Let’s get this straight from the outset. Most people in America are not like us reading posts on Steemit, they’ve probably never heard of it. They’re not your early adopters of technology, they didn’t get the iPhone when it first came out, they probably still need help with their computers, and I’m positive there are dozens of other cases we can bring up to prove the different layers and difficulty of humans adopting a technology.

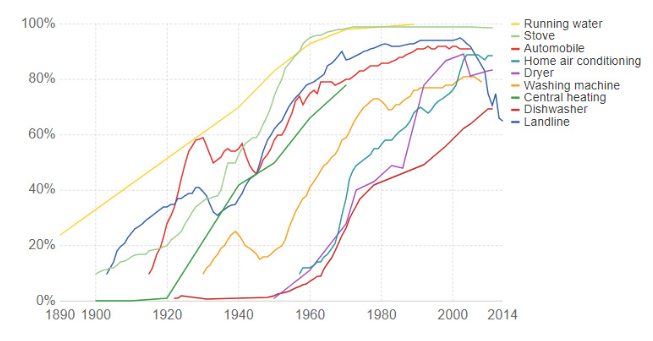

Humans, in general, are slow in adopting new technologies. Going back to 1876, when the telephone was invented, we can see it took almost a century for every household in America to adopt one. Similarly, the trend has happened with the automobile, dishwasher, dryer, and many more innovations (as shown in the graph below), all of which are considered essential nowadays. These “essential” technological advances have all gone through their own set of problems, criticisms,

moments of doubt and uncertainty —forging their own unique, but similar adoption paths.

Bitcoin and Cryptocurrencies are following a similar path to previous technological innovations.

I’m no expert in cryptography or blockchain technology. What we’re looking here is not their highly complex cryptographic systems and development, but technology through the eyes of humans, the different stages they go through, and their rate of adoption — in particular with the US population.

The first Personal Computer was released around 1975 in the US, but it wasn’t until the late 1980’s after companies like Dell and Gateway were started, that the general public had access to them. At that point, they still weren’t considered a massive success. However, in the late 1990’s they made huge progress among early adopters and certain industries when PC’s became cheaper and processing power got faster.

For a long time, they were considered a temporary fad. But then in the early 2000’s, after the Internet had been around for a few years and computers became more powerful, consumers were able to stream music, play games, chat with others online, create communities, and much more — making PC’s the essential and “cool” thing to own at home.

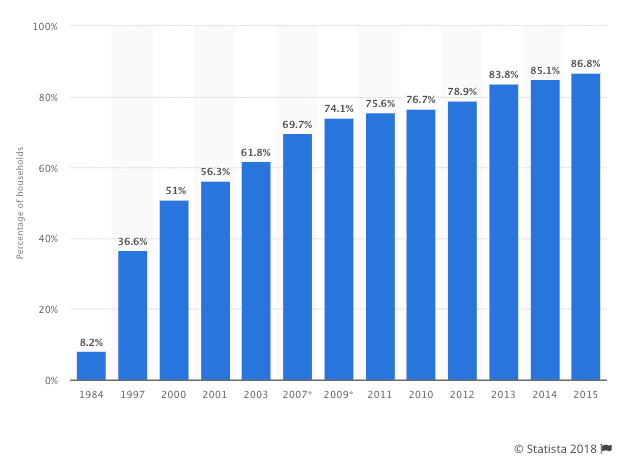

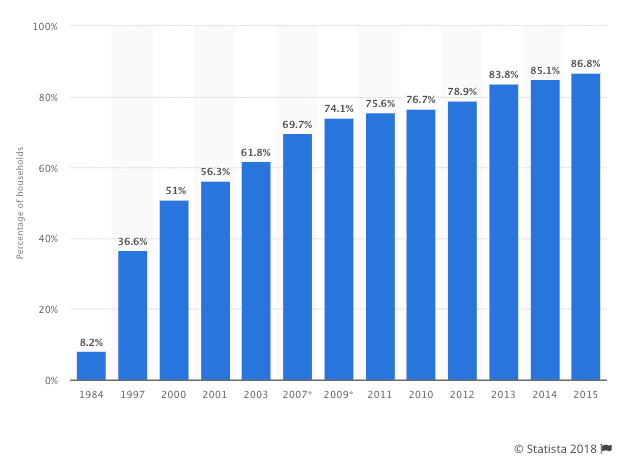

The statistic shows the percentage of U.S. households that have a computer from 1984 to 2015

As we can see, it took almost 25 years, after its introduction, for PC’s to be massively adopted by consumers here in the US. In hindsight, as with every innovation that matures rapidly enough, a period of adoption was essential for both the technology to evolve and, likewise, for humans to integrate them into their routines.

Technology goes from being exclusively in use by professionals and the tech-savvy to mainstream and used by almost every person.

This is what’s happening with Cryptocurrencies right now

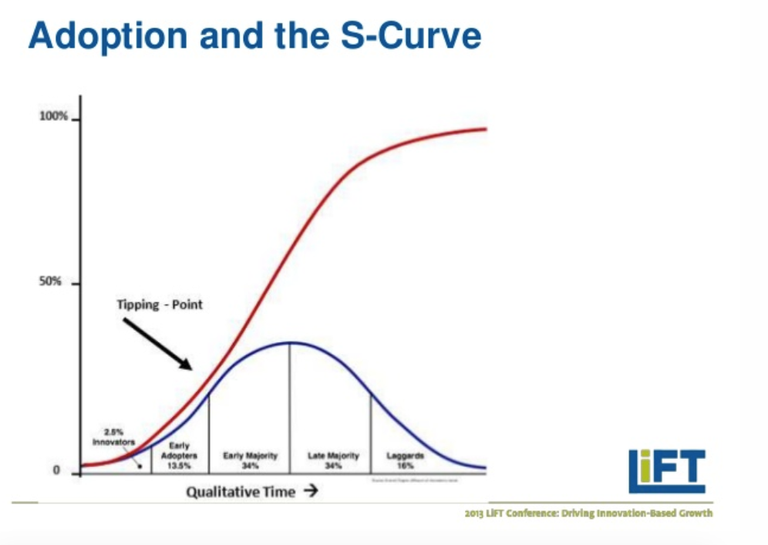

What history and those who study major shifts in technological movements show us is that if an innovation is successfully diffused (read about the Bass diffusion model), or distributed correctly, then the cumulative rate of adoption over an almost infinite period of time (let’s say 100 years) typically exhibits an S-shaped function. But what does this have to do with Cryptocurrency?

Well, how something propagates depends widely on what is known as “cognitive advantage”, or the ability of a particular community to accept a new innovation. By determining what this cognitive advantage is for a certain group, we could estimate the potential for this innovation to be established within that group, as well as how fast it spreads amongst it.

The cumulative number of people in a group with the same thought process and pre-existing ideas can determine the fate of an innovation, simply by accelerating the rate in which they share their knowledge with other communities. And similarly, how those other communities share with new communities, and so on. Current adoption numbers for Cryptocurrency are proof (see further below) that the technology is following the same path of adoption as other previous technologies fueled by a particular set of pre-existing beliefs.

Moreover, in order to understand who the people are in any initial group, we’d have to deconstruct their pre-existing beliefs and values that got them there in the first place. In terms of Cryptocurrencies, there are a few pre-existing ideas/issues that I’ve noticed were shared by those who were interested in the technology in its early years.

The first group of users believed or were (and probably still are) influenced by the following issues:

-Increased distrust of Governments and Central Banks

-An uncertain Geopolitical Climate

-Increased interest in Financial Independence (i.e. independence from banks holding your wealth)

-Interest in creating highly Trustable (immutable and irreplaceable) Transactions — “math at its finest”

-Interest in Privacy

There are probably a few more I’m not mentioning here (feel free to comment and I’ll update the list), but these 5 meet the criteria to argue in favor of Cryptocurrencies. The first group of people that shared these 5 basic beliefs was, and still is, the most important group in introducing Bitcoin and Cryptocurrencies to other communities.

As such, it’s natural that in order for Cryptocurrencies to be adopted in the US, and other countries, that these beliefs still hold true at any point in time and that newer groups create and adjust them in their own unique ways. The narrative for Cryptocurrency has begun to evolve from this is “just an Internet fad that is weird, stupid, and obscure” and into the hands of new groups with new interests and incentives to understand this phenomenon and participate in it.

What follows from here is highly dependent on creating platforms that are easy to use and to understand. The better the shared narrative and distribution of this technology through new products and other events, the faster the adoption rate will be as the beliefs are transferred from one community to another, and mature over time.

Network Trends

Albert-László Barabási, the Romanian physicist better known for his work on network theory, said: “Network thinking is poised to invade all domains of human activity and most fields of human inquiry. It is more than another useful perspective or tool. Networks are by their very nature the fabric of most complex systems, and nodes and links deeply infuse all strategies aimed at approaching our interlocked universe.”

In addition to pre-existing beliefs of a community, we have the rate in which these communities share their information. That’s where humans play a larger role in disseminating information as a result of their intrinsic willingness to share. Sharing is part of the complex system of our social fabric and it’s how we socialize, how we communicate with each other, and how we show affection. We tend to grow a certain internal “positive” karma and acceptance when we share.

Humans as Nodes and The Disaster Phenomena as idea proliferation

Humans are the centerpiece of any network — the main node — since we are where it all begins. We could go deep into human connectivity and network theory, but the concept behind this idea is that “adoption” is pretty abstract and subjective, but rather simple. Often times adoption rates are simply a product of a distribution phenomena, like a disaster or a world event that takes place (sometimes referred to as “The Disaster Phenomena”) or also, potentially, a specific feeling of oppression that triggers such reaction, with a product that is an outlet or vehicle of usefulness.

An example of “The Disaster Phenomena” is the train crash that happened in Tarriffville, Connecticut in 1978 — the disaster that made the telephone famous. The story goes as follows:

After the train crash, forward-looking doctors in the nearby city of Hartford had had Bell’s “speaking telephone” installed. An alert local druggist was able to telephone an entire community of local doctors, who rushed to the site to give aid. The disaster, as disasters do, aroused intense press coverage. The phone had proven its usefulness in the real world. Excerpt from “The Hacker Crackdown.”

(Another example could be Social Media’s influence in the Arab Spring, and its later proliferation, which has brought immense growth to Facebook, Twitter, and other Megacorps)

Cryptocurrency in the US hasn’t gone through anything similar to what the Telephone experienced with the crash in Tarriffville, but disasters are certainly triggering the popularity of Cryptocurrencies in other parts of the world, like in Venezuela, where the annual inflation rate has soared to almost 27,000%! Venezuelans are turning their remaining Bolivares into Bitcoin, the most accessible currency available to them that doesn’t need a bank, as fast as they can.

I hope no group of people has to suffer or go through a disaster to boost Cryptocurrency’ s popularity, but history has made it clear that it’s helped before.

What does this mean for Bitcoin and Cryptocurrencies?

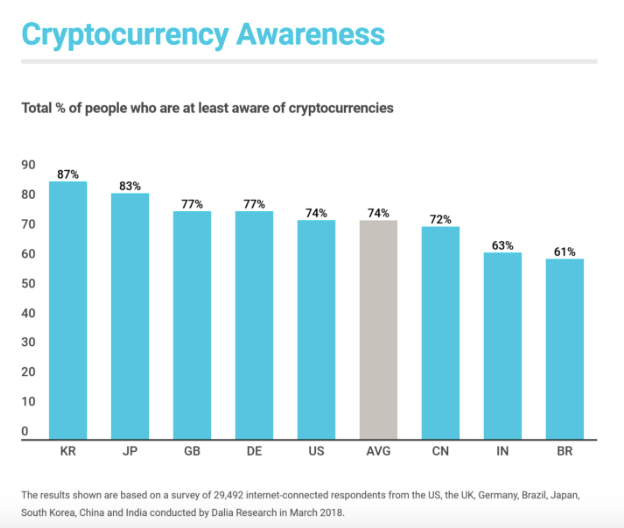

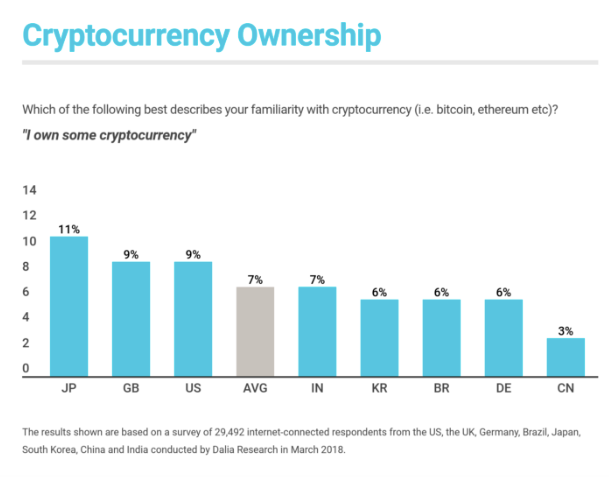

In my opinion, as far as Bitcoin and Cryptocurrencies goes, I believe we’re in the first few years of the “Cash Cow” period where fast consumer adoption begins. Dalia Research, a Berlin-based firm specialized in understanding global audiences did an extensive survey in 8 of the largest Cryptocurrency markets (US, UK, Brazil, Germany, Japan, South Korea, India, and China) in an attempt to understand how many people actually own any cryptocurrency.

Their findings are interesting. In the US about 74% of people are at least aware of cryptocurrencies. This is huge, but not surprising given the media coverage of Cryptocurrencies worldwide. However, according to their research, only about 9% of the population in the US actually own any cryptocurrency. If we put that into numbers, we’re talking about roughly 29 million US citizens who own at least one Cryptocurrency. Most of which came in the latter part of 2017 as Bitcoin price reached sky-high levels.

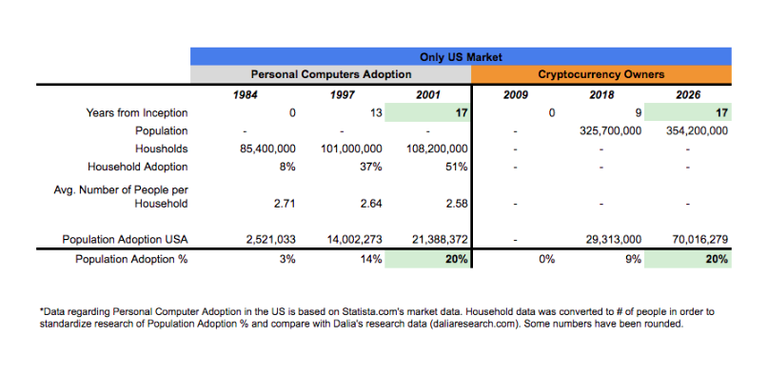

Now, if we make a comparison with the Personal Computer adoption (in my opinion the closest technological shift as life went from physical to digital) around 1984 (the first few years of personal computing) we see that about 8.2% of households had a personal computer, that translates to around 3% of the population (see the graph below). Let’s assume that 1984 is ground zero for PC’s in this analysis. If we then take that number and add the next data point available on PC adoption, we see the graph states around 36.6% of households owned a PC, when converted into population numbers we’re looking at roughly 14% of the population owned a PC in 1997.

If we then compare ground zero for Bitcoin, 2009 when there was ~0% adoption, until now in 2018, we see the population adoption in just 9 years vs. 13 from PC’s as very close at 9% for Bitcoin, vs. the 14% for PC. We could argue that with 4 more years we’d see the same adoption rate of Cryptocurrencies than in that same time span for PCs, 14% or close.

Now, if we try to compare the adoption rate in the span of 17 years for the PC from 1984 to 2001, we get that around 20% of the population owned a PC at the end of that period. For Cryptocurrency, at its worst growth rate of 20% US market adoption in the next 8 years, that would mean that 70 million people will own some form of Cryptocurrency by 2026. That’s about 41 million people more from this day on.

I personally believe Cryptocurrency ownership will grow twice as much in the same period as the right use-cases become available.

Cryptocurrency is Moving Fast

The main difference between Personal Computer’s and Cryptocurrency is that Cryptocurrency’s adoption rate is moving at the same rate, or faster, in other countries around the world. The US is the leader in many ways in the Crypto space but it’s not the leader in its adoption. This is positive as it suggests it’s still early in the life of Cryptocurrencies in the US and we can see a future path of inevitable growth.

The Different Stages of Technology Adoption

Golden Vaporware

The first stage, according to Bruce Sterling author of The Hacker Crackdown (a great book!), is called the “Golden Vaporware” stage. And I quote: “At this early point, the technology is only a phantom, a mere gleam in the inventor’s eye. One such inventor was a speech teacher and electrical tinkerer named Alexander Graham Bell.” He also states that “Most Golden Vaporware technologies go nowhere.” True, but not a fact.

You could say Bitcoin went through this stage in its early days when Satoshi Nakamoto published the Bitcoin White Paper and when the pizza was purchased with 10,000 BTC in 2010 (insane in hindsight).

Rising Star

The second stage is called “Rising Star or Goofy Prototype”, Mr. Sterling states, “Technologies in their Goofy Prototype stage rarely work very well. They’re experimental…The prototype may be attractive and novel, and it does look as if it ought to be good for something or other. But nobody, including the inventor, is quite sure what. Inventors, and speculators, and pundits may have very firm ideas about its potential use, but those ideas are often very wrong.”

This stage could be compared to when Dogecoin came out for the first time. Or a few years later when Pepe Cash went from meme to a tradable collectible on the blockchain.

Cash Cow

The third stage of technology is known as “Cash Cow” stage. In this stage, a technology finds its place in the world, matures, and becomes settled and productive. Sterling expands, “The telephone was about speech-individual, personal speech, the human voice, human conversation, and human interaction.” And he adds,

“When you picked up a telephone, you were not absorbing the cold output of a machine– you were speaking to another human being…A telephone call was not a call from a telephone itself, but a call from another human being.”

What Bruce is trying to tell us is that, technology is built on a set of beliefs (like previously discussed), it’s played with and battered with, criticized, until it goes through a process of early adoption through the human network (mostly as a game or toy), and then it becomes essential to humans. It adapts to human needs as it evolves and consumers find new ways to use it.

Right now, in 2018, Bitcoin has served as the “Golden Vaporware”, Litecoin and Dogecoin as the “Rising Star / Goofy Prototype”. These have brought the third stage and have allowed for other technologies to emerge like Ethereum. Ethereum, in turn, has provided a new opportunity for the technology to evolve with its ability to create new projects on top of its blockchain. Ethereum is potentially the “Cash Cow.”

Projects Helping Adoption of Cryptocurrency in the US

There are many projects and companies working towards developing the technology and in getting Cryptocurrencies in the hands of consumers in the US and other parts of the world.

I’m listing below some companies that are doing well to help with Cryptocurrency adoption, or that are set to do so in the next year or two. I’ve added a “difficulty score” from easy, normal, to hard.

The difficulty score takes into account my subjective views on how easy it is for non-tech people get set up and use each product/platform. As such there are no products that require coding to get started.

Here they are:

(ps: remember, imagine non-tech savvy people trying to use these products.)

Wallets, exchanges, and financial products:

-Abra: (easy) bitcoin and cryptocurrency wallet app

-Coinbase: (easy) buy, sell, transfer, and store digital currency

-Gemini: (normal) buy, sell, and store digital assets

-Binance: (hard) digital assets exchange

-Square / Cash: (easy) accept credit cards anywhere pos / accept cash anywhere app

-Balance.io: (tbd, not yet launched) ethereum wallet that supports all ERC-20 tokens

Over the counter products:

-CBlocks.io (easy) buy a cryptocurrency starter kit with a credit card (they went from mystery box to actual cold storage wallet starter kit)

-Coinmama: (easy) buy bitcoin and ethereum with credit card

Hardware:

-Ledger: (medium) hardware wallet for your bitcoins

-Trezor: (medium) the original and most secure bitcoin wallet

Leisure:

-CryptoCribs: (easy) similar to airbnb, but you can pay with crypto

-Coupa Café in SV: (easy) for coffee aficionados in Silicon Valley

Shopping:

-Fancy.com: (easy) a place to discover and buy amazing things curated by their global community

-Overstock.com: (easy) like amazon, one of the first retailers to accept bitcoin

Games:

-CryptoKitties: (easy) collect and breed digital cats

Creative space:

-RareBits: (easy) buy, sell, and discover unique crypto assets

Media:

-CoinTelegraph: (easy) bitcoin and ethereum blockchain news

-Coindesk.com: (easy) leader in blockchain news

These are just some examples of current platforms or products that come to mind. If you have more you’d like to add, please let me know in the comments and I’ll happily add them if they’re useful for Cryptocurrency beginners.

If you’d like to use your Bitcoin or Cryptocurrency for buying stuff, check out some of the merchants who already accept them: here.

Where is Cryptocurrency in the US going?

No matter how you see, it’s still quite hard to understand how will the technology be used. But the Internet is a great example of what to expect from Cryptocurrency, as it’s transformed many times over the last 30 years. This phenomena is worldwide and moving fast, probably faster than any other technology before it.

Some barriers to entry also exist, like regulations. But those have always been in existence, as new governments and institution start integrating this new technology within their organizations. A similar shift happened when work PC’s became a thing and, likewise, when the Internet helped fuel access to information and distributed communication in the workspace and at home.

What’s clear to me is that’s still complicated for the US to buy and use Cryptocurrencies in general, but we’re almost approaching massive adoption in the next 2–3 years. In fact, 41 million people, at the minimum, will join the technology in the next 8 years in the US alone.

There is a great collective push from different communities and a range of different companies working on driving awareness and creating the next innovative products to fuel adoption of the technology. and the US is almost ready for massive adoption.

I’m excited for a future that involves Cryptocurrencies!

If you think this article has been helpful, please share it. Additionally, if you have suggestions on how to improve it, please feel free to comment below.

I’m Ramón, an entrepreneur and growth marketer interested in networks, marketplaces, design, and of course, crypto. Say HI on twitter!

Coins mentioned in post:

Congratulations @ramoncacho! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!