The Hurdle

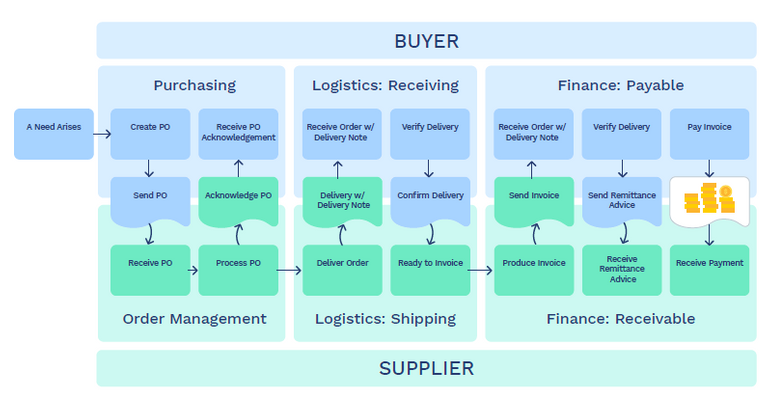

Between two businesses transacting, the customer to supplier protocol is a chain of protocols that can span the length of weeks to months. The purchase-to-pay process for the customer and the order-to-cash process for the supplier has a length of intermediaries that make it so. This is the obvious cause for payment delay between the two parties and this affects the work flow and cash position of both parties. see case below:

Source

Why Is This Platform Relevant?

Across the globe and in all stable countries, small businesses contribute vast revenue to the economy. Using OECD for instance (Organization for Economic Cooperation And Development), an organziation comprising of 35 nations, 99% of the enterprises registered are small businesses, in fact, 97% of U.S enterprises are small and mid-sized businesses.

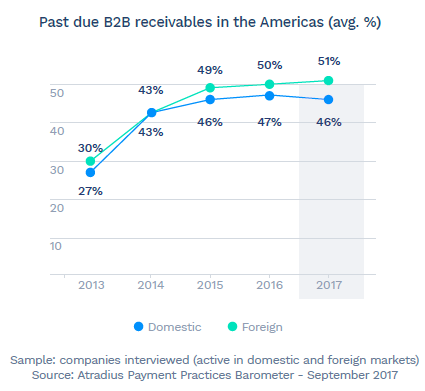

As at 2017, 48% B2Bs showed that payments were not made when due. That statement comprises at least a thousand SMBs put in a precarious situation.This crisis has made banks take precautionary measures against SMBs. Small businesses are less likely to acquire a loan than larger enterprises. This is because the payment delays create credit gaps that denote credit unworthiness and as such, giving loans to SMBs are considered higher risk and less profit.

source

Remember to note that SMBs provide a larger scale of employment and as such stifling the growth of these businesses also hurts the economy. Also between the buyer and supplier, there are financial departments in between that handle the mega load of transactions, this leaves room to error and fraud but thankfully here is a platform that aims at eliminating all of that.

What Solution Does InstaSupply Provide?

As defined by InstaSupply, their platform will provide a centralized workflow for buyers and Suppliers to manage their payments and collections, this eradicates outside parties such as the financial departments. Their platform collects the data from both sides, allowing users to create and place purchase orders, track deliveries and match orders to corresponding invoices. This mechanism allows the user to manage their expenses, allows them to also review, accept or reject an invoice.

No Lagging, Speed All The Way!

Invoices accepted are paid and pushed to the financial software that handle them, requiring manual recording by customers. Funds and net fees are received under 24hours in transparency. An unlimited number of invoices can be settled and remittances are sent, therefore all accounting is current.

source

User Managed Automation Policies

• If a PO and delivery is on the system and matches the invoice, invoice is approved. If there is no PO or a PO does not match an invoice, manual approval will be necessary.

• Funds are the released to the supplier if they have opted for Token holders will have access to services such as:

Why Does InstaSupply Have A Token?

The token is Payblok, a token sale that will provide interested businesses with access to the following:

• An Integrated Payment Solution

• Supply-Chain Financing

• Asset-Based Lending

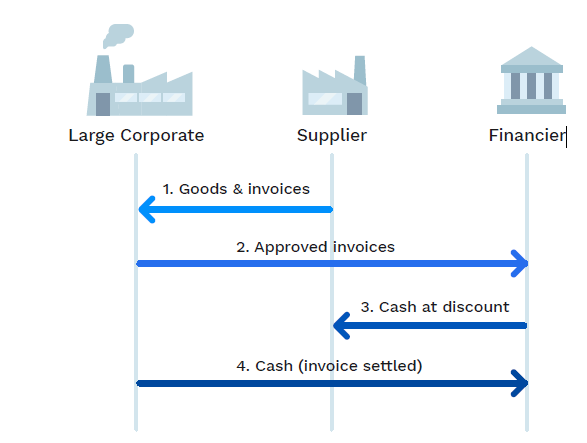

Who Gets Supply Chain?

All suppliers can access this feature, however suppliers with Payblok in possession will be offered great discounts.

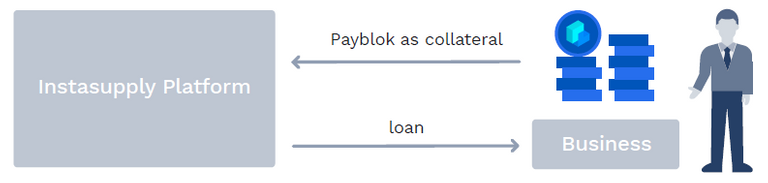

What Is Asset Lending?

The asset in question is the Payblok token. It will be used as collateral; when a loan is not repaid, the Payblok equivalent will be collected by InstaSuppy.

source

Great Incentives!

InstaSupply is backed by a great team and they understand the problems SMBs face. The transition from normal protocol to a centralized platform that will handle all aspects of transactions would ofcourse disrupt businesses. It is because of this, that InstaSupply has laid out a rewards system that will not only be profitable to businesses but also promote growth in partnerships.

• A 0.5% reward in Payblok for total value of each invoice paid on the platform.

• Approving or verifying invoices early and taking an early payment discounts also attracts another 0.5% discount of Payblok rewards to both the Payer and Payee.

• Businesses receive 1% of all payments that referred businesses process in their first six months.

In Summary

InstaSupply is a one-stop platform that handles everything in-between and removes the credit gap on both books of the customer and supplier. It aims at making transactions faster and aiding SMB growth. It could become a monopoly on its own in the nearest future and with 2300 businesses already on board, it is well on its way there.

Websites:

http://www.instasupply.com/

https://payblok.instasupply.com/

Also you can read up from their whitepaper:

InstaSupply And Payblock

A review article by

Raybae.

Congratulations @rachelrick! You received a personal award!

Click here to view your Board of Honor

Congratulations @rachelrick! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!