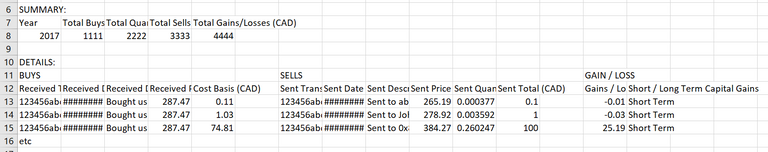

The exchange(s) you use for your crypto currency buying and selling probably have big differences in the quality of their reporting quality. As I begin the gather my information for Canadian CRA reporting, I see that the first exchange I used here has very good reporting, which exports to a spreadsheet, to with the summary of my Capital Gains as well as all the transactions:

CoinBase - Very simple

Sadly, the other exchanges I have worked with are not so great.

- Quadrigacx - They don't even mention Tax implications on their web site, and when you create a support ticket to request information related to taxes, you get a form letter reply, saying they can't help you and its your responsibility!

- Kraken - At least acknowledges it, and provides a function to download transactions by month, but its going to be cumbersome to figure it out.

Just another factor to consider when you are selecting an exchange to work with.

Does the fact that Quadriga doesn't report on it work in our favor?

Probably not. The CRA still wants their share.

https://steemit.com/bitcoin/@veeev/thetaxmancomethcryptocurrenciesandthecra-flrxbx5cap

I’m sure CRA wants their tax no matter how we figure it out. I was just so pleased about how easy CoinBase worked.

See my new solution: https://steemit.com/cryptocurrency/@robvann/income-tax-solution-for-cryptocurrency

FYI, I found this solution to my income tax reporting need:

https://steemit.com/cryptocurrency/@robvann/income-tax-solution-for-cryptocurrency