How Did We Get Here?

In the midst of the 2017 bull market, awareness toward Bitcoin and other cryptocurrencies reached phenomenal levels. All of the large mainstream media outlets started their own investigation and research efforts into the space to try and cater to the curiosity of their readers. What ensued was a dramatically bipolar situation that saw these outlets simultaneously call for the banishment of cryptocurrencies and encouragement toward exploratory efforts into the space. Big media is possibly the prime reason we are where we are in terms of the public perception of cryptocurrency; but that’s a topic for another day.

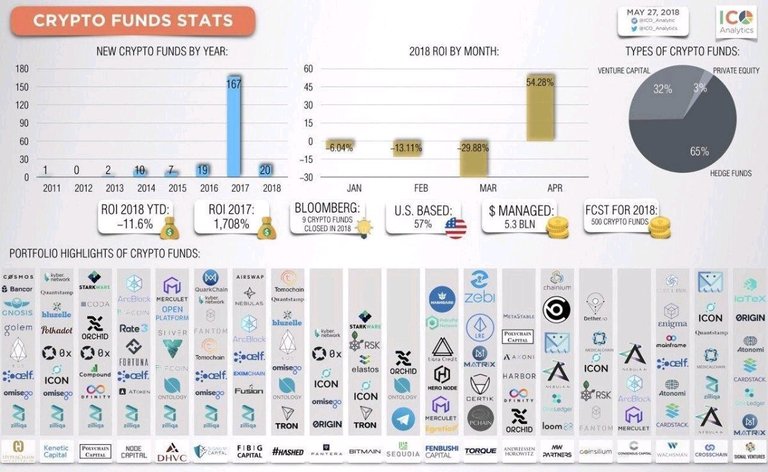

Cryptocurrency became the new Amazon and Netflix for the investment management industry. Every hedge fund, mutual fund, pension fund, family office, private wealth service, brokerage, individual, and institutional investor quickly embraced research into cryptocurrency. Some of them halted their efforts almost immediately seeing regulatory and ‘ethical’ hurdles. Others who truly saw fundamental promise or were eager to make a quick buck off market exuberance continued their research. But what nobody saw coming and what now seems like it was bound to happen was the sheer number of ‘cryptocurrency hedge funds’ emerging in the space. In October this year, CNN reported that 20% of hedge funds opened in 2017 and 2018 were cryptocurrency funds. The first thing that goes through a cryptocurrency enthusiast’s head when they read this is “adoption”. But is this really the adoption we need and are these funds even functioning correctly?

The Biggest Problem With ‘Crypto Funds’

A majority of the funds that opened with a focus on cryptocurrency have one huge and unique flaw that none of the traditional hedge funds have; lack of diversification. I’ve gone through the portfolios of numerous cryptocurrency focused funds that were transparent enough to publish online factsheets. The most astonishing finding that nobody in the industry seems to be talking about is the complete and utter lack of diversification. Their cryptocurrency diversification alone is questionable since their prime focus seems to be liquidity and investing in top market cap based cryptos. But their holdings are fully held in either cash or cryptocurrencies. For a large amount of funds, complete investment exposure into one asset class is a recipe for disaster. I have personally attempted to convince people cryptocurrency exposure is necessary, but 100% exposure is a colossal catastrophe. Anthony Pompiliano, the head of digital assets at Morgan Creek, advises mutual funds and pension funds to open a 100 basis points or a 1% exposure to Bitcoin. By rationalizing the logic behind the advice he gave pensions, he might suggest an aggressive investor with a large amount of capital give a 5–10% allocation to the same.

Source: CryptoIsComing

It’s no surprise to me that some funds are down 80–95%, downsizing, or completely closing shop. It actually serves them right for the kind of aggressive action they took in an infantile and high volatility market. Traditional and existing hedge funds from Soros and Bridgewater to Renaissance and Third Point most definitely have an exposure to cryptocurrency that they’ve not actively disclosed (from what I’ve gathered). But they haven’t been wiped out because they’ve had the wit to allocate a small amount of their total holdings towards it; there was no question of a large allocation for them. This is because they understood the high risk of the size, age, and volatility of the market. Bitcoin was indeed in what modern economists would call a bubble. But this doesn’t mean Bitcoin is dead. Bitcoin sees a bubble every 3–4 years or so; the market rationalizes and the prices stabilizes much lower before it goes on a massive bull run all over again, shattering its previous highs.

The Inability to Identify Sound Opportunity

Coming back to the cryptocurrency diversification in itself, what is the obsession with market cap? I understand the need for a hedge fund to have a certain degree of liquidity in every asset they invest into, but the kind of crypto selection they’ve engaged is truly questionable. One particular fund that I won’t explicitly name had a whopping 68% allocation to Bitcoin! A fund manager who chooses market cap weighted portfolio allocation for a cryptocurrency fund in 2018 is either incredibly inefficient in risk management or has no clear knowledge of cryptocurrency market dynamics. I’m sorry to say it, but if a dedicated fund manager or their research and analysis division cannot find more than 30 projects worth investing in then they deserve to close shop. Instead of making allocations of astonishing 60 and 30 percentages in one crypto, a competent fund would be able to make .1 — .5% (or even lower) allocation to a certain internally formulated list of cryptocurrencies they see future promise in. Despite it being crystal clear that most projects will not make it to 2025, there are some projects solving real world issues in such a dazzling yet sensible manner, you can see their potential success rate well outperforms the crowd.

If we ignore whether stocks and fixed income securities are a good buy at this point of time, we come to a very logical assumption that the best performing fund, even with an astoundingly aggressive stance on cryptocurrency, would not have more than 20–30% allocation toward it. The argument that this is part of the shift away from traditional assets is dubious. At this point of time, we have to embrace harmony between traditional and contemporary investment methods. This will create true portfolio balance rather than overweighting one particular asset class.

Revolutionizing the Structure of Investment Companies

Now while all of this holds for the hedge funds, crypto based VC has been immense in propelling development in the space. The likes of Andreessen-Horowitz, Naval Ravikant, Pantera Capital, and Blockchain Capital have been true pioneers of the space by providing much needed funding to cryptocurrency and blockchain projects with huge potential. The future is undeniably bright for Blockchain based VC as well as blockchain/crypto hedge funds, but improvements to the latter are much needed for them to ascend as true competitors to existing hedge funds.

The future of large scale cryptocurrency investments lies in a hybrid theory of sorts. I believe the future of cryptocurrency funds will be to provide the dual value and function of both venture and hedge funds. They will invest in private projects at a seed level as well as trade and invest in tokens of companies in spot and future markets. This will create exposure to both trading income and to cash flow from the project’s operations. For this, these companies will need to employ research professionals with the expertise to run a hedge fund as well as a VC firm i.e. individuals with knowledge of blockchain business development and marketing as well as experts in technical and fundamental analysis, portfolio construction and rebalancing, examination of ICO’s, and other specific roles that fit into the strategy of that particular entity.

Digital assets will become a huge part of our everyday lives. Even if in the form of centralized digital assets that work based on cryptography, the benefits in comparison to paper cash are immense. The developments into digital payments are progressing with every passing day with the help of companies like Square and Circle that have positive public perception. The decentralization revolution is in its early stages. When the use cases are visible to the general public and the benefits are put out into a public domain for them to formally witness, they will understand the opportunity and potential that these assets hold. Cryptocurrency investment has only just started; the future is bright and its true promise is yet to be fully unleashed.

- AB

---

ReverseAcid Monthly Recap

---

Crypto Analysis Series

- Part 1 - Basic Attention Token and How It's Revolutionizing the Internet

- Part 2 - Golem Network Token as a Potential Giant Killer

- Part 3 - Augur and the Future of Decentralized Predictions Markets

- Part 4 - Dogecoin - Such Meme, Much Value

- Part 5 - Zilliqa

---

Previous posts:

- Looking Back at the Ethereum Hard Fork Timeline - A Precursor to Constantinople

- Gold Making A Rebound

- Blockchain Patents Race

- XRP-USD Chart Breakdown: Daily Timeframe

- Governmental Incentives for Implementing Distributed Databases

- Current Scenario of the Global Stock Market: A Detailed View Into Major World Indices

- Giving in to Your Fear: Does the Current Market Warrant this Magnitude of FUD?

- DLT, Blockchain, and Cryptocurrencies: What it all Means for FinTech and More

- Confidence Crisis: HODL on to Your Horses

- Bitcoin Technicals: In Depth Breakdown of the Current Move

---

About Reverse Acid

---

Be a part of our Discord community to engage in related topic conversation.

---

Follow our Instagram and Twitter page for timely market updates

Is it true that Bitcoin has found new bottom ?

No it's not true. The breakout from the current bottom was not satisfactory. Neither in price action nor volume. I would be incredibly surprised if this is the bottom.

Posted using Partiko Android

I think it is the latter, which in itself is proof that he is also inefficient in risk management, which requires you to have a clear knowledge of the market dynamics!

I meant they either have no idea how the market moves or no idea how to diversify between digital and traditional assets. But now that I think about it, you're 100% correct. Knowing your market is risk management 101. Thank you so much for the input!

Posted using Partiko Android

Oh yeah, you were clear in that.

Don't worry, I enjoyed reading your article. Unique original content with plenty of takeaways, for a novice investor like me. Thanks.

Glad you enjoyed it, keep an eye on this space for more :)

Posted using Partiko Android

Those fund managers want to play safe and make sure not to lose so much money in the table.

Posted using Partiko Android

Essentially the point, right? A hedge fund exists to beat stock market index returns. If they don't do that and just allocate 65% to Bitcoin then shut down cuz they lost 80% of their principal, they aren't very good fund managers. I can see a pure crypto fund that doesn't lose money like this but that involves a reliable stablecoin; something we haven't seen yet. But you are also 100% correct, fund managers usually focus on not losing money over making money. That's why they're professionals ;)

Posted using Partiko Android

It is cool to discover new crypto talents of your kind on the Steem blockchain. :)

Thanks @chesatochi. Will need your support to keep us going.

Posted using Partiko iOS

Thank you for your interesting post on cryptocurrency. As a one of steemit-er, I am deeply interested in this kind of information :-) have a nice and and look forward to your next post!!

Appreciate your support, we'll do our best to keep increasing our standard of content!

Posted using Partiko Android