Trading cryptocurrency is a gold rush. Doing wise investment is essential once you have some money. I consider trading an entertaining and challenging pastime. And the most important aspect of trading is risk management. Without risk management one could deplete his budget and game is over, the most important goal is to stay in the game. Risk management includes the wise attitude never ever to go all in, its advisable to trade with low percentages of what you own, every trade includes the risk to lose money, so a single loss should never be too destructive concerning your total assets. Imagine you go all in and lose half of your Bitcoins in a clumsy single trade. It’ll be very bad. So a wise trader always take only a small percentage of his capital for a single trade and then splits that again in some other parts for different entries and take-profits-levels.

.jpeg)

In the Crypto trading world, Exchange Companies lack interoperability hence individuals who should take precaution measures given their amount of capital invested and their trading activities happening in several exchanges, have unfortunately no way to automatically monitor their holdings.

It's quite unfortunate that Crypto investors continue to lack a number of crucial tools that will be necessary for the space to achieve its potential. Key among these are professional-grade trade execution, compliance, position and risk management, and reporting functionality, which still causes them to choose different exchanges when executing various trades.

Unreliable Trade Execution

Carrying out trade execution has some challenges these can be:

There could be fragmentation of digital asset exchanges, coupled with relatively low trading volumes compared to traditional markets, this often creates problems around liquidity and slippage.

Comparatively small order sizes have the potential to consume available liquidity, causing significant slippage from the current market price. This can lead to high trading costs for market participants.

Most exchanges suffers from high latency, Because most existing digital asset exchanges began as small ventures and have grown organically as the market has surged, they often cannot handle large order volumes.

Another which has been a pain to me in trading is the case of a user being locked out of exchanges, in some cases for days, due to technical difficulties. In many cases, exchanges lack adequate customer support, which can increase frustration on the part of traders.

The ability to rebalance portfolios presents another challenge for investors trading across disparate exchanges. Traditionally, rebalancing is a tool used by investors to ensure that trades are made that maintain certain allocation targets across a portfolio that is constantly fluctuating.

LACK OF SECURITY

When it comes to security of our sensitive information(Passwords, Private keys) in most cases it relies on the hands of a third party that is responsible for the security protocols that are applied, this means we aren’t really in control of our sensitive information, and there are multiple cases of hack from exchanges in which their users accounts are tampered with. And this brings about the need for risk management and customer support which is integral to the safety of the funds of crypto traders.

LACK OF REPORTING AND COMPLIANCE

It's of great importance that Institutional entities are also required to keep extensive audit records for both internal and regulatory purposes. The details are often granular to the level of individual traders, triggers to pre-trade limits, and order amendments. But these outputs are not available on most crypto exchanges, and as a result, funds must build proprietary systems at significant expense in order to monitor and log all activity. The exchanges i’ve used there’s not reporting on investment or any updated report on tradings, which is a major challenge.

Compliance is very necessary in any company for it to thrive and for things to go accordingly, and Crypto funds are no exception, but the fragmentation that exists among the various exchanges can make satisfying these needs difficult.

With all this said its pertinent that the Crypto world needs a unifying factor that can bring all trades in a place..

That's where Caspian comes to play!

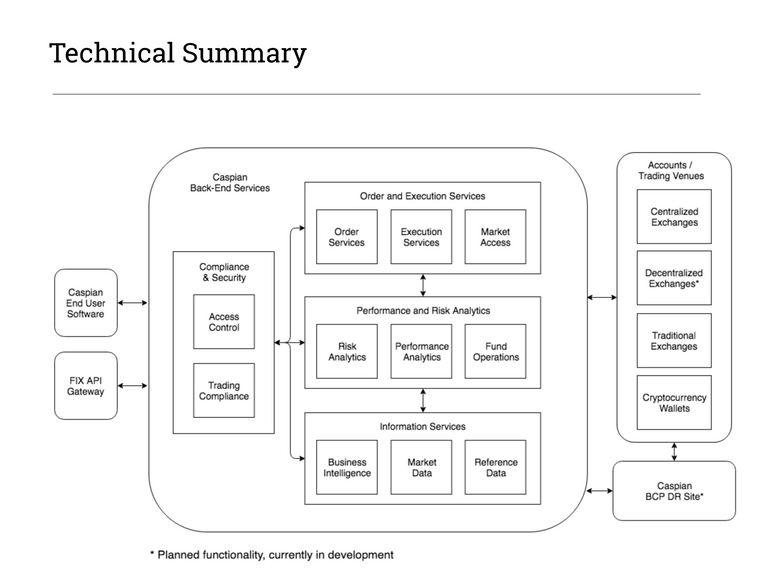

Caspian is an ecosystem designed to solve the problems facing crypto investors using a single, user-friendly interface. It achieves this by providing sophisticated connectivity and interoperability across various digital asset exchanges, helping to bring liquidity, volume, and dynamism to the sector.

Caspian technology is expected to drive further growth in digital asset participation on the part of institutional and experienced investors. Caspian equips investors with a comprehensive OEMS, PMS and RMS, backed by comprehensive customer support. Its features include professional-grade execution, position management, and reporting capabilities.

The benefits of the Caspian platform can be organized into three overarching categories corresponding to the current needs of the crypto-trading space: Execution, Position Management, and Compliance. I’ll hence be stating them and also giving their benefits

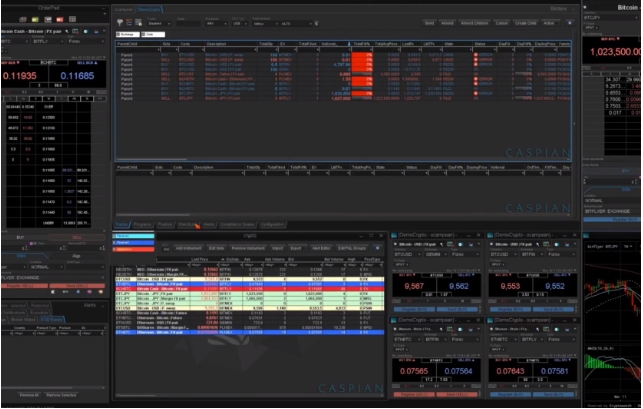

It's interesting that withCaspian I have a unified control center optimized for fast trading, which will serve as the main hub me while trading my Cryptocurrencies.

Caspian single interface provides the following:

Caspian makes it easy for me as a trader to select major digital asset exchanges through a single interface. For each specific exchange, OEMS enables access to all order types, asset types, and ticket sizes supported by a given exchange.

Caspian is providing APIs allowing traders to stage and send orders and slices; obtain order, execution, and position information; and receive pricing information, exposure breakdowns, and other transaction information.

When trading it's very necessary to view prices, bid/ask, and know depths for each exchange to the smallest available ticket size Caspian provides traders with that. And also the :

● Ability to stage, send, and amend orders in multiple ways, including single-click

orders sent directly from the price depth; user-defined order shortcuts; and order staging and slicing.

● Ability to view and manage margin across multiple exchanges.

● Ability to view the progress of each order or order slice. Users can receive alerts about slippage or time-to-fill, allowing them to take action depending on market conditions.

● Ability to utilize workflows across multiple distinct users and user roles. A single organization can assign different roles to its members, e.g., portfolio managers, traders, compliance officers.

Caspian PMS and RMS together allow me as a trader to monitor positions, P&Ls, and exposures and to maintain detailed records of each. They sit downstream from the OEMS, which sends them all execution and order information.

While the OEMS is designed to be light and nimble for fast trading, the PMS and RMS record and track every piece of data in perpetuity. This allows an investor to view all of its positions and historical data at any time. Using these features, users can maintain a complete book of records for a given trading entity and can view the data in real time or historically.

In the future, existing risk features from the Tora platform will be ported to Caspian , including value at risk, shift scenarios, and stress test scenarios.

Caspian is also making sure that accounts are being reconciled, thus making sure that transactions are carried out as agreed. We can also see that rebalancing is lacking in the normal exchanges, rebalancing can help generate orders that continually bring the fund back in line with its objectives.

Allocation engine: With this technology I will have transparency of transactions, The allocation engine allows trading through a single order and a single exchange account, even if the result of the trade is intended to be distributed to different funds, portfolios, strategies or other business units, this helps the trader to achieve a good execution order.

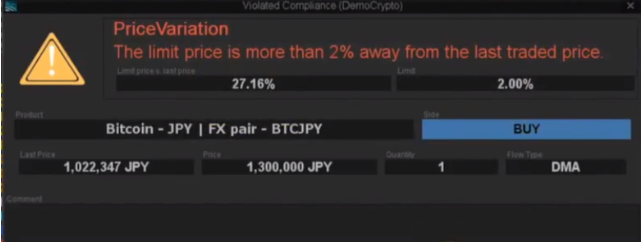

The compliance engine provides multiple levels of functionality to address user defined limits

and rules covering both pre-trade and post-trade workflows.

● Pre-trade limits, which include simple limits as well as more complex portfolio or trading parameters such as exposure limits. These limits can delay order execution until compliance checks are complete. They can be triggered at various stages of a trade, including staging, sending, or amending an order. There are three levels to the limits: warning limits, which can be overridden by the user; approval limits, which require a supervisor to approve the order before it can be sent to market; and absolute limits, which cannot be overridden.

● Post-trade compliance includes alerts, monitoring, and reporting. Alerts and reports can be delivered to users via email or other mechanisms, either on a schedule or as they occur.

A view of Caspian Compliance Window

A technical Example of Compliance Report

With Caspian there will be robust reporting capabilities, consisting of simple “flat file” reports such as trade files, snapshot reports, position data, audit reports, and compliance reports.

These options offer me flexibility in preparing graphical reports and other external-facing materials.

Caspian enables allow me to design report templates including graphs, editable tables, and filtering. Users can then schedule and receive graphical reports directly in PDF, in Excel format, or in Powerpoint.

Importation of Data: With Caspian I can import data provided by each exchange via its protocols and APIs, focusing the information into a single portal which users can use as a “one-stop shop.”

This includes execution data, instrument information and instrument prices (both real-time and mark-to-market), margin and account information, and volumes and liquidity information.

Online Dashboards: With Caspian I will be able to harness a number of associated dashboarding functionalities. In particular, it will enable customizable web dashboards, enabling me to:

● View web-based visualizations on an ad-hoc basis, including exposure breakdown graphs, margin reports, and order fill status.

● Amend visualization in real time by adding formula columns to tables or changing chart types.

● Save amended visualizations as both a new report that can be scheduled and sent as a file, and as a new dashboard that can be viewed online.

Caspian is a cloud-based platform, with distributed services built around a microservice architecture, and functionality accessible via thin UIs and APIs. It helps users create significant flexibility, allowing the platform to accommodate solutions ranging from private clouds hosted in a client’s traditional data center to environments supporting large numbers of clients hosted on cloud computing platforms provided by established players in the space.

With Caspian I can be able to handle large volumes of data while ensuring low latency for messages on their way to and from the exchanges.

Caspian partitions data and communication channels into distinct spaces for each client.

Backend services are configured to handle one or more such partitions, aiming to keep the load of each instance below a set threshold, with setup closely monitored. If an upper capacity limit is reached, re-partitioning occurs and new instances are automatically or manually launched (depending on specific client needs) to cover the new distribution.

Reliability is a key in trading and in the financial world. Caspian built on Today system, is leading 99.99% uptime in the past ten years of operation.

Security is paramount. With Caspian my privacy and integrity of all data is safe.

Any solution is only as strong as the support around it. On this front, the digital asset

space has been historically weak. Caspian will leverage the resources of Tora and Kenetic to offer a professional, multilingual product support team based on an initial Service Level Agreement.

An advantage and a challenge to the crypto space is the rapid pace of change. Any solution must be able to quickly adapt to new tradable products, new exchanges, new digital assets, and new technologies. In many cases, this requires actual development, making a skilled, flexible, and adaptable development team even more critical. By leveraging Tora’s development team of over 150 people, Caspian offers this flexibility.

Every action I make in the

Caspian system is timestamped and recorded, providing a detailed audit trail, where any information like the time, enables me to track any change back to its origin while providing sufficient information for any regulatory audit.

i've been trying to invite my forex trader friend to start trading Cryptocurrency but he is afraid that he might lose money due to too many complications and technicalities in trading I immediately introduced him to Caspian and he loves the idea and starts trading he also talks to his fellow forex traders how it's easy and secure and there is now a mass adoption in trading Cryptocurrency in my area.

A crypto investment company is helping it's users trade there coins and bring profit to them on a daily bases, but they're are having difficulties in executing transactions and having up to date reports on trading and because of this they are losing customers and it's stressful trading in different exchanges but with Caspian there problem is solved automatically.

Here are some of the plans by Caspian that will help people to massively adopt Cryltocurrencies and easy trading.;

● Partnerships with existing exchanges to speed client acquisition and facilitate introduction to high volume traders.

● Customer outreach through service providers such as fund administrators.

Caspian plans to connect with various service providers that work with new and existing asset managers evaluating the crypto space. We expect these relationships to be a major source of new clients looking for an institutional-grade trading platform.

● Promotion of Caspian through events, trade shows, conferences and meet-ups.

● Online marketing strategy focused on institutional and experienced traders.

.png)

The Caspian token (CSP) is an ERC-20 compliant token to be issued on the Ethereum blockchain. The CSP token model has been designed to serve several principal objectives. In the broadest sense, the goal is to link Caspian best-in-class functionality with a token that incentivizes platform use and the development of unique third-party tools and features. Specifically, the token is intended to create a rich, participatory ecosystem where platform users also become community members with an active interest in the platform. This is accomplished by giving the token user-to-platform utility (discount and governance) and user-to-user/developer utility.

Caspian is definitely removing stress and so much risk from Traders, they're making it easy to trade and with all the bad news about exchange hacking, Caspian is making sure your funds are totally safe from hackers, making it possible for you to manage all your trading platforms in a single interface. Even if you're a novice in trading with the regular report on investments you can be able to understand how trading goes making it possible for you to predict markets..

With this I strongly believe that the mass adoption for Cryptocurrency will be a lot easier, both traders and institutions will massively adopt this platform Caspian!.

An image of Order Window

Video of Compliance Demo

Video of Order Execution Management

Disclaimer: this article shouldn’t be taken as financial advisement as it represents my personal opinion and views. I have savings invested in cryptocurrency so take whatever I write with a grain of salt. Do not invest what you cannot afford to lose and always read as much as possible about a project before investing. Never forget: with great power, comes great responsibility. Being your own bank means you’re always responsible for your own money

Now let’s watch this video made by me on Caspian technology

Caspian Intro Video

Caspian’s senior management team brings decades of combined experience in finance and technology. Members of the Caspian team have held senior roles at well-known investment firms and technology companies, and several were early adopters of blockchain technology. In their respective roles at Tora and Kenetic, they have proven their ability to work effectively together building financial and trading solutions that have achieved major success.

.png)

.png)

.png)

Caspian PARTNERS

MORE INFORMATION AND MATERIALS

Caspian Website|Caspian WhitePaper|Caspian Steemit|Caspian YouTube|

Caspian Telegram|Caspian Videos|Caspian Blog|Caspian Events|Caspian News|Caspian Linkedin|Caspian Management|

hereThis is an @originalworks contest you can join

My tweet on Caspian

caspiantwitter

caspian2018

@contestbot

Congratulations @ozurumba! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPSponsored Writing Contest!

This post has been submitted for the @OriginalWorks You can also follow @contestbot to be notified of future contests!