I'm relatively new to crypto trading. But I have already learned a few lessons the hard way. In this post I'll talk about my experiences and how it prompted me to revise my trading strategy.

My first strategy was to invest about 50% of my budget into Bitcoin and Ethereum, 30% into well-researched altcoins and 20% into, equally well-researched, (pre)-ICO tokens. Then I wouldn't touch it for about half a year and see what happens.

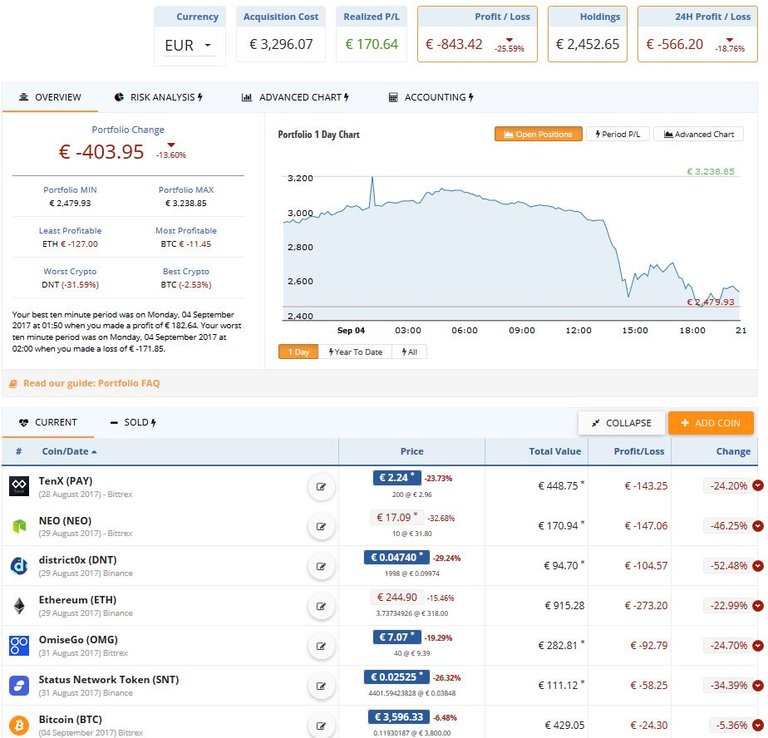

A few of the coins I invested in immediately made huge gains. TenX went up about 20%, OmiseGo and Ark saw similar gains. Then the crash came and the market cap dropped from 180B to (currently) 142B in only two days. OmiseGo is now at -27% compared to when I bought it. TenX trades 24% lower than when I bought it. Luckily I was able to sell Ark when it was still about 15% up, after which it started dropping as well.

My P/L is now about -20%. I know I do not have my portfolio to blame for this, since the cap market also lost about 22% (so far). But I still regret that I didn't sell my profit in TenX and OmiseGo when it was at about +20% and then used those funds to invest into other undervalued coins. I'm pretty sure that in the long run the market will recover and my portfolio will see lots of green numbers rather than red ones. But I might have to wait quite a while before that happens.

So I decided to try my hand at minimal 'trading' rather than at 'holding'. Here's how I'm going to do it:

- I will create pool of 20-30 coins/assets of which I have faith in their long term potential, taking into account parameters such as: competition; price vs circulating supply vs total supply; use cases; monetization of tokens; potential for mass adoption; ...

- Based on technical analysis I will select 7-8 undervalued currencies/assets from that pool and invest in them.

- As soon as one of these assets reaches a 20% ROI I will sell the tokens and select the most undervalued asset from the pool to invest in.

- I will never sell tokens at a lower price than what I bought them for, with a few exceptions:

- If bad news related to a token is released and a further price drop can be perfectly predicted.

- If bad news related to crypto in general is released and a drop in total market cap can be predicted, in which case I will sell the two best performing assets from my portfolio.

- If a coin surges from -50% to -10% I might also sell, since a pullback can be expected after a 40% increase.

- This does not apply to Bitcoin and Ether and the ROI should always be measured relative to Ether or Bitcoin. It's no use to sell a coin with 20% ROI if Bitcoin has just increased 30% in value.

You might think, "Why do you need a framework with rules? Can't you just act on instinct?" For me it wouldn't work that way. These rules should keep me from being impulsive on the market. Let's see if this strategy will pay off, once the market recovers from the pullback.

What do you think about the strategy? Let me know if you think there's a better way. All advice is welcome.

To be continued

SHRL24

interesting post.. i follow you.. hope you upvote me also.. thanks and follow me

Congratulations @shrl24! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPWelcome to Steemit!

We have all been waiting for you, we are glad you could make it.

I have given you a upvote to help you out!

Hope you love Steemit as much as we do.

Give these a read:

Chat with us:

If this post was helpful, please leave an upvote. It helps me to keep helping new users.

I'm sunnybooster, a booster for accounts not posts. Send me 0.5 STEEM or SBD to get a week of upvotes! If you don't yet know what this is its fine.

I am a bot and this was automated. I exist to help out new members and attempt to get them hooked