When we began developing the concept for Token Report, the first thing we recognized was the wall of noise facing anyone, even an experienced crypto investor, hoping to make sense of the ICO market. Never mind analysis — simply discovering and keeping track of facts was a source of pain.

That was in May. Now, we’re seeing new ICOs open at a rate of 20 to 30 per week. This world has gotten more complicated for the investor and the analyst, and we believe the coming quarters will bring more complexity.

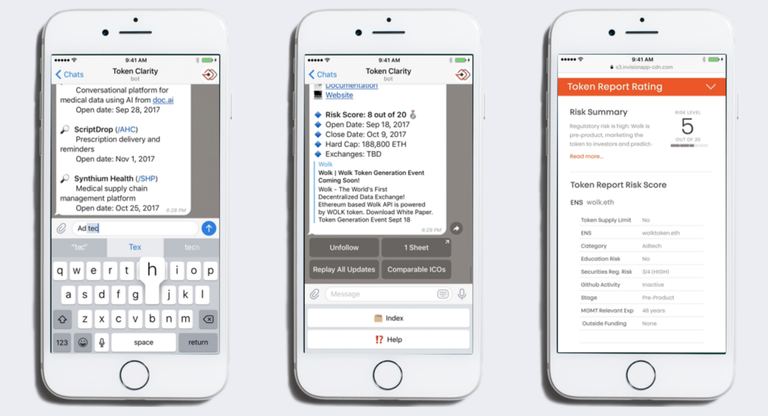

As we developed a financial research approach, we decided to focus first on this problem of establishing material facts about every ICO of interest. As we began having conversations with customers, we saw the need for a product out of that process. The first iteration of that product is Token Clarity, a message-based interface with our fast-growing database.

It lives inside Telegram. We’ve been developing it in a private alpha with a handful of customers. Today, we’re opening it up to a private beta that will last from now until our ICO, which is Nov. 28.

You can read about Token Clarity and see a live demo of it in action on our website. Or, skim through my brief notes on it below.

Either way, you can sign up for beta access using this brief form. Beta invites in this first round are limited, so please sign up now.

Here’s my brief sketch of what Token Clarity can do:

Query the database

Search for ICOs by industry category, ticker or project name.

Alerts

We send an alert whenever we list a new token. The alert will include the ICO open date, hard cap and a brief description of the project. If you are interested in the project, you can use the Follow button to get future alerts in real time. We send alerts to let you know about:

- Changes to the white paper

- Changes to the team

- Changes to the terms

- Changes to the token

- Changes to the advisory board

Token Clarity’s Follow alerts are designed to keep you abreast of any material changes to tokens you are buying, or thinking about buying.

Benchmarking

The ICO market is like being in a crowded restaurant: Everyone’s busy with their own food and their own dinner companions, but you don’t necessarily know who’s at the next table. Token Clarity changes that. We bring context to every ICO project, letting you see who’s out there, operating in the same industry category.

Look up any ICO and hit the Comparables button to see a list of others in the same category. In the more detailed One-Sheet, you’ll see a bar graph charting how that project’s hard cap compares to the amounts raised by similar projects.

The One-Sheet, a detailed summary

The Token Clarity One-Sheet is a visual guide to everything you need to know about a token. Our research team writes concise summaries:

- Project summary

- Team summary

- Risk summary

- Liquidity summary

The one-sheet includes data visualizations on risk and on how an ICO’s hard cap compares to the total amount raised by top ICOs in the same industry.

Risk Score

The Token Report Risk Score is a transparent, objective assessment of what ICO developers have done to reduce risk ahead of the ICO. It includes:

- Securities regulatory risk: Is the project likely to be regulated as a security? Regulations and markets may change, but right now securities regulation limits tokens from listing on several major exchanges. We deem this a liquidity risk.

- Team experience: How many combined years of experience in a relevant industry does the senior management team have?

- Technology: Does the project have an open-source repository? Is it active? In a crowdfunding event, greater transparency reduces risk.

- Market: Is there an analogy company that customers will know? Projects face significant market risk if their product is like nothing anyone has seen before. Not everyone is willing to read a white paper in order to understand your product.

We’ll have a more detailed description of the risk score and our thinking behind it in the coming days, but for now it’s enough to say that our goal is to provide a rating system that is simple, objective and transparent.

Closed sale data

We have amount raised and close date on nearly every ICO that has closed, as well as live-price data via CoinCap. We also have data on ICOs that failed to meet their minimum fundraise goals and those that canceled for other reasons. Our aggregate quarterly ICO fundraising data was recently cited by The Wall Street Journal: https://www.wsj.com/articles/whats-an-initial-coin-offering-icos-explained-in-11-questions-1506936601.

Road map

- Multi-layer industry categories: We’ve done our best to categorize ICOs simply and accurately, but many projects fit into multiple categories. We’re developing a way to understand and compare ICOs more multi-dimensionally.

- Keyword tags: Improving our search function by adding relevant keywords. We believe this can be done programmatically.

- Etherscan data: Integrating data from etherscan.io will improve our ability to provide live updates on open ICOs and provide valuable information about distribution and ownership on closed ICOs.

- A past-work graph on every ICO advisor, partner and operator. In a frothy market, it can be hard to establish correlation. We’re beginning to establish the network of facts that can do that for both momentum investors and value investors.

If all this provokes questions, please join our Telegram forum and ask our team here: https://t.me/joinchat/DtuO-A237efEOnxD1BKy6g. We’ll answer them as well and as quickly as we can.

Congratulations @selinejung! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!