Bitcoin's (BTC) cost is exchanging a hesitant way subsequent to hitting 19-day lows underneath $6,900 on Sunday, however could get an offer on acknowledgment above $7,100, specialized investigations demonstrate.

The main digital currency tumbled to $6,890 on Bitfinex yesterday – its most reduced level since July 17 – before completion the day (according to UTC) on a level note at $7,025.

The value activity demonstrates BTC needs clear predisposition, however could likewise be viewed as an indication of bearish fatigue, as the costs have effectively influenced a 21 percent to slide from the ongoing high of $8,507.

On the off chance that the bulls can push costs over Sunday's high of $7,090, at that point a minor remedial rally could be in the offing. Then again, a slide underneath the earlier day's low of $6,890 would resuscitate the bearish view.

At squeeze time, BTC is exchanging at $6,975 – down 0.80 percent on a 24-hour premise.

Day by day diagram

The above graph appears, BTC made a doji flame (stamping uncertainty) on Sunday at the 50-day moving normal (MA) bolster, making the present close (according to UTC) significant.

A bull doji inversion would be affirmed if BTC closes today (according to UTC) above $7,090 (Sunday's doji flame high). For this situation, a remedial rally to the 100-day MA, presently situated at $7,474, could be seen.

In the interim, a nearby (according to UTC) underneath $6,890 (Sunday's doji light low) would flag a continuation of the auction from the July high of $8,507.

In the event that the bulls neglect to constrain a rally soon, the concentration would rapidly move back to the bearish elements: descending inclining 5-day and 10-day MAs, the rupture of the key help of 100-day MA a week ago and a bearish relative quality file (RSI).

Further, BTC's closeness to the exceptionally vital converse head-and-shoulders neck area bolster (previous obstruction) of $6,820 is another huge motivation behind why the bulls need to make a brisk rebound.

A move beneath $6,820 would discredit the bearish-to-bullish pattern change affirmed by the backwards head-and-shoulders breakout on July 17 and would move chance for a dip under the rising trendline (yellow spotted line).

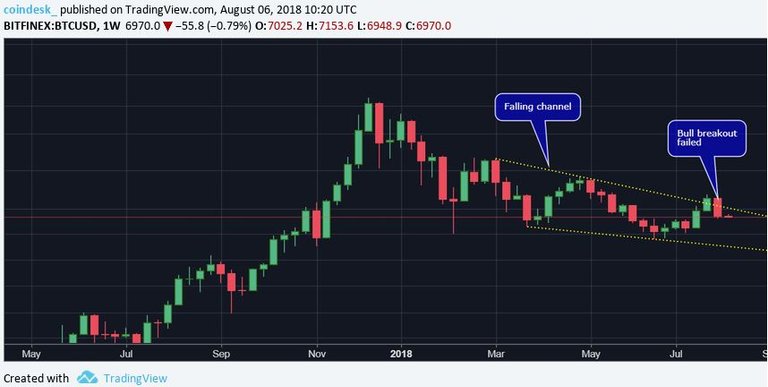

Week after week graph

As observed on the above diagram, the long haul bullish view has been discredited by BTC's nearby at $7,025 yesterday.

BTC shut over the falling direct opposition in the earlier week, *seeming to confirm* a long-run bearish-to-bullish pattern change. Be that as it may, the breakout wound up being a bull trap [comma] as the digital currency fell back inside the channel a week ago, nullifying the long haul bullish standpoint

View

BTC could ascend back to 100-day MA of $7,474 if costs close today above $7,090. All things considered, the fleeting predisposition would stay bearish as long as the 5-day and 10-day MAs are inclining south.

A nearby today beneath $6,890 would build the danger of a dip under the key rising trendline bolster, at present observed at $6,700.

Revelation: The writer holds no cryptographic money resources at the season of composing.

Bitcoin picture by means of Shutterstock; Charts by Trading View

The pioneer in blockchain news, CoinDesk is a media outlet that makes progress toward the most noteworthy journalistic benchmarks and keeps a strict arrangement of publication strategies. CoinDesk is an autonomous working auxiliary of Digital Currency Group, which puts resources into cryptographic forms of money and blockchain new companies.

This article is planned as a news thing to educate our perusers of different occasions and improvements that effect, or that may later on influence, the estimation of the digital currency depicted previously. The data contained in this isn't proposed to give, and it doesn't give, adequate data to frame the reason for a speculation choice, and you ought not depend on this data for that reason. The data exhibited in this is exact just as of its date, and it was not set up by an examination expert or other speculation proficient. You should look for extra data with respect to the benefits and dangers of putting resources into any digital currency before choosing to buy or offer any such instruments.

Join 10,000+ dealers who come to us to be their eyes on the outlines, giving all that is hot and not in the crypto markets.