Many of the thought leaders in the risk management industry are looking to captive insurance companies (CICs) - (http://captivatingthinking.com/what-is-a-cic/) as a solution for the complex, interconnected and rapidly evolving global economy. And, it's this same complex, interconnected global economy that has given rise to crypto-currencies, powered by revolutionary block chain technology. Both realms (captive insurance and crypto-currency) attract entrepreneurial forward thinkers who value innovation, freedom, and the opportunity to control their own economic choices. These realms are destined to cross and the sooner-the-better. In fact, captive insurance company owners should get the ball rolling by adding BitCoin (the premier crypto-currency) or other crypto-currencies to their insurance reserves.

There are two solid reasons for owning BitCoin in a captive insurance company.

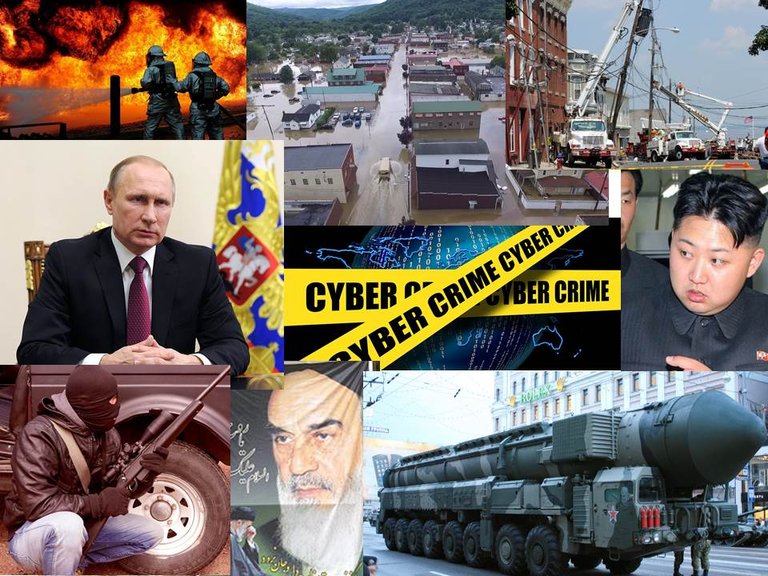

The first reason is that BitCoin can often be used to manage cyber-attacks. Cyber-attacks against small and mid-market businesses continue to proliferate and perpetrators continue to advance the complexity of their attacks. Whether it's hacking, spyware, malware, ransomware or any other form of attack, businesses need to be prepared.

In a cyber-attack, fast action is critical to deal with the breach and get systems back on line to avoid lost revenue and reputation damage. An ever popular approach for thieves is ransomware. Ransomware attacks occur when a hacker or invader enters a company's system and encrypts the server and all data. The thief then demands payment to provide an encryption code or key to the business. The hackers often demand payment with BitCoin. Having BitCoin readily available in its CIC, enables a business to act quickly. We foresee a day when some insurance policies issued by CIC's might be denominated in bitcoin rather than dollars.

The second reason is that BitCoin and other crypto-currencies offer appreciation potential. My Economics Professor always said, "a dollar today isn't worth a dollar tomorrow...and, you can't add them." His point was simply that over time, the purchasing power of dollars (a fiat currency) is eroded by fiscal and monetary policy. Sure, the dollar may have its ups and downs, but the long term trend is that buying power erodes. BitCoin's supply is constrained, meaning that its growth cannot be manipulated by fiscal or monetary policy. Its broad and growing adoption also suggests that it is here to stay, and it has a clear head-start building its network effect. In the event of a cyber-attack in two or three years, a business will likely be far better off paying a cyber ransom in 2020 with BitCoin it purchased in 2017. Also, once purchased, crypto-currencies can be easily exchanged for other crypto-currencies. It is also worth noting that crypto-currencies can also function as a potential "Black Swan," whose unexpected growth could significantly bolster insurance reserves.

But remember, crypto-currencies are very, very volatile. Both regulators and common sense would suggest that no more than a small fraction of the CIC's reserves be dedicated to them. Fortunately, a small fraction may be all it takes to make a big difference.

In the 21st century, complex, interconnected global economy, enterprise risks abound, threatening the very existence of small and mid-market companies. Examples of enterprise risks include (but are not limited to): cyber, business interruption, reputation damage, loss of key contracts or customers, loss of key suppliers, loss of key employees, regulatory change, government administrative actions, commercial crime, terrorism, excess general liability and existing commercial insurance deductibles. Small CICs also benefit from significant tax advantages that enable them to accumulate loss reserves. Under Internal Revenue Code (IRC) section 831(b), small insurance companies are taxed at a rate of 0% (zero percent) on underwriting profits. CIC reserves are effectively the owner's wealth.Captive Insurance Companies provide a means for alternative risk financing. For small and mid-market companies, the business owner (s) can also choose to own their own insurance company that insures risks for their business, in effect creating an additional profit center. The CIC can replace commercial insurance, insure warranties, issue bonds or insure enterprise risks. By insuring enterprise risks, the CIC can serve as a chassis for a business' overall Enterprise Risk Management (ERM) (http://captivatingthinking.com/what-is-erm-2/) program. ERM is a disciplined approach to assessing and addressing all risks a business faces.

Hence, ERM with a CIC enables a business owner (s) to turn risk into wealth, and crypto-currencies can play an important role in addressing risk and boosting the risk to wealth benefits of captives.

Learn More About Captive Insurance (http://captivatingthinking.com/)

Great insight on the benefits of crypto in the insurance world. I specially found interesting the portion of the article talking about cyberattacks and how quick acting transactions can stop these attacks from getting out of hand.

Thanks for your note. For small and mid-market companies, speed is vital to get back on line and stop the bleeding.

CIC's and Banks should both be dedicating resources to adopt blockchain technology. The one's that don't will not survive.

Great point.

Congratulations @randy-sadler! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Great post, but one question, do they as an established insurance companies can have Cryptos?, As far as I know, there are limited to certain inversion or assets, for law regulation, so I do not think they will, on the short or middle term, will be able to invest in Cryptos. I think that is bad for their costumers and share holders

Great question. The good news is that insurance is regulated by States and not the Federal Government. Provided the insurance company has sufficient liquidity to pay claims, most regulators allow a wide range of investment for insurance reserves. Captive Insurance Companies normally have an investment policy statement (IPS) that is approved by the insurance regulator at the state level. Bitcoin or other cryptocurrencies could be included in the IPS and owning them would be justified since potential claims in the future might require cryptocurrencies for payment. Bottom line - many captive regulators would approve holding some Bitcoin.

You are right and more about the recent Virus like WannaCry or the most recent of them Petya, that are asking the “rewards” on Bitcoin. I think that they are or are going to be into Cryptos, basically, Bitcoin in other to paid to some of their clients. And as the risk is out there will be insurance policies on Bitcoin. Regardless of the regulations. Very interesting

Thank you for sharing this, I'm following you ^^

Thanks! I'm following you too.

totally agree! this post reinforces my post today. blockchain is power back to all of us! https://steemit.com/blockchain/@kintar0/blockchain-power-to-the-people

thanks a lot for the great post! definitely want to see more great ones like this! new follower+upvoted+resteemed

Thanks so much!

Great analysis I have nothing to do with economics and don't really know much about cryptocurrencies but it was one of the few articles I have really understood

Awesome - thanks so much!

Thanks for great in-depth post, I'm sure most financial institutions will be getting on crypto's very soon!

Yes they will.

Great info !

Upvote and following! Check me out :)

Is anyone really paying these ransoms in bitcoins often enough to make that a compelling reason to hold them?

Believe it or not... Yes - many companies pay the ransom to get the code to un-encrypt their hard drives and get back up and running.

How come the numbers reported on the ransom are so low? I heard the most recent one was under $10000.

Most articles I have read say that ransom-ware attacks agains small and mid-market businesses ask for $50,000.

Sure, that's what they ask for. What do they get?

What about the reports of wipes happening even after paying? Only fools negotiate with terrorists, though I guess there could be many foolish companies.

It's certainly a gamble. Pay $50,000 and possibly get back up and running or refuse to pay and lose valuable time and possibly go out of business.

Here is a good article on the subject:

http://www.denverpost.com/2016/10/23/small-companies-cyber-attack-out-of-business/

You are correct, sometimes victims pay and don't get an encryption key that works. For many businesses, paying $50,000 is worth it for a shot at getting the ransom ware lifted. However, it usually takes a while to buy bitcoin if you don't have any and don't have an account, so it's worth holding some so you at least have the option to act quickly.