Something is happening in cryptoland! But what exactly?

Personal reflections...

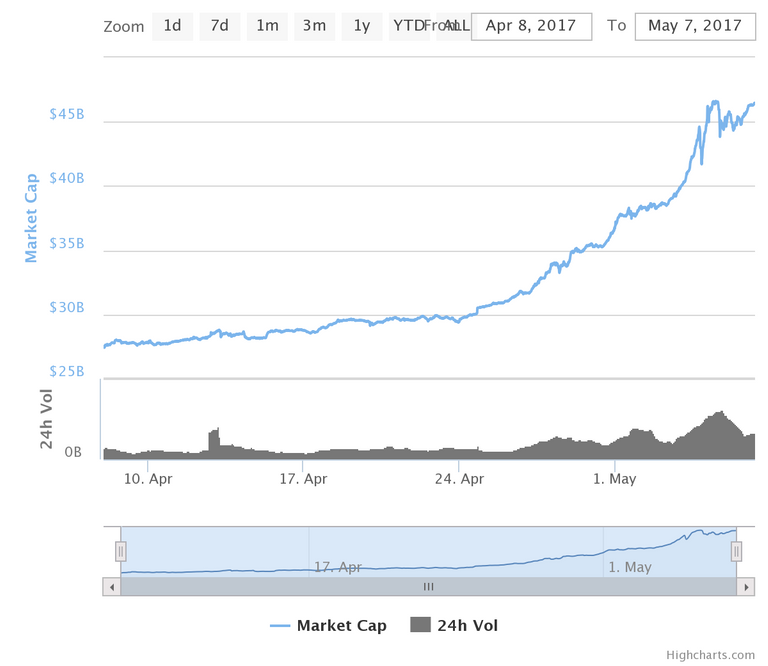

It has always been a volatile and crazy market overall, but for the last 1-2 weeks, it has just exploded:

image from Coinmarketcap showing overall market cap of 821 projects/currencies in 30 day graph

image from Coinmarketcap showing overall market cap of 821 projects/currencies in 30 day graph

So I asked myself: Who could the new investors be?

Is it because more and more real people are entering the market(s)/projects and distributing their investments? Is it maybe institutional investors (pension funds, investment funds, banks)? A specific region or country?

One, some or all of these entering the market leads to an increase in the evaluation of the projects/currencies invested into...so far, so good.

So if it was one of these groups, one would expect, especially bitcoin and ethereum to benefit...which they do (both at all time high regions).

But if it was mainly institutional investors, one would expect a due diligence and therefore they probably would stick to these two (although in my personal due diligence, bitcoin would not look good aside (mass-)psychological/emotional reasons/motives) - but actually almost all projects/currencies have taken off...

So it seems arguable, that the new investors seem not to be institutional as they could not be able/willing to diversify their investments so wide and into currencies/projects so opaque, even the most sophisticated experts in the field cannot comprehend if it is a copycat, scam or a grand vision...right? Then again, CFDs were not transparent as well...

Of course there are the "oldies" in the sphere - those having invested in digital currencies for a long time and some of them viewing any blockchain project as a currency at first (or for ever)...these seem to be really diversifying, maybe as the bitcoin scaling debate (Bitcoin Core VS Bitcoin Unlimited) seems to also get on their nerves...but probably mostly because they want more of the "invest-early-profit-extremely"-scheme working even better for them...

So - this group could explain the dive into anything not bitcoin and Ethereum putting some of their profits into rather smaller and new projects/currencies.

And then - one could stop pondering and look at data - but to find data in a sphere that loves anonymity and uses private/public keys like others use facebook/whatsapp - is really hard.

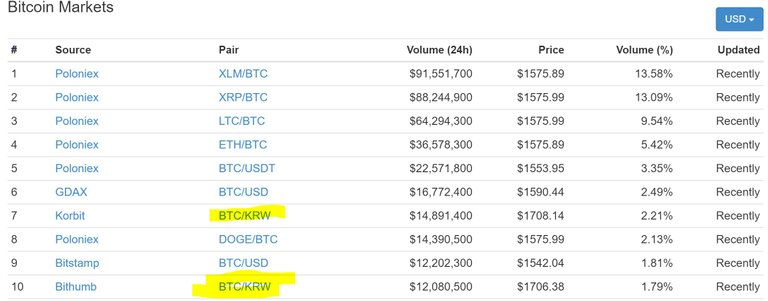

But why not look at one thing, that is tracked well, thanks to the markets: The trading pairs being used.

And there something lurked, that I did not expect to see so clearly - the KRW, the (South) Korean Won.

For bitcoin, looking at the trading pairs in late 2016 it was mainly people buying/selling BTC (bitcoin) with CNY (Chinese Yuan, although called Renminbi in China), after the Chinese Central Bank understood the effects on "currency control" and undermined selling BTC for USD in China, the strongest trading pair for BTC was with USD (January17). Unfortunately I never did screen shots, but I do not remember seeing the KRW there in the upper region - until now.

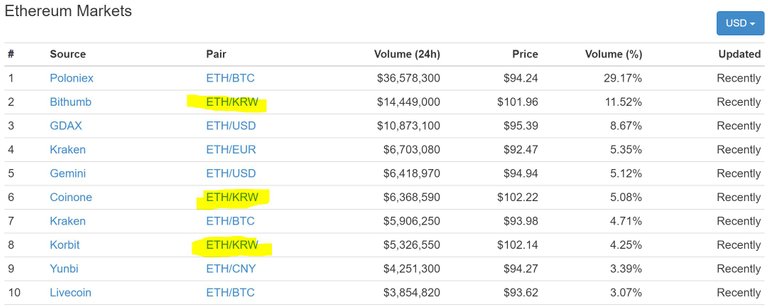

Actually there was a story a month or so ago, that Ethereum's star was rising in South Korea. And that ETH (Ethereum) to KRW trading pairs made up 10-17% of all ETH volume...

Funny enough - ETC (Ethereum Classic) which has a very similar name and could get mixed up has also risen in South Korea...

So for now, to me, it seems, there are a lot of new private investors from Korea in the markets...maybe even institutional players in South Korea (as some insurances there like Kyobo Life at least are doing a lot of PR about blockchain projects).

And the "oldies" are diversifying like never before - something I (obviously) have not data to show for, but is a result of so many Slacks and Telegram groups I read for some time...

The combination of these factors bring a small percentage of traditional investment funds to crypto, which is a huge increase for crypto.

Great comment - Thanks! Intersting - "hockey stick adaption VS FOMO bubble" one could call it ;-)

Actually I used the comment to write up on "Hockey stick or bubble" ;-)

Thanks for giving me the final push to that ;-)

I don't understand what makes ETH such a better/more stable investment than, say XMR or LTC. In my opinion eventually, as crypto becomes more mainstream, people will see that ETH and XMR (hopefully Steem as well) have more to offer than BTC does as far as features go (ETH with the smart contracts, XMR with it's anonymity features).

ETH has its smart contracts for sure, but it also is a infrastructure blockchain, allowing others to build on it instead of creating new chains....at the same time, ETH is very well at gaining traction for private clones of itself with big corportation (see Ethereum Enterprise)...

So ETH has a fully different story...that said - it also still has to overcome some open issues...will be interesting.

I am with you regarding Steem - it did boost off the last days (I actually missed it and just saw it today while gathering the data of my article)...good thing.

But I think, steemit has to get some stuff done to become more than a "crypto-blogger's baby"...and I want that!

XMR - well - from what I learned the community can be very ... aggressive in its tone towards other currencies...and their proposition is not unique - zCash and "DeepWebCash" and others are all into the "anonymous currency" game...momentarily I personally doubt it will be XMR that will win that game...but who know?

Perhaps I am over zealous when it comes to XMR but I was under the impression that zCash has significantly weaker anonymity features. Then again, I was reading in XMR threads. I agree the community is overly hostile from what I've seen but that I don't know how that might translate long term.

I think the hostility will (actually already has) lead to a lot of potential users turning away...maybe trading XMR, but never using it as a trusted project/currency.

I have long given up on REALLY understanding which anonymity features are better...but my guts tell me, ZCash has a much better reputation within the influencer community (founders and devs of other projects/currencies) besides maybe bitcoin core, who seem to value XMR highly...

The only thing I see XMR stronger than ZCash is that ZCash's founders and devs are existing public people...with XMR at least I know only of FluffyPony as someone public....

Why is that important? Governments are still far from understanding the crypto sphere...at the moment they think, BTC may be more than a trend, but once they understand there are projects/currencies allowing to hide who is sending how much where - boy - they will freak. And then all publicly available people involved, have some problems to solve ... ;-)

But I think, XMRs greatest enemy is their handling of users and potential users...

From what I have seen in my limited experience, XMR is used more than zCash as an actual currency. For example alphabay takes XMR, BTC & ETH, but not zCash. I do think that theres a small change in the XMR community to try and end the hostility, your point about them turning away potential users is well made in that regard.

Great exposition. I think the new entrants are mixed. Both ordinary people in the street and institutional investors are most probably investing in cryptomarket right now.

Thank you!

You are probably right about the mix - I wonder if institutionals are allowed to invest in something so opaque and volatile as cryptos, though? I understand they can make claims for BTC and ETH - but the others?

I hope we will soon find out, who has almost doubled the overall market cap ;-)