Most people are well aware of how cryptocurrency volatility is a big problem. Although there are periods during which volatility seemingly quiets down, this week has been filled with wild price fluctuations. As of right now, all currencies and assets in the top 10 are bleeding value once again. IOTA, NEM, and Ethereum are the biggest “losers” of the lot, by the look of things.

Another Day of Red Candles For Cryptocurrency Traders

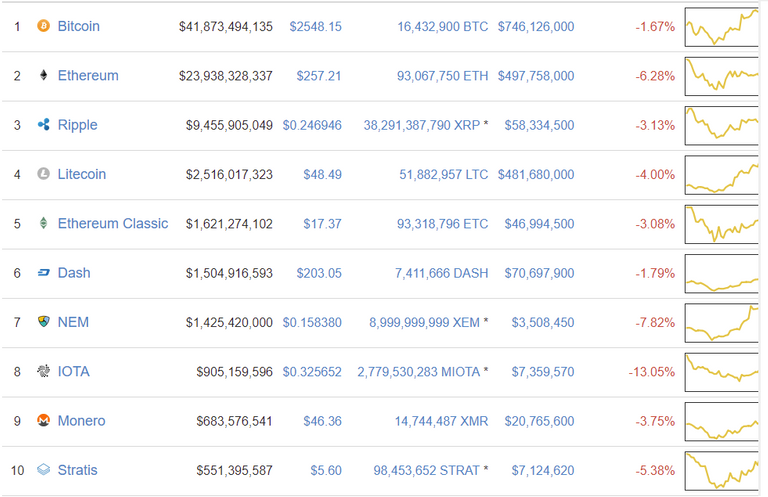

People who speculate on the value of individual cryptocurrencies have hopefully opened a few short positions. All major currencies are going down in value as we speak, which is rather surprising. In fact, Bitcoin is the only currency holding its own, with “just” a 1.3% dip. Other currencies are not faring all that well, with IOTA recording the largest losses at -11.42%. NEM – at negative 6.18% – and Ethereum – at negative 5.51% – are not doing all that great either.

One could argue market volatility has returned in full swing ever since the total cryptocurrency market cap surpassed the US$100bn mark. Since that time, we have seen multiple sharp dips, followed by recovery, followed by another dip. It is evident this US$100bn mark is a psychological threshold for a lot of traders and speculators, albeit it is anybody’s guess what the real story is.

When Bitcoin drops in value, all major altcoins will do the same. However, they are not doing so in an equal manner, as Bitcoin is the one currency with the smallest losses over the past 24 hours. It is well worth noting how Dash is the only other currency keeping pace with Bitcoin, despite its 1.46% dip. No other currencies keep losses minimized to 2% or less as of right now, which is rather surprising. It is possible a lot of altcoins are being exchanged back to Bitcoin, yet the timing doesn’t make much sense.

One thing people should pay more attention to is how Ethereum Classic is declining far less in value compared to Ethereum. Granted, Ether is far more “valuable” in US Dollars compared to ETC right now, but one would expect both of them to go down in equal fashion. That is not the case, as ETC lost 2.04% in value, compared to Ether’s 5.51% loss. An interesting trend, although it doesn’t have to mean all that much right now.

What is rather disconcerting to see is how IOTA seems to be taking a lot of hits in the value department lately. The token started trading on major exchanges not too long ago and was instantly catapulted in the top ten. Maintaining that position is a big challenge, as its market cap has dipped well below US$1bn in quick succession. Depending on how the markets evolve, that market cap may very well drop out of the 10 in the weeks to come.

Last but not least, the overall cryptocurrency trading volume has also taken a nosedive. Right now, this volume sits at well below US$2.5bn in the past 24 hours. Such numbers are to be expected during a weekend, but not necessarily during the week. It is possible we see a small pullback before the next major bull run. However, it is also possible future corrections are coming thanks to some currencies being way overbought in recent weeks. Only two currencies have a market cap of over US$10bn right now, which is very peculiar.

Happy Steeming....

After rising from $20B to over $100B in total market cap it's going to be one violent ride until this rollercoaster settles down. I've used this time to assess and reorganize my holdings to focus on the ones which I think will do well in the mid term to long term after the bearish movements have come to an end and we reenter a short/mid term bull market again.

With respect to IOTA or any other Crypto that have just hit exchanges, they get massively inflated to begin with, all the time. And if they are sitting over $1B in total market cap from the get go they'll likely lose considerable steam until things settle back to normal and they can begin the rise up again. It's simply that they are unproven, and filled with Hype... so yes, way over bought. This includes coins that people LOVE, like Stratis, Golem, Waves, Augur. All have lost quite a bit since their all time highs a few weeks back.

Now, consider the valuations on Litecoin. How long it took for it to finally break that $1B market cap, and now the $2B market cap. Dash did $1B in relatively shorter time but even it's been around the block a wee bit and is now being accepted and used in the marketplace as digital currency. Until the newer tokens prove themselves, speculation is all there is unfortunately.

The bear market will end. Whether it's this week, next month, or in 2018. We'll be back to pushing the upper boundaries again. I'm trying to just avoid looking at the market bleeding right now, and trying to remind myself how far we have come from January this year. It's a great sign, just have to be patient.

Agreed and great reply from you. Followed you