I didn't invest a lot of money into cryptocurrency and digital assets back in 2017. I remember thinking what a big deal it was when I decided to put 1% of my investment portfolio into BTC, ETH, and NEO (of all things! 😩). To me, that was a reasonable amount to invest, relatively, into magic internet money.

I think, in the runup to the miraculous bull run of late 2017 and early 2018, I may have let myself get caught up in the frenzy enough that I contributed approximately 5% of my investment capital into cryptocurrency and then, through appreciation alone, that got up to about 15%. I took a little profit in early 2018 but, of course in retrospect, not enough.

But that's on me. I'm not blaming anyone for those "losses." Because, really, they're not actual losses. Just like they're not gains until you sell, whatever I had on paper in January 2018, I really didn't have in actual value. Who knows? If I had tried to sell NEO at $185 I might have crashed the market with my bag!

I now know what caused me to miss out on those profits. And that had nothing to do with anything else but me. What caused me to do what in retrospect was so stupid? That's easy.

Greed.

To put it simply, I thought NEO was going to $300. To this day, I'm not ever sure what my logic was, but I distinctly remember thinking that on multiple occasions.

Oh well. Live and learn. 🤷🏻♂️

The great thing about life is that you get to live another day and try and do better next time.

What I am most thankful for in this experience is that I had studied portfolio management long and hard enough to avoid the single most common pitfall that pretty much singlehandedly REKT anybody who stayed invested in crypto in 2018. I mean it sounds so simple when you say it but, in fact, it is quite difficult. Emotions usually get the better of most of us. So it's important to have established some rational guidelines you can harken back to BEFORE things get emotional.

Probably the most important guidance for investors is easier said than done.

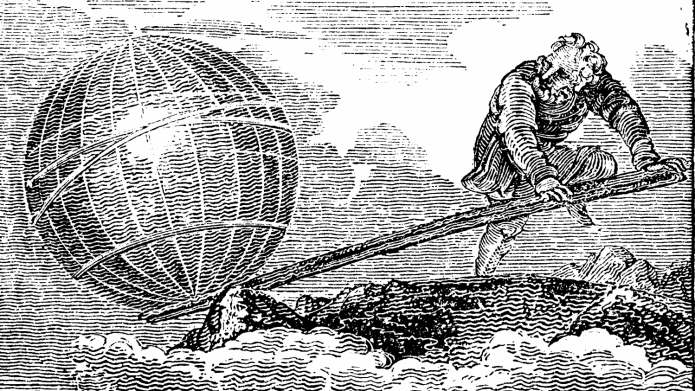

Don't put all your eggs in one basket.

Because the chances are high when you do that that you are gonna break some eggs. Just like this. I mean that brilliant investment idea that you think no one else has and you are ready to go AWL EEN on? It just might work out. Or it might not. If you lose all your powder in one last showdown, you might go down in a blaze of glory, but you ain't playing again. Not with that capital, at least. So maximize your chances while ensuring that you live to see another day. And play again.

And yet, I still hear about people who put money into coins crying, "I lost millions." Or in Chinese, "我的三百万变成20万。(My 3 million has become 200,000!) Well, that's awful. But did you really do that without "millions" invested in other assets? That's just crazy. I can't imagine going all in on digital assets, literally, to where they were 100% of my investment portfolio. I mean maybe once we have security tokens and a reliable wallet to store them in... 😝 but we are far from that right now.

Intuitively, I think most people understand that. But when emotions get involved, the picture is much cloudier. For instance, nearly everyone, including myself, falls prey to the great killer of investment alpha: the sunk cost fallacy.

The sunk cost fallacy leads investors to throw good money after bad by doubling down on their worst investments, so that they can "more quickly get their money back."

Yeah, somehow way back in the lizard part of your brain, it sounds good to lower your cost basis. I guess the thinking is that your investment, once it eventually goes back to your original buy-in price, will bring you that much more in return at that point. The problem is that IT MIGHT NEVER GO BACK TO THAT PRICE EVER AGAIN. The logic here is flawed.

Instead of investing money in your best ideas at the moment, the ones which supposedly have the most potential to gain at that precise time, you invest in an idea simply because you have invested in it before. It is literally like saying, "The last time I ate this food it made me sick. So I will eat it again because maybe now I have built an immunity to it, and if not, maybe this time I eat it and get sick will get me that much closer to a time where eventually I can eat it and not got sick."

Yay!

Greed, lack of portfolio diversification, and sunk cost fallacy are some of the reasons why most people fail to outperform even a basic stock index fund like SPY. But by far the worst investor trait that young investors use to try and CRUSH the markets, the most dangerous threat to your financial independence surely, is leverage.

Leverage itself is neither good nor bad. It merely amplifies your investment decisions.

But that is why when you are young and inexperienced, on its face, borrowing money to make investments is a decidedly bad idea. Without investing experience, you are just amplifying your learning curve. That's not very likely to be a winning formula. Most of the world's best investors, like Warren Buffett or Bill Ackman, don't really hit their stride until they are well into their 40s and 50s.

Moreover, if you are using leverage, and if that money is coming from friends and family, and they do not agree to the sharing of the investment risk, it can destroy relationships. If that money is borrowed on your own behalf, and the investment does not perform according to your expectations, you could be hamstringing yourself for years, or even decades.

So don't do it!

And yet, every time there is a bull run in some asset class, the same process is repeated. The smart money that has played this game over and over again throughout their lives come in and grab their 50% to 100%. Then calmly leave out the front door, leaving a mass of noob retail investors to fight over the last 20% to 30% scraps at the top. Firmly secure atop their pile of cash, waiting for the next bubble to appear in some other asset class at a later date, these guys watch as everything crashes around the retail investors, 60-70-80% losses in some unfortunate positions are the norm in such a situation. And if you committed one of the "capital" sins above anywhere near that bull market top... Well, God help you.

The only thing left for you to do is pick yourself up and

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

I really hope we get out of this correction, I bought a lot in December (my entry point in crypto) and tried to take advantage of this dip as well. It would be nice to be able to one day take out my initial investment and let the rest do its thing. A lot less stress losing money that you never really made to begin with.

Great timing, @madbiker! I’m sure you are up big time then. Or wait... do you mean December 2017 or December 2018?

Posted using Partiko iOS

What a difference a year makes, huh?

Posted using Partiko iOS

2017 but still hodling and buying

What was that quote or saying... "the more personal the experience, the more universal it is".

You're not only one that who got burned in that darned "Crypto-Winter of 2018".

Lookin' back and zoomin' out of the BTCUSDT chart... it was one big-ass correction (aka. one big friggin' "price markdown" a la Wyckoff) then a long-ass Accumulation till now. The upthrust... that's just test to shake off weak hands (those darned bear short-sellers) out of the market to bait us to buy and raise the price so that they could sell it off later. Whew!

I started off writing something different. Something like 2018 was for crypto like 2008 was for half the world. But then it turned into this... The bigger issue is not what happened to those who lost a couple 10k USD, it’s those who went all in with all their money and then some. Those people who had millions of dollars worth of shitcoin in January 2018... Why?

Posted using Partiko iOS

Them snake eyes... will get ya'. Greed... it's a much more potent addictive that hope or any physical drug. We are all human... we all succumb to temptation sometime. That... and the magic-pill and lottery ticket mentality that we have have. Not cool bro.

To try maintain a clear mind, clear thoughts, unbiased while full on distracted by our emotions of that moment.

I'm starting to think that trading and investing is like an emotional shit-testing on our minds to see we survive not falling on pitfalls and traps. Hmm...

Oh yeah... investing all your nest egg without proper research, analysis, and having without some kind of system or method... just basing it on "blind faith" on a technology is a big, big, BIG NO! NO! Noob mistake.

Ooh I just feel heavy for those people. :(

You got a 7.50% upvote from @brupvoter courtesy of @shanghaipreneur!

scash!tip 100

⚡$$$ Tipped @shanghaipreneur

⚡100.000 SWIFT! If you don't know how I work, click here! Currently the price ofSwiftCashin the market is$0.003 USDperSWIFT. Current value of the tip is$0.300 USD. To find out more aboutSwiftCash, please read our whitepaper!Thanks! What is this token?

Posted using Partiko iOS

It's a better version of bitcoin if you ask me! Read the whitepaper to find out more if you want. You can also join http://miner.swiftcash.cc for more "free" coins if you're interested while it lasts :P

Really? How much of it do you have? It must be a lot if you think it’s better than bitcoin! Why do you think that?

Posted using Partiko iOS

Just read the whitepaper and judge for yourself. I've been involved in this project before it launched so I might be biased. :)

@shanghaipreneur purchased a 19.84% vote from @promobot on this post.

*If you disagree with the reward or content of this post you can purchase a reversal of this vote by using our curation interface http://promovotes.com

Congratulations @shanghaipreneur! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!