In a time where cryptocurrency high volatility and future exchanges are the norms of the financial system, high cost of transaction fees is the last thing any trader or business owner needs now. Market microstructure like high transaction fees affects the liquidity of markets to large extends, thereby making the market unstable and volatile for users.

Citing high transaction fees and other factors as reasons, Tom Karlo, Stripe Product Manager complains;

"We've seen the desire from our customers to accept Bitcoin decrease," says Karlo.

The relationship between volatility and liquidity in the futures markets and other markets are so proportional and sharp, that a sudden downward or upward turn in one, affects the other greatly. Their relationship can be vividly seen in the 2007-2008 financial crises and the 2010 ‘flash crash', when market volatility exploded, liquidity disappeared and share prices plummeted. With liquidity being the depth of sells and buys order in a market and volatility being the rate of price change, a ‘thin’ or illiquid market becomes volatile. With less orders to absorb market fluctuations, buyers and sellers find it easier to push price up and down.

In the cryptocurrency financial system, volatility and liquidity are no new comers. Liquidity and low volatility are very important for a coin to be useful for general trading. With high volatility, there's too much risk holding funds, and with insufficient liquidity, wallet recharge and transaction fees will be high.

In as much as Futures were introduced to put a brake on the fluctuating volatility rates, there are still high transaction fees in futures exchanges.

Digitex Whitepaper says,

But despite lower costs(due to futures) transaction fees are still significant on high volume, low profit margin futures trading strategies. They act as a massive brake on the potential liquidity of futures markets by converting marginally profitable strategies into losing strategies after commissions.

In a nutshell, notwithstanding the presence of futures exchanges, there is still a relationship between high transaction fees in future markets and liquidity that inversely affect the volatility in futures market.

Moreover, should we talk about the issue of security too? This is an era where users find it hard to trust exchanges as several scenarios have already occurred where accounts and funds of traders or user of a platform where looted away by the system. Sometimes, these funds are hacked by the users or several external hackers.

How then can a trustless nonvolatile and liquid market be created for both the centralized and decentralized market system and the future markets?

Allow me to introduce you to a system that creates a liquid market through on it’s trustless decentralized system. That system is the Digitex Future Exchange.

What is Digitex Future Exchange?

Digitex is a decentralized trustless transaction charge fee future exchange platform built on the blockchain. Digitex eliminates the bug of contracts participants having to pay for the commission fee. Digitex also decentralizes the system, withdrawing the control of the system from the owners and developers and gives it to it’s users, hence it eliminates the issue of trust. Moreover, on Digitex, smart contracts hold all account balances and all account transactions and these account details can’t be accessed by Digitex.

Also, Digitex do not hold or store private keys of users, hence, the elimination of the issue of theft or hacking. To enhance a more trustless system, users on the platform possess a consensus model of control over the tokens creation and operation of the system.

Futures and Futures Trading

Futures(Future Contracts) are financial contracts that gives the buyer an obligation to buy an asset and also gives the seller, an obligation to sell an asset) at an agreed price in a particular time in the future no matter the current market value of the commodity in the future.

Futures Trading is a form of investment that involves drawing up a future contract about a certain commodity, which will state the details of future contracts of that commodity.

For instance, a beverage producing company can agree to buy two bags of cocoa from a cocoa merchant in the future, it may be to protect against the predicted volatility of the price in the future.

Future trading is a good example of Derivatives trading. Unlike the Spot trading where Cryptos are exchanged directly for cash and vice versa, in future derivatives, speculations are made and a price is agreed upon for the goods to be bought in the future.

What does Digitex offer the Future Market?

Commission-Free Futures

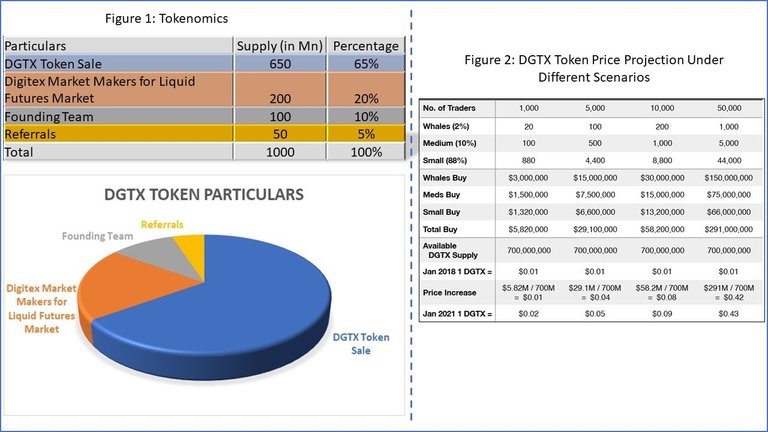

Digitex created am ERC -223 compatible protocol ethereum based token called the DGTX token. This is used as its local currency in which all profits, losses, margin requirements, account balance and all other financial details are denominated and detailed using the DGTX token.

Who pays the transaction fees?

The system creates more coins on the platform to take care of the costs incurred by the transactions instead of charging commissions on contracts participants.

How is the liquidity created?

The relatively small inflation cost of creating extra tokens is more than offset by the eventual influx of demands for the DGTX token. These demands and sell of DGTX tokens will then liquidize the market.

For traders to participate in this commission free and liquid market created by the Digitex model, they must own the DGTX tokens. The DGTX tokens is used for voting on decision takings in the system and it is what gives the DGTX token it’s utility as a vehicle of trading highly liquid futures market without any transaction fees. It is pertinent to note that, the rise in demand for DGTX tokens in the future due to the expansion and adoption of cryptocurrency and the need for a trustless system will surpass the initial coins created as revenues to take care of the transaction fees. However, for the first two years, there will be no creation of new coins as revenue because this cost will be covered by the proceeds from the DGTX Initial Coin Offering(ICO).

As time elapses, the rise in price of the DGTX tokens due to it demands will eventually reduce the amount of tokens produced and this therefore, reduce the inflammatory feature that would arose during the early coin creations. This creation of coins will offset by 2021 and its users and traders will vote on how many will be produced, each vote will be equaled to 1 DGTX and the voting process will be controlled by the decentralized blockchain.

Trustless Future Trading

.png)

The Digitex Futures Exchange interoperates the good features of the centralized and decentralized financial exchanges on it system.

Disadvantages of the decentralized exchange such as

•No real time reading due to latency of on-chain order books

•Expensive on-chain transactions

•Lack of privacy

•No margin trading

Now, the centralized exchange has merits over its counterpart in its own way. Such features of the centralized exchange includes;

•Matching engines on dedicated central serves are very speedy thus, enabling real time trading

•Central servers have complete privacy

•Margin trading is allowed

Digitex Futures Exchange uses a hybrid mechanism to replace the centralized account balances with am independent and decentralized smart contract on the ethereum blockchain. This will enable users(traders) to use Digitex without needing to trust the system with their money or assets. Digitex interoperates the speed and reliability of the centralized servers and the trustless and decentralize features of the smart contracts to give it’s users an intelligent and excellent platform.

What benefits do the decentralized feature of smart contracts offer to users on the Digitex Futures Exchange?

•Even in the presence of external pressures, Digitex cannot interfere with users' funds or freeze their accounts.

•Digitex CANNOT mismanage user's funds

•Digitex eliminates the threat and probability of hacking because it does not hold any user's private key.

All these are possible simply because, Digitex does not have access to any user's account as they are controlled and kept by smart contracts.

Digitex Oracle Updates Account Balance Smart Contract

The centralized exchange acts as an Oracle to the independent smart contract that holds the traders’ account balances. When a trader wants to withdraw DGTX tokens from his account, the smart contract must first ask the exchange for an update on his trading profits and losses, as well as his current margin liabilities on his current matched and unmatched orders. In this way the smart contract can update his available to withdraw balance. Such updates to a trader’s account balance in the smart contract are on-chain, so to minimize gas costs updates are only sent to the smart contract when the trader wants to withdraw.

This communication between the exchange and the smart contract presents a potential attack vector to hackers who might want to hack into the exchange for the purpose of updating the smart contract with incorrect information that lets them withdraw more than they have. The solution to this is to calculate the trader’s profit and loss from scratch from all of his matched trades whenever the smart contract asks for an update to a trader’s account balance. By doing this it is impossible for a hacker who has somehow gained access to the exchange to send incorrect updates to the smart contract because he will be unable to create the fake matched trades needed (each needing a counterparty and matching timestamps) to calculate his fake profit and update the smart contract with it.

The Digitex Tokens

The DGTX token is the nucleus of the Digitex Futures Exchange, without it, traders cannot participate in the decision making processes of the system or utilize the excellent trading opportunities it offers. It is an ethereum based protocol token. All profits, losses and financial details are denominated in DGTX token.

Some key elements of DGTX includes;

•Traders can eliminate DGTX price risk from their trades with the DGTX Peg System.

•DGTX is an ethereum based token that will be tradable for many cryptocurrencies including Bitcoin, Ether and Litecoin.

•The Tick value of every Digitex Futures market is 1 DGTX token

•Smart contracts hold all account balances and these are denominated in DGTX token.

•Margin requirements on each Digitex Futures Exchange are payable and denominate in DGTX tokens.

•The DGTX tokensale/ICO will create an initial supply of 1,000,000,000(1 billion) DGTX tokens.

DGTX Peg System

As the name ‘Peg’ implies, the DGTX Peg System is used to eliminate price risks on trade by ‘pegging’. Here, traders can eliminate DGTX price risk by utilizing the exchange’s DGTX peg system. The DGTX peg system works in such a way that it allows creating of futures contract on the price of DGTX which will allows anyone who owns DGTX tokens to lock in a sale price at the market price at that particular time, whilst keeping physical possession of their DGTX tokens to use as margin for doing trades on the Digitex futures markets. The price of DGTX can be pegged in this way against ETH and BTC.

In the DGTX Peg System, holders and owners of DGTX tokens will have the ability to engage in buying and selling of liquid futures contracts on the price of BTC, Ether, Litecoin against the USD(US Dollars) with no transaction charge. However, if a trader trades outside the peg system, they’ll incur commission charges. Nevertheless, the more active a trader trades outside the Peg system, the less he will have to pay for commission charge.

Moreover, apart from making efforts to list DGTX in various exchange, the Digitex futures Exchange will integrate Ox project into it’s system. The Ox project is a decentralized token trading protocol that allows the instant and trustless trading of any token pair. Digitex also intends to play an active market making role in the DGTX Peg System future market. Digitex will ensure traders wishing to eliminate DGTX price risk while holding futures positions can do so effectively and without stress with right spreads, coupled with no commission and negligible amount slippage.

Why should one use Digitex Future Exchange?

• It offers zero trading fees feature

• It provides a trustless system (Decentralized account balance) whereby traders won’t have to trust the system with their funds.

• Digitex future market offers traders very high leverage enabling them to gain 100x gains from relatively small price movements.

• There are no auto deleveraging

• Absolute privacy is guaranteed

• It utilizes the decentralization feature of the blockchain technology

• Digitex provides highly liquid future markets

• It interoperates some of the biggest cryptocurrencies such as Bitcoin, Ethereum and Litecoin thereby creating three futures markets thus; BTC/USD, ETH/USD, LTC/USD.

• Each of these future markets will have large tick sizes. Digitex futures market is made up of three types which are; BTC/USD, ETH/USD, & LTC/USD. They all have large tick sizes.

Tick sizes refer to the minimum price increments that futures contracts can move up or down. For BTC/USD it is $5, for ETH/USD it is $1 and for LTC/USD is $0.25.

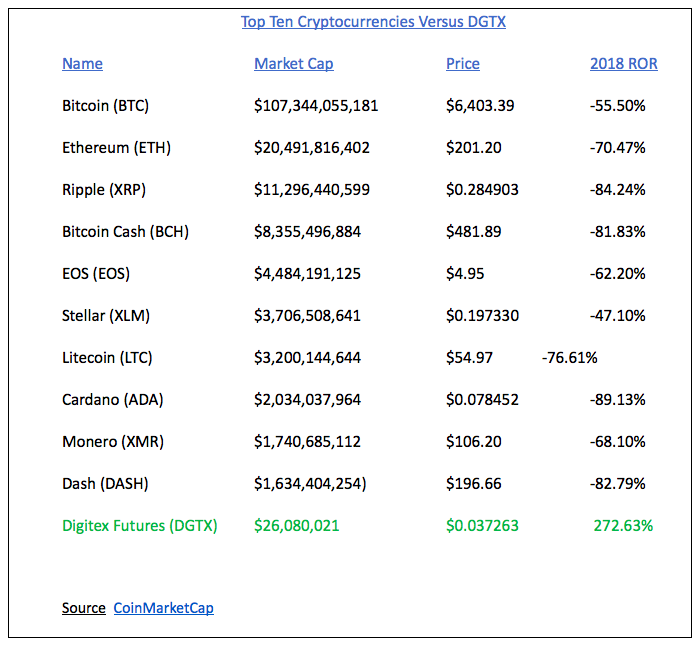

Not till convinced? Check the picture below showing Digitex versus the Ten Top Cryptocurrencies

The Decentralized Governance By Blockchain(DGBB)

.png)

Digitex will operate on a decentralized governance by the blockchain as DGTX owners will vote on decisions taken in the system. Their decisions will be in their own collective self interest and for the growth of the platform.

DGTX owners will vote(I.e submit proposals) on how many tokens should be created to cover the initial operational costs. They(owners of DGTX) will be tasked with preserving the current value of DGTX by minimizing the creation of new tokens but yet providing just enough tokens needed by the system.

The Future of Futures With Digitex

Lower costs of transaction fees notwithstanding in futures, it is still significant on high volume, low profit margin futures trading strategies. This is a setback on the potential liquidity of futures markets by converting marginally profitable strategies into losing strategies after commissions. These fees no matter how low, now turn to be problematic for users dealing in low profit, high volume futures.

With Digitex, there are no fee charge on transactions, thereby, all users of Futures will benefit through Digitex. Even those that trade on high volume and low profit deals, which aforetime are always robbed by the little commission charge, will not be charged on Digitex thereby allowing them to get their small gains.

Due to it’s foundations and startup Roadmap, Digitex will be on the forefront of cryptocurrencies, blockchain and the fiat financial system. Interoperating the best centralized and decentralized features, will ensure the influx of both fiat system users and the lovers of decentralized system into the Digitex ecosystem.

Through middlemen and brokerage services, traders who don’t actively participate in trading get the lowest profits in the end. Especially for small scale traders who depend on the low outcome of the transaction to take in as profits, trading fees of most brokerage companies eliminates this for them and they are forced to invest more to profit or quit the market. Even for the ‘big money' traders, they’ll still have to look for cheaper brokerage services in order to realize more income. In Digitex, there are no middlemen, instead there are trustless smart contracts that control agreements, and interestingly, Digitex doesn’t charge commission fees in order to let everybody in the system profit.

When compared and contrasted against some other exchanges, Digitex users, even the small merchants, enjoy large profits in their small trades because of no fee charge.

With the table below, one see a good example of how traders on Digitex can gain massively, when compared to other exchanges like CryptoFacilities and GDAX.com

Lastly, we are living in a democratic world where everybody wants to take part in the decision making process but this has not been attainable in most financial systems. Imagine a country where the governors, senators and president is the only person living there. They’ll for sure make the best decisions. In Digitex, the users invest their funds in the system through buying the DGTX tokens and then they are tasked with making decisions on how many tokens are created in order to fund the system to ensure it’s stability(avoid hyperinflation) and continuation. The users thereby, will surely make good decisions in the best interest of themselves and the system because they now exist for one another. Also, since votes and activities are determined by tokens, owners will vote and trade reasonably, this will cause increase in demand for DGTX tokens, growth and mass adoption of the platform.

Few Use Cases

Peter is a trader that prefers future derivatives trading over spot trading in order to avoid volatility of prices and the resulting hike in transaction fees. He however, is a small scale businessman and depends on the small profits he derives from this. But then, the small transaction fee charge of the brokerage company is hindering and eating his profits. He is left with no choice but to stop trading. Then he is introduced to Digitex by a business partner, now Peter buys DGTX tokens and possesses the power to trade in it liquid market without losing his small profits.

The only reason Alice is afraid of online and crypto exchanges is because her father was dubbed by some exchange sites some years back. She doesn’t also trust exchanges because of several cases of hackers she has read online. But now she hears of Digitex, and now is registered and hold DGTX tokens. She doesn’t worry about security issues because Digitex doesn’t control private keys or have access to user’s account because in Digitex, these are controlled by smart contracts.

Synopsis

Digitex Future Exchange is not a trial system where when users start trading, after some months, they’ll be charged, No. Digitex has been designed to eliminate transaction fees and ensure absolute safety for users' funds and accounts. Digitex creates a liquid market for it’s users for futures exchanges. The DGTX tokens will be the nucleus of the system, regulating activities and being used as a unit for voting. The Digitex Future Exchange also gives room for fiat and other cryptocurrencies exchange while incentivizing on it to ensure that the more active users pay less if operating outside the Digitex Peg System.

Conclusively, since activities and voting are controlled by tokens, it will prevent users from excessive trading while making sure they take decisions that will be in their best interest and that of the system.

Not a fan of long notes? Watch the official video here

Want to watch my own video? Click below

Digitex Website

Digitex Whitepaper

Digitex Blog

Digitex Telegram

Digitex Reddit

Digitex Facebook

Digitex Twitter

Digitex Youtube

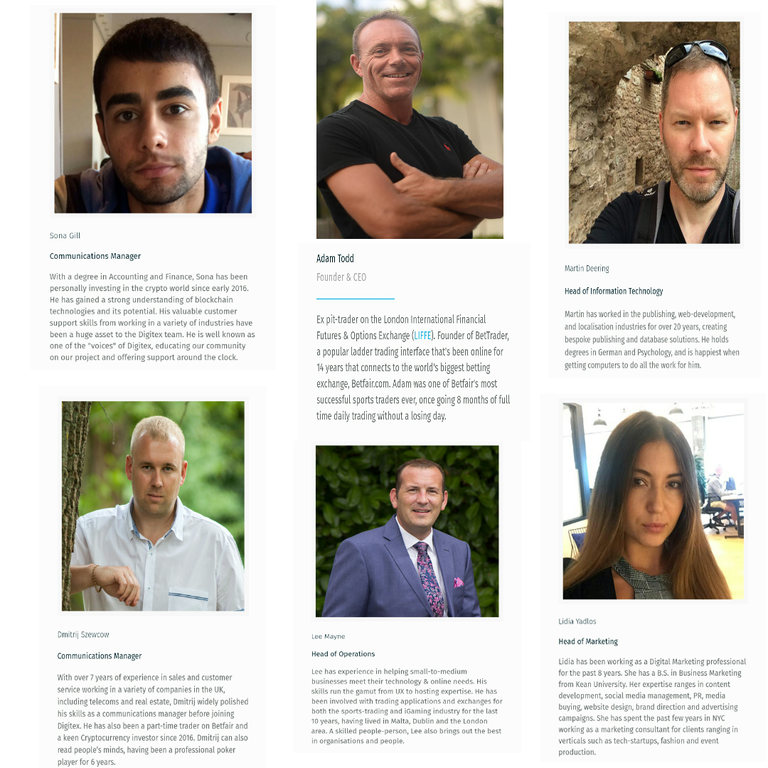

The Team

Advisor

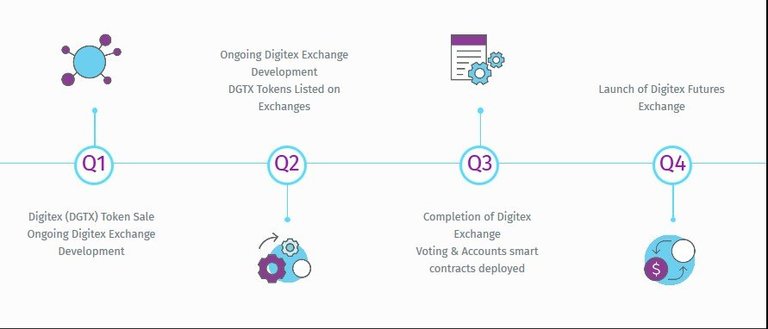

RoadMap

Listings

here to check on itThis is a contest organized by @originalworks. Click .

Note: All media and quotes used herein are sourced from the Digitex's sites and resources. And they are licensed for use in this contest

Twitter link:

digitextwitter

digitex2018

This post has been submitted for the OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Coins mentioned in post: