The answer to all of those questions is... Yes! Today is November 17th and I had an idea yesterday to do a cryptocurrency research based on its growth since last year. Some people say cryptocurrency bubble will burst soon, but I think that we're nowhere close to that bubble actually to burst, based on increasing popularity and new money coming in as more people get to know about cryptocurrency, benefits of investing as "early birds", blockchain advantages compared to government, banking system, where you have to trust that they make reasonable and smart decisions handling your money, blockchain helps to resolve this issue of trust... I'm very passionate about cryptocurrency future, blockchain technology, fast and cheap transaction options to send some monetary value through crypto to anywhere and anyone in the world, I see potential to replace fiat currencies and banks one day, even though it will be bumpy road to drive, but it's increasingly possible, day by day, as time goes by and market cap keeps going up with no signs of returning and no, it likely won't happen next year or year after that. Only we, early adaptors, will decide which currency has that opportunity to be adapted and used worldwide just as same as fiat currency for everyday payments like paying bills, purchasing electronics and even ordering food at your favorite restaurant. Okay, enough for the intro, it's time to start research! :)

Just imagine you had a 1000$ starting capital to invest into cryptocurrency about a year ago, in November. I'll pick random currencies based on 70% core / 30% "play money" approach. Let's pick 3 from top 10, 2 from top 20, 1 from top 50 and 1 from top 100 by market cap as our "safe, core" investments, 1 from 100 to 150, 1 from 150 - 200, 1 from 200 - 250 by market cap as "play money" investments... So, my random picked cryptocurrencies to put into my portfolio by market cap position is 1, 4, 9, 13, 17, 36, 74, 122, 187, 224.

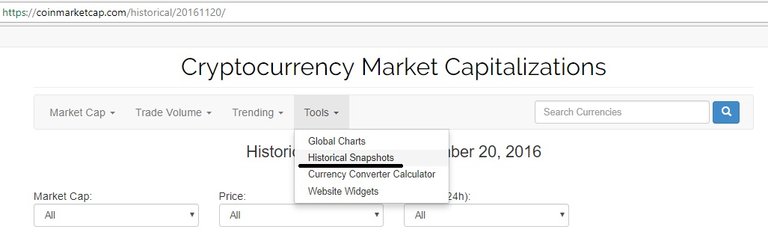

Next step is to open coinmarketcap.com historical snapshots, November 20th for example:

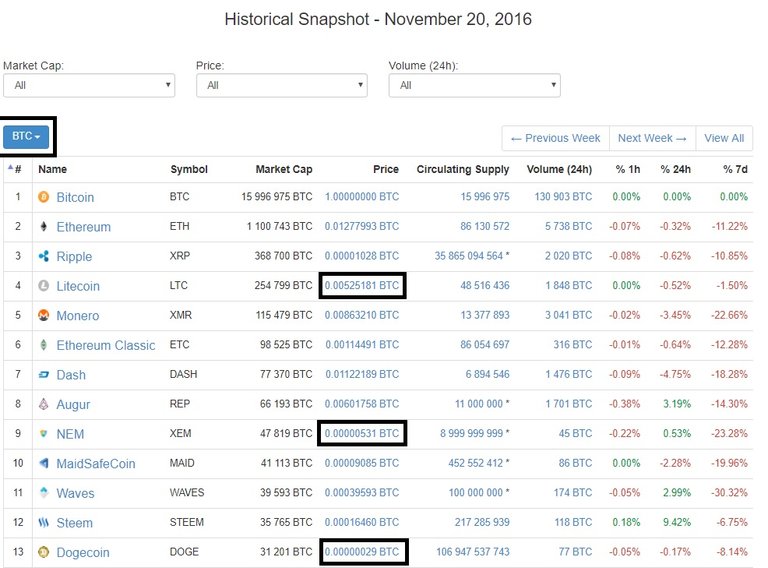

Okay, after sorting all by market cap (or doing nothing at all, because everything is sorted by market cap already) let's find out what I randomly actually picked:

1) Bitcoin;

4) Litecoin;

9) NEM;

13) Dogecoin;

17) Iconomi;

36) Counterparty;

74) Curecoin;

122) Wild Beast Block;

187) StabilityShares;

224) Titcoin.

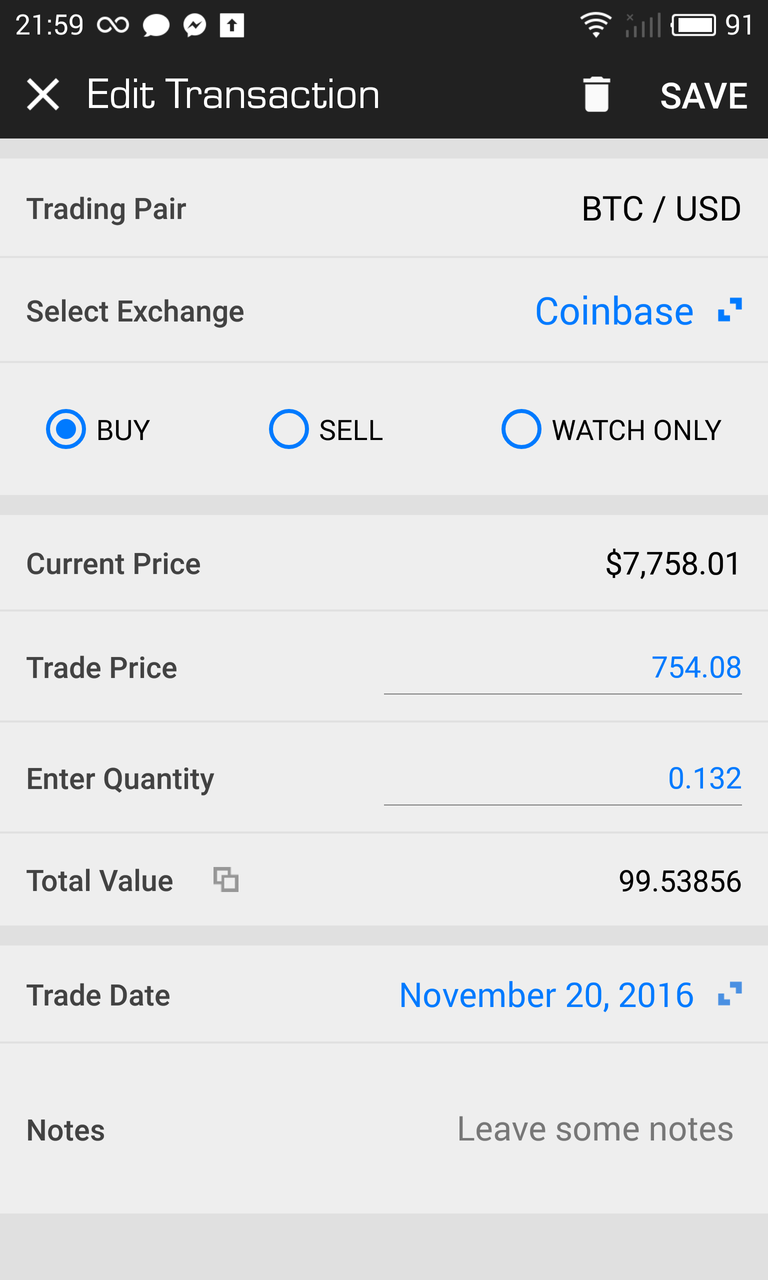

Next step is to split 1000$ equally, putting 100 dollars into each of these coins/tokens, every single one of them exchanging using Bitcoin markets. For this purpose easier is to use Blockfolio mobile app and set buy orders by the current price of BTC in historical snapshots. But, before that, I have to buy Bitcoin to exchange it later to all my altcoins in Bitcoin markets on November 20th, 2016 price @ 754.08$ per 1 Bitcoin. 1000$ was 1.32 BTC back then, 10 equal parts of 1.32 BTC is 0.132 for each cryptocurrency project.

As you can see, that's the way I made buy order for Bitcoin, for all altcoins had to calculate 0.132 / BTC price for 1 altcoin based on historical snapshots.

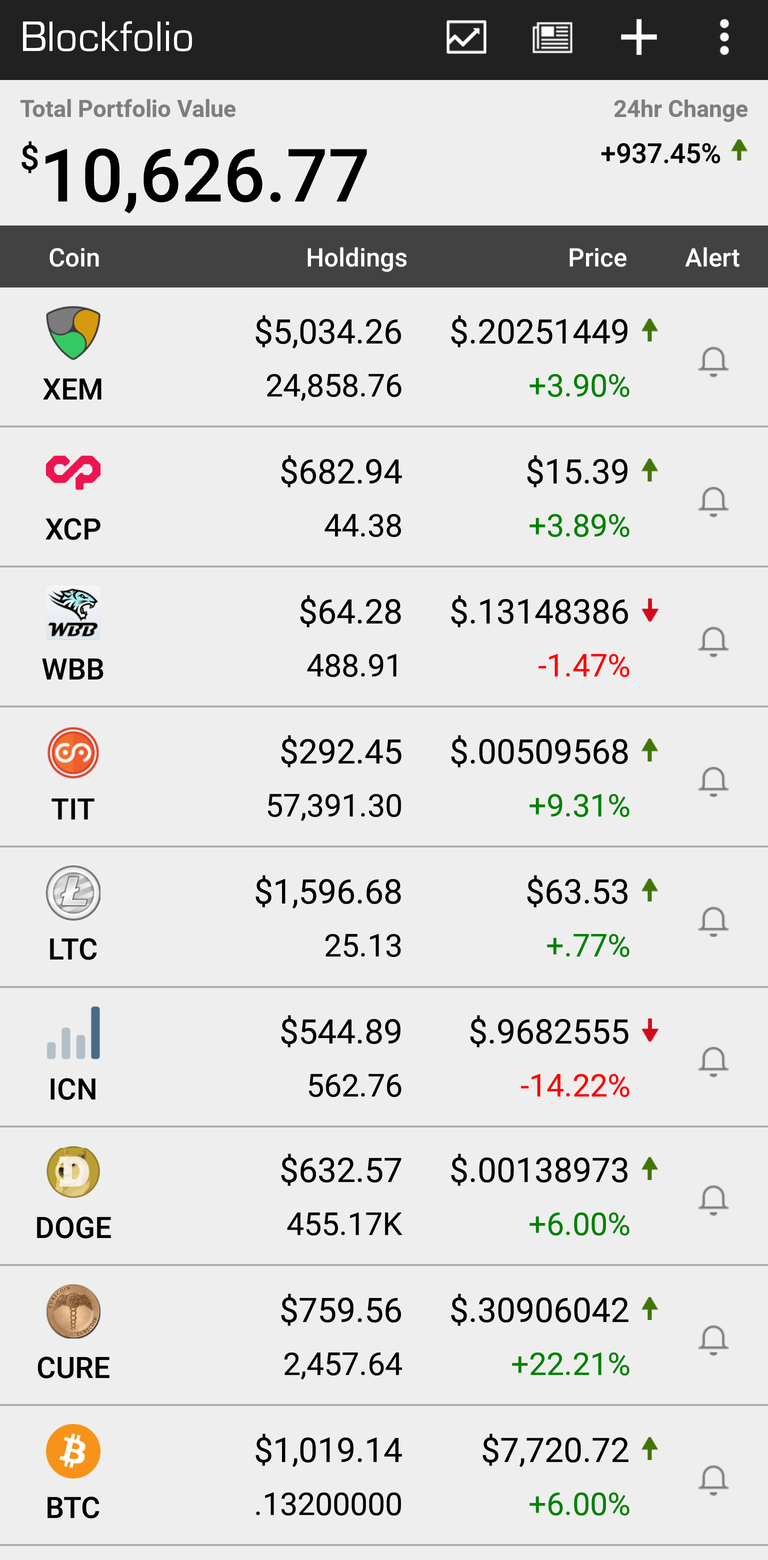

Finally, when all cryptocurrencies added to the portfolio, here are results!

9626.77$ of pure profit after 1000$ initial investment and, let's pretend, completely forgetting about this for a full year... As you can see, there's only nine, StabilityShares wasn't so stable at all and died... :D That's the main reason investing into small market cap and low volume coins is "play money" and riskier than big players, but profit percentage IF project becomes very successful is a lot bigger than top market cap cryptocurrencies. High risk losing it all, but enormous profits when that kind of cryptocurrency becomes a success!

Interesting thing to point out - all of them, except Litecoin and NEM decreased in Bitcoin value per altcoin unit, but as Bitcoin is like a gold to all of the cryptocurrency market, that 10 times growth for Bitcoin itself pushes altcoin price per USD up also if altcoin doesn't drop dramatically like Wild Beast Block did, only one without profit and almost 40$ loss actually. If it would be possible to trade every single one of them straight @ USD market, the picture would be different, so long-term investing @ Bitcoin market is suggested and most popular anyway.

As you can see in the picture below, total portfolio value of BTC increased only by 0.06 or 4.5% and that increase was made by Litecoin and New Economy Movement only, even greater than 4.5%, but rest of altcoins pushed that down to 4.5% as overall portfolio BTC increase average.

Okay now is time for the conclusion. Disclaimer - never ever use this strategy by picking random numbers and investing real money into projects you don't know a damn about, this research is for educational purposes only! By this research I wanted to show how you should do when investing in teams and cryptocurrencies you truly believe in, how important is to not get scared when sudden price drop happens, eventually it will go back up and reach new heights, how, maybe, investing and forgetting in many cases are better than checking your portfolio every 15 minutes, that's maybe the case for some traders, but trading is riskier than investing, even though more profitable for skillful traders than long-term holders. :)

I like this video a lot, nice representation what I wanted to say about investing in general and importance of holding no matter what, shout out to @suppoman.

Thank you so much for staying this far with me and not running away because of my grammar... :D English is what I read and understand like 95%, but not my native language I mainly communicate, so if someone got something valuable out of this research, comment what it is! Make sure to leave upvote and follow if you're interested for more in a future!

Congratulations @rihardsc! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP