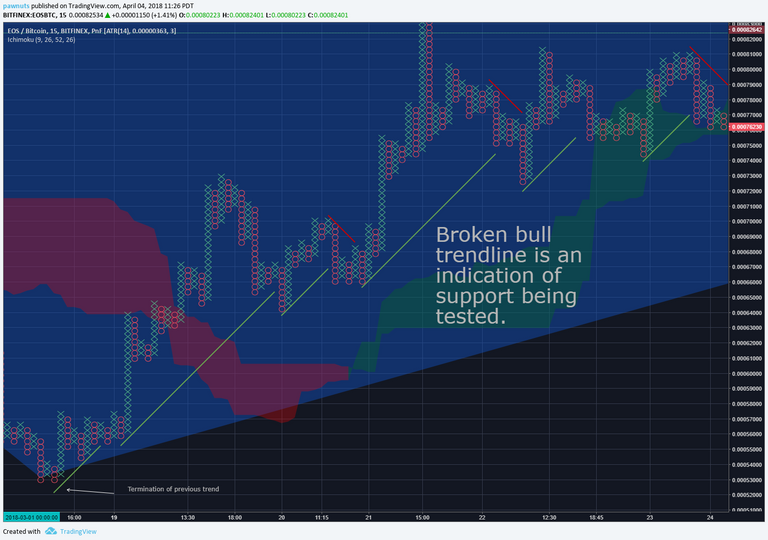

March ended with approximately a zero net gain/loss. we saw the February decline terminate in the first half of the month followed by a shakey but consistent uptrend. EOS on correction during the upward leg is consistently testing support suggesting an inclination towards the bearish side.

However, this is counteracted by broken resistance levels that suggest a more bullish outlook on termination of this rising triangle.

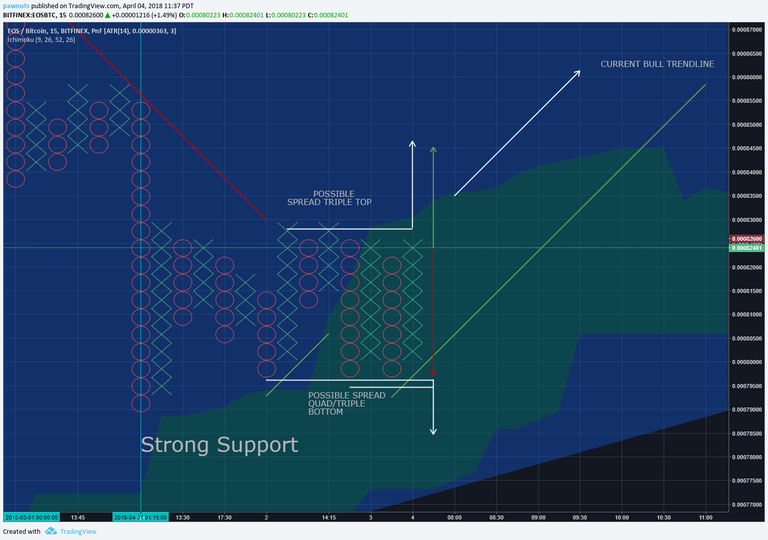

Currently (4/4/18 18:45 UTC), a spread Triple Top may be forming and strong support would lead me to suggest this will be the case. However, an alternate less likely pattern might unfold - A bull trap followed by a Spread Quad / Tripple Bottom formation and a movement in a downwards direction.

Historically though, when presented with ambiguous direction over an Ichimoku support cloud the price bounced.

Please, subscribe if you like these posts!

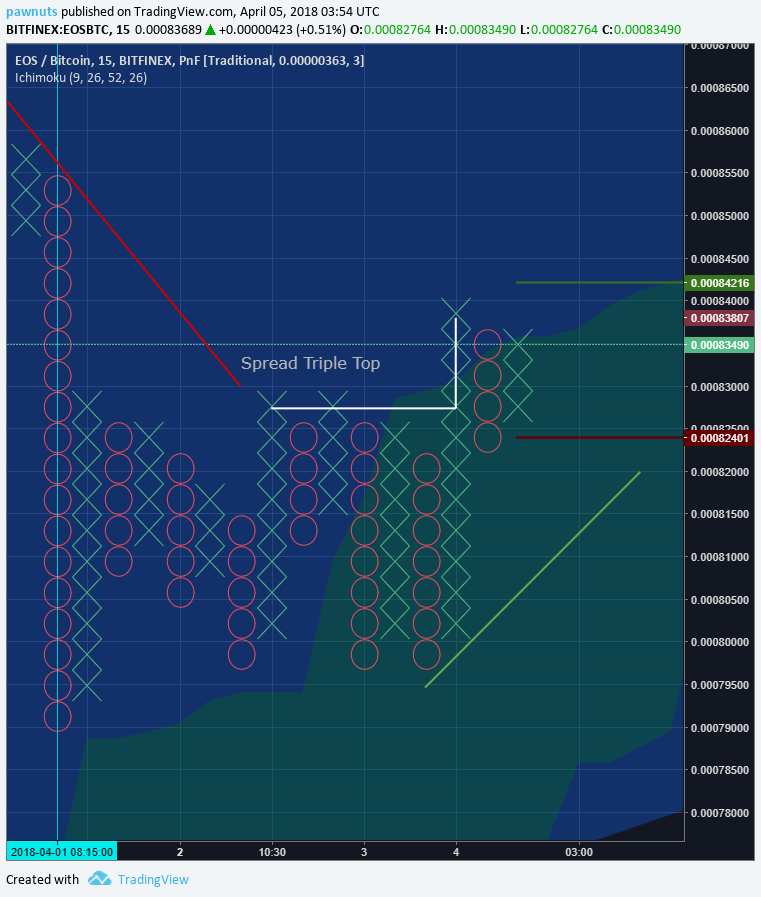

UTC 03:54 UPDATE:

A Spread Triple Top has formed. If the price goes above 0.00084216 before reversing then this signal is locked.

Hey there, I'm just a local trading nut weighing in with some opinions. I would say that a broken bull trendline is a bullish sign more often than not, depending on the context. To me the price action of EOS since Mar 16th is actually bullish, with the broken bull trend lines and subsequent reversals. I suppose with time we will see.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.tradingview.com/chart/EOSBTC/dVEomkri-4-4-18-EOSBTC-P-F-AN-ANALYSIS-OF-MARCH/