Organizations of all shapes and sizes heavily invest in data and analytics, yet few trust the results of data analysis.

According to CapGemini and EMC study of 1,000 senior executives and decision makers across nine industries and 10 countries, over half (56%) of the decision makers put investment in big data analytics in their budget plan over the next three years.

Hiring specialists in collecting, maintaining, and analyzing data takes a big part of the investment. Data scientists are the most in-demand and highest paid employees in IT industry right now in the United States right now.

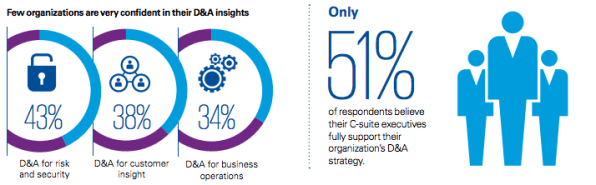

Nevertheless, according to a recent survey of over 2,000 data and analytics (D&A) decision makers in 10 countries by KPMG and Forrester Consulting, only 38% of respondents have a high level of confidence in their customer insights, and only one third trust the analytics they generate from their business operations.

Even if they have very low level of confidence in what they have about customers, all of the respondents state that the information is vital to business operation and decision-making. Half of them reported that they use data and analytics tools to analyze existing customers, 48% use them to find new customers, and another 47% use the data to develop new products and services.

Christian Rast, the global head of data and analytics and a partner with KPMG in Germany, indicated, “As analytics increasingly drive the decisions that affect us as individuals, as businesses, and as societies, there must be a heightened focus on ensuring the highest level of trust in the data, the analytics, and the controls that generate desired outcomes.”

“There is no doubt that subjective, gut-feel decision-making is being augmented by data-driven insights to allow organizations to better serve customers, drive efficiencies and manage risk,” said Bill Nowacki, the managing director of decision science at KPMG in the U.S.. He also mentioned that the survey, however, shows increasing investment in and returns on D& A comes from executives’ level of confidence in their insights.

Necessity of D&A in decision making but which can be trusted?

Another reason for the lack of trust in insights generated through D&A could be a result of sheer complexity, suggested Brad Fisher, the U.S. D&A leader, and a partner with KPMG U.S. “Transparency about the use and impact of an organization’s data and analytics is key to overcoming the long-held bias that conventional decision making is more reliable,” he said in a statement.

The shift of making decisions based on data analysis will be more precipitous. What’s more, a capability itself to extract right data and analyze it from gigantic amount of data is also important. ‘Garbage In, Garbage Out,’ as being said, no results will be meaningful with useless data.

On the other hand, transparency of extracted data is also an important issue in a generation of big data.

Low credibility of data brings out skeptical insights. Moreover, data with low credit restricts many opportunities to create profits from companies utilizing data and analysis.

Blockchain to secure credibility

Reliability and transparency of data can be enhanced by blockchain technology. Blockchain scrutinizes data based on algorithm which requires consent from majority and guarantees irreversibility of data on the basis of hash algorithm and time stamp. Blockchain will be a technology which provides better insights to decision makers by stimulating establishment of data transparency.

**The article is written based on other article and insights from RECORD team.

(Reference: https://www.fastcompany.com/3065294/why-executives-dont-trust-their-own-data-and-analytics-insights)

레코드 파운데이션은 지난 3년 간 운영해온 음악 산업 노하우를 기반으로 음악 관련 데이터를 보호하는 블록체인을 개발하는 프로젝트입니다.

레코드파운데이션의 토큰 판매에 참여하세요. http://recordfoundation.org/

궁금하신 점은 오픈채팅이나 텔레그램에서 문의해주세요.

Nice one, analysis are very important in decision taking, nothing gives insight more than it those.