Utilizing leverage when trading crypto on margin allows traders to control much larger positions than they could do otherwise on a basic buy/sell exchange, but, with the exact same amount of capital originally invested.

How large the position becomes is determined by how much leverage a trader takes advantage of, as their capital is multiplied by this number.

For example, a $100 deposit with 50x leverage increases to a $5,000 position, or, with 100x leverage increases to a $10,000 position.

Therefore, a successful trade’s returns are relative to this increased position size and obviously much more rewarding. If a leveraged trade is unsuccessful all that can be lost is the initial deposit, as accounts cannot go into minus or become in debt to a trading platform.

So how do you get started?

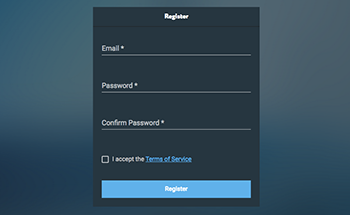

Step 1. Sign up

Register with a leverage providing crypto trading platform. Currently, the best options are Prime XBT or BitMEX as the only two platforms which offer as much as 100x leverage.

Prime XBT extends this leverage to BTC, ETH, LTC, EOS, and XRP; whereas BitMEX limits 100x to BTC only, and less on all other available assets.

(To keep it simple, I’ll use Prime XBT as the example moving forward, as different platforms have slightly different procedures and between the two Prime XBT is simpler to operate.)

Registration takes 30 sec or so, with only an email as verification required - no lengthy KYC and/or AML procedures.

. . .

Step 2. Fund Account

This can be done directly with Bitcoin, or with almost any other altcoin, as well USD or EUR via the platform’s integration with Changelly - which converts the currency to Bitcoin there on the spot.

It’s important to understand that the margin requirement is the minimum amount needed to keep a position from being liquidated. Traders are advised to keep a sufficient buffer and never utilize 100% of the available margin.

. . .

Step 3. Calculate Margin Requirements and Leverage

The margin, or ‘required deposit’, can be considered as collateral, which means that if the trader suffers a loss they have enough funds to cover that loss.

Margin required = total value of trade divided by the leverage.

So, let’s say a trader wants to long/short a position of 1 Bitcoin worth $4,000.

To calculate the margin required for the trade, the trader would have to divide the total value of the transaction ($4,000) by the leverage provided for the trade.

Therefore, the margin amount required for the trade at 100x leverage is calculated as $4,000 / 100) = $42. Thus, the trader will need at least $42 deposited into their trading account.

Within the platform in the ‘trading information’ section, Prime XBT warns:

“a trader should never open a position while utilizing maximum leverage, otherwise, they risk being stopped out in case the market moves opposite direction”.

. . .

Step 4. Place Trade

There are several ways to place an order on Prime XBT - from the ‘Watchlist’ widget, the ‘Chart’ widget, or from the ‘Dashboard’ widget. To trade long you would click the green “buy” button, and/or to trade short you would click the red “sell” button. Upon doing this a window will appear providing further options, such as the choice to add stop-loss, protection, OCO (one-cancels-the-other) orders, in addition to the basic market and limit orders.

These several different order types allow traders to implement advanced trading and hedging strategies, effectively to reduce risk and increase their profit potential. Furthermore, existing orders can be modified or canceled at any time.

. . .

What’s a Margin Call?

A margin call is issued to a trader at the point their equity equals or drops below the required margin amount.

For example, let’s assume that a trader has an equity balance of $3,000. If a trader has leveraged 100x on a $100,000 position value, they have locked $1,000 as the margin requirement of 1%. Now the trader has only $2,000 as “free equity”.

If the trade goes badly and the value of the position drops to $98,000, the unrealized loss will be equal to -$2,000 and the available margin (available equity) has been “eaten up”. The platform will issue a margin call and close the position at that point.

However, if the trader is confident the market will turn and the trade will profit with given time, they should add additional funds to their trading account BEFORE it reaches the margin call level.

. . .

Trading with high leverage is inherently riskier, like all good things - high risk = high reward. Risk management strategies and planning is essential, in accordance with thorough technical analysis of market trends.

The benefit of trading on an advanced trading platform like Prime XBT, is the ability to trade with the trend and profit on both rising, falling, and even flat trending markets by going long or short, with the power of greatly increased market exposure that leverage provides.

To learn more, head to https://PrimeXBT.com.

😁👍