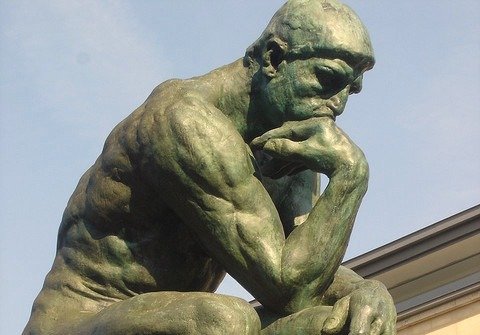

As always I have been thinking more and more about the cryptocurrency market and its potential future, in doing so there are a number of questions I have been asking myself which I will share with you all. Make no mistake I am still positive about the future of cryptocurrency, I am however constantly asking questions and analyzing potential problems/solutions. I would love to get some of your thoughts on the below questions:

1. Do we need institutional money?

Recently we have seen a lot of news about 'institutional' money entering the space and how it will be of significant benefit to the cryptocurrency market. While I don't doubt that institutional money will likely bring more investment in the market and subsequently higher prices, I am inclined to question what was the original purpose of Bitcoin? From what I understand Bitcoin was created as a means for regular people to escape from traditional markets that are preconditioned to operate in favour of large institutions, wealthy individuals and governments. By introducing traditional market products such as ETFs and derivatives in to the crypto-space, as well as institutional investment, are we not making the same mistakes we have seen before us in traditional markets leading to central dominance?

2. Is there a maximum upside for contract platforms?

Ethereum, EOS, NEO etc are all predicated on providing a platform to host decentralized applications. While at present the relative success of Dapps and the platforms they run on has been limited, no doubt in the future there will be a breakthrough whereby dapps drive the price of the platforms significantly higher. When the price of the native cryptocurrency on the platform reaches significant highs, is there not a point at which the cost of implementing a dapp on the platform outweighs the potential use-case/return, thus making intrinsic value of the native coin/token capped?

3. Can't important crypto-websites be censored?

One of, if not the main benefit of cryptocurrency is the ability for networks to be censor-resistant from governments. While this is true, almost all of cryptocurrency interaction (exchanges, price tracking etc) is undertaken through traditional websites. What is to stop governments banning websites like we see already today? Sure there can be new ones that pop up, but for the most part we have seen how that goes with file sharing websites.

4. Is it realistic to expect people to hold and use multiple cryptocurrencies?

As everyone knows, currently there are thousands of cryptocurrency projects all with their own native coin/token. While we can rest assure that a large number of these projects will fail, what happens to the 'successful' projects that people want to use? Do we expect everyone to hold a wallet wilt multiple cryptocurrencies that they use to interact with different projects/networks? Convenience is of the utmost importance for consumers, does the nature of cryptocurrencies pose a problem in that sense?

5. Will enough people care for cryptocurrencies to gain traction?

Some of the noted cryptocurrency benefits include decentralization, privacy and individual-control. While to most of us already involved in adopting cryptocurrency these benefits are of importance to us, however do they combine to make a compelling enough argument for other people to adopt? We are living through a time when an individual's privacy is continually being reduced by governments and corporations. We have had a large number of bombshell reports (snowden/wikileaks/Cambridge Analytica) exposing the scale of privacy breaches taking place and for the most part the general public don't seem to care.

Not only privacy seemingly a non- issue for most people, but also the rise of corporations centralized power. Recently both Apple and Amazon passed trillion dollar market caps (Bigger than a lot of countries GDP). Both companies along with Google Facebook and Twitter have acquired massive amounts of power that seems to grow by the day as they collect more data. Of most concern is the continued divergence of the state and these corporations. Amazon has a massive contract with the CIA, while the other aforementioned companies seem to be pushing agendas based on their political views.

What are your thoughts on the above?

Please note this does not constitute any financial advice. My thoughts and opinions are mine only and do not represent any qualified analysis or advice. As always please do your own research when investing.

Image source: Flickr

Some good questions here and I have some not-too-short answers. It's late here tho. Maybe I'll have a crack tommorrow if I remember :)

Thanks! I would really appreciate your thoughts!

Ok, I'll give you my 2 cents on these.

We don't really need institutional money but it will come eventually anyway. The way I see it the institutions are just vehicles or tools that people use who are too busy (or lazy) to do the research and invest themselves. So, as demand for cryptos increases, demand from institutional clients increases with it and the institutions themselves will respond to that. Maybe I am being too cynical but to my eye most institutions are really just herd followers and parasites. They will come when there is money to be made and their clients demand it.

No, I don't believe so. Is there a maximum upside for Bitcoin? No. As it gets pricier and transactions fees go up, we get new smaller cryptos like Litecoin or DASH to backfill. Same will happen with smart contract platforms. The blue chips (like ETH and EOS) may get expensive, but the big DApps will afford it and the smaller DApps will start up on new cheaper chains - in EOS case they are often airdropping new chain tokens to existing EOS holders. Check out WORBLI and TELOS. Two EOS forks are already happenning with more niche goals and appeal.

Yes, kind of. Websites can move offshore or even set up on something like TOR if they want to resist censorship. The websites are just a front end to a decentralized back end. Governments can make it harder for the lay-person to access friendly front ends but the savvy uses will always be able to get around it.

Yes. I imagine there will be some dominant/popular cryptos but the way I see it this comes down to personal choice and all we need is some good wallets and seamless low-fee exchanges to abstract away the conversion processes at point-of-sale. Check out Shapeshift - it's an early leader in this space. Also the Nano Ledger S is probably the best hardware wallet available today that supports a lot of currencies and tokens. I see cryptos as more than just currencies and I envision people holding diverse asset portfolios such as shares, bonds, real-estate via crypto-tokens on hardware wallets in future. All that is needed is work on the front end of these wallets to make this easier for the lay-person to do. A bit like when the internet first came out it was hard to use, now it's second nature to just about everyone.

This is an excellent point and it's something I have struggled with recently. A lot of people in crypto are right about the huge benefits of the tech, but the mainstream (in the West) dont really care about decentralisation or privacy. They WILL care about it being cheaper, faster and easy to use though and I remain optimistic that serious dysruption to the status quo will still occur on those fronts. That's one of the main reasons why I am keen on EOS. They have sacrificed some decentralisation and privacy to reach the mainstream.

I imagine that Amazaon and the other FANGs will launch their own crypto tokens in time. In fact I see many businesses having their own tokens to the point where there are millions or even billions of them. A lot will use them like "coupons" or store credit or discounts and for a lot of mainstream this might be the first exposure they get to the tech in the late-adoption phase. The way tokens are starting to be used now it's like holding shares in a company that pay dividends, but you can also use those shares to buy products/services direct from the company. It takes a bit of a mindshift, but the old paradigms of how we use and manage our assets/currencies are being broken, even merged.

I do fear that the mainstream will throw away the last vestiges of their privacy and this could give us an Orwellian future, but as long as there is alternatives (like Monero) for privacy that are not driven underground then the true crypto believers have a fighting chance.

Superb analysis. Really appreciate the insight.

Question #4 is something I worry about and is why I think in the end there will be a handful of "transactional" coins and then a bunch of novelty coins and also a store of value one, likely btc.

Yeah I tend to agree, confident in btc for this very reason.

Coins mentioned in post:

Congratulations @rhyscn! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP