Most new crypto coins like to spruik some algorithm that they claim is “ASIC Resistant”. While nobody wants to see mining of their favourite crypto coin get centralised, what this "ASIC Resistance" claim really means is that the big players have YET to build an ASIC that is optimised for that algorithm.

Any algorithm can have an Application Specific Integrated Circuit built for it that will perform better than your PCs CPU and/or your GPU, it’s just a question of whether your coins market cap and the mining revenue they can make from it is worth the effort.

You don’t believe me? Let me give you a recent example of DASH and the X11 algorithm

This is the chart for the DASH networks total hashrate. The network hashrate is what determines the difficulty of mining a particular crypto and as the difficulty goes up the harder it is to get the mining reward. Do you see what I see? About 3 months ago (late July 2017) the network hashrate was around 14 TH/s and now it is up around 320 TH/s. That’s an increase of almost 23 times!

" "

"

You might think, that’s ok, DASH has been growing and going up in price so that might seem normal. Here is the DASH price in USD for the same period.

The DASH price has been doing OK, but it has less than doubled. This means that people who previously invested time and resources into mining DASH (which uses the X11 algo) have seen a huge drop in the profitability over this period - A drop which I estimate to be over 90%.

" "

"

Why has this happened? Let me introduce this bad boy - The D3 Antminer….

This ASIC was released to the market in the last couple of months and it has had an immediate effect on the network hashrate for DASH. I bought a Genesis Mining X11 contract earlier this year and got 500MH/s for about $2250 USD (yes, I do have sour grapes) and this thing has 30 times the hashrate for a cheaper cost. It’s pretty hard to compete with that sort of power.

But wait, wasn’t the X11 algorithm supposed to be ASIC Resistant?

X11 is actually not one, but 11 different algorithms which are chained together. Let me quote from http://cryptorials.io/glossary/x11/

"It is known as a chained algorithm because it uses 11 different algorithms which are chained together. These are: blake, bmw, groestl, jh, keccak, skein, luffa, cubehash, shavite, simd, and echo.

It is ASIC-resistant and suitable for both CPU mining and GPU mining."

So 11 different algorithms…yep that’ll be ASIC Resistant won’t it? Nice try, but NO!

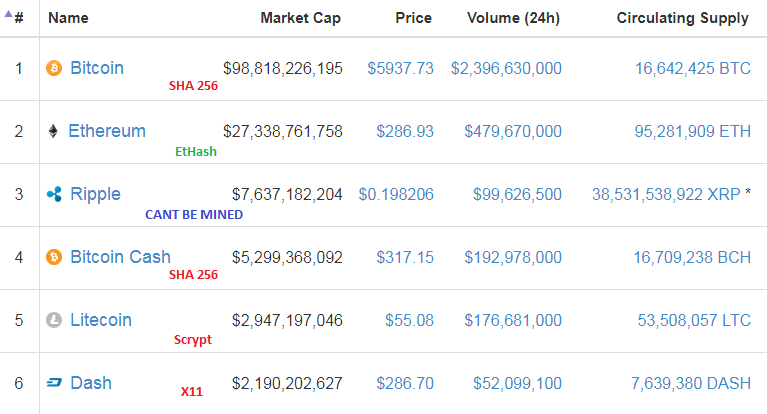

The truth of it is that you can build an ASIC for any algorithm if it’s worth enough to make a profit. Let’s take a look at the top crypto coins by market capitalisation and see if I can illustrate my point.

Any algorithm can have an Application Specific Integrated Circuit built for it that will perform better than your PCs CPU and/or your GPU, it’s just a question of whether your coins market cap and the mining revenue they can make from it is worth the effort.

You don’t believe me? Let me give you a recent example of DASH and the X11 algorithm.

You might think, that’s ok, DASH has been growing and going up in price so that might seem normal. Here is the DASH price in USD for the same period.

DASHPrice20171024.png

The DASH price has been doing OK, but it has less than doubled. This means that people who previously invested time and resources into mining DASH (which uses the X11 algo) have seen a huge drop in the profitability over this period - A drop which I estimate to be over 90%.

Why has this happened? Let me introduce this bad boy - The D3 Antminer….

DASH_ASIC20171024.png

This ASIC was released to the market in the last couple of months and it has had an immediate effect on the network hashrate for DASH. I bought a Genesis Mining X11 contract earlier this year and got 500MH/s for about $2250 USD (yes, I do have sour grapes) and this thing has 30 times the hashrate for a cheaper cost. It’s pretty hard to compete with that sort of power.

But wait, wasn’t the X11 algorithm supposed to be ASIC Resistant?

X11 is actually not one, but 11 different algorithms which are chained together. Let me quote from http://cryptorials.io/glossary/x11/

It is known as a chained algorithm because it uses 11 different algorithms which are chained together. These are: blake, bmw, groestl, jh, keccak, skein, luffa, cubehash, shavite, simd, and echo.

It is ASIC-resistant and suitable for both CPU mining and GPU mining.

So 11 different algorithms…yep that’ll be ASIC Resistant won’t it? Nice try, but NO!

The truth of it is that you can build an ASIC for any algorithm if it’s worth enough to make a profit. Let’s take a look at the top crypto coins by market capitalisation and see if I can illustrate my point.

Then we have Bitcoin Gold making the news right now. Why is that? Well it’s big “Value Add” to the Bitcoin crypto-sphere is that it is going to use a new mining algorithm that is "ASIC Resistant" so that we can have a decentralised Bitcoin network once more. They are going to use Equihash. Yep, good one guys! If you succeed in making BTG worth something, you will fail in the long run just like the others because history will repeat. But don’t worry because you’ll make a shedload of cash from your pre-mine in the process. Just how stupid do you think crypto investors are? Actually don’t answer that…..

So it all sounds a bit dire. Do we accept that any new algorithm that might claim to be “ASIC Resistant” is a lie and trying to decentralise crypto mining is just a pointless exercise? Is it inevitable that any crypto which is successful and has a big market cap will have an ASIC developed for it that will inevitably centralise the mining? Should we move to Proof of Stake or Graphene or some other form of mining and ditch Proof of Work altogether?

Maybe? Or maybe all we need to do is keep coming up with new mining algorithms and put a hard fork in our favourite cryptos roadmap every 6-12 months to drastically change the algorithm. It sounds like a joke, but if we did that then maybe we shift the goalposts enough that the big centralised miners have a huge disincentive to invest in developing an ASIC for each algorithm.

In the meantime you can join with me in calling bullshit on any new coins claiming to have an "ASIC Resistant" algorithm. As crypto enthusiasts and investors we really do need to wise up to these crypto myths and start coming up with REAL solutions.

Good article, but you may want to edit it again.

Oh I didn't see that thanks for the reminder