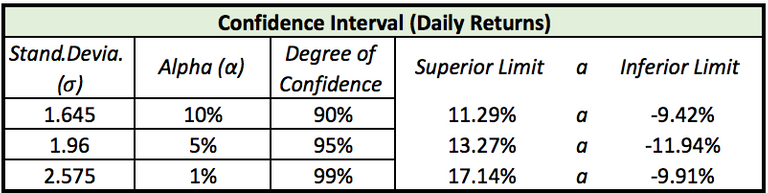

In order to finish this article, I also create a confidence interval. Here we can appreciate the different degrees of confidence and the levels of significance (Alpha). What this table tries to show is the boundaries of the daily returns that the portfolio would earn daily.

As conclusion, after using the last 730 days closing prices of these 4 cryptocurrencies we can see that cryptocurrencies are very volatile, even though we diversified the assets into a portfolio, there will always be a greater risk than a traditional stock portfolio but also a greater return. It’s only a matter of how risk averse or risk lover the investor is.

Remember that the main purpose of this article is just to inform and show my opinion and research with you guys, I do not intend to tell you how to invest your money or give any kind of financial advice. I hope you like it and I’ll be reading any comments about this or any opinions you have about the topic. I will be posting more things like these.

Thank you!!!

Congratulations @oscarho0105! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @oscarho0105! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!