The crypto-market alone is not enough for digital assets. The need to create an exchange to allow for a switch between stock and crypto-market has been on the increase these days.

ALLSTOCKS plans to bring this vision into practice by creating a distributed global stock exchange platform to interface with all major stock exchanges and stock brokers around the world.

The platform will

allow the trading of crypto-tokens backed by the real financial assets that they represent;

the network will, therefore, create a decentralized system, which will help all stakeholders to trade with its ERC20 compliant token, while the real financial assets will be held in an escrow account.

The ALLSTOCKS network will allow users to trade currencies and bonds through Blockchain technology.

ALLSTOCKS Network will give developers greater capacity to develop their tools and apps for investing, hedging and carrying out transactions using ALLSTOCKS tokens. This will be done through the release of its generic API interface.

Organizations that are exposed to cryptocurrency’s fluctuations can better protect their capital through more stabilized assets with ALLSTOKCS initiatives.

IMPLEMENTING THE ALLSTOCKS SYSTEM

The ALLSTOCKS NETWORK will be a function of;

Ethereum Blockchain: Allstocks chose ethereum blockchain because it decouples mining rewards from transactions between the system’s participants. In simple terms, Ethereum denotes mining rewards as Ethereum gas, a price paid to carry out transactions on Ethereum, while asset-backed tokens are made a part of the mining process.

Ethereum Mining: Ethereum miners solve some cryptographic puzzles so as to win Ether, a crypto token that helps the system to run smoothly. Ether also enables developers in the Ethereum network to pay for fees and services.

Cryptocurrency Tethered Token (CTTs): Cryptocurrency Tethered Token are asset-backed tokens that represent real financial assets that are held in the ALLSTOCKS system. ALLSTOCKS plans to support all fiat currencies and all financial instruments. The plan to add more assets in the future has been in place.

Fiat Currencies: ALLSTOCKS will support many internationally tradable fiat currencies. These fiat currencies include USD, EUR, GBP, RUB, CNY, JPY, and more. More fiat currencies will probably be supported in the future as the exchange gets its needed world popularity.

Money Market Instruments**: ALLSTOCKS will offer stable low-yield assets. Investors will be able to buy tokens tethered to US Treasury Bills. When it is done, the implication is that dividends and interests will keep accruing until real financial assets mature.

Dividends and interests, if present, will be given to current CTT holder as fiat CTT. The effort

made in developing ALLSTOCKS is a continuous one, so in the future, more financial institutions

will be incorporated into the network, and financial instruments will be enhanced to support

the newly added financial institutions.

Regulation Compliance: Because CTTs can also be embedded to meet certain regulations because they can be programmed. We all know that fiat cannot be restricted, however, the buying and resale of other financial assets must be restrained by country-based geography. If this is achieved, then they will be fully compliant.

Escrow Account: All financial assets used in the network will be held by an escrow account on behalf of ALLSTOCKS issued CTTs.

Off-chain activities require the oversight and input of authorized regulators because a large component of the system will be off-chain. It is important that stakeholder interaction will be opened and well-managed to ensure full compliance

without sacrificing reliability and transparency of the whole system.

AssetsExplorer: This Shows the underlying assets with full transparency and ease, allowing any user to explore the relation between issued Cryptocurrency Tethered Tokens to its real asset.

How it will work.

Wondering how it works? Read more from the whitepaper

ALLSTOCKS Network Tokens: The ALLSTOCKS Network’s fees and commissions will be

levied in the form of its tokens. Tokens issued by the ALLSTOCKS Network will be listed on all

exchanges that are ERC-20 compliant.

Role of ALLSTOCKS Tokens

The major business requirement of ALLSTOCKS is for CTT to be tethered to the underlying real financial assets. To this far, off-chain assets are scrutinized with the help of virtual exchange currency. Virtual exchange currency is required because it serves as the intermediary between on-chain and off-chain payments that enables the facilitation of payment of off-chain fees as well as system interaction.

CTTs are suitable for ALLSTOCKS Network to provide a dedicated chain in the near future. The reason being that CTTs must remain tethered to the real-world financial assets. While ALLSTOCKS tokens act as the gas of the network by providing access to the relevant network features, the ALLSTOCKS Network itself ensures that CTT is tethered to the real financial assets.

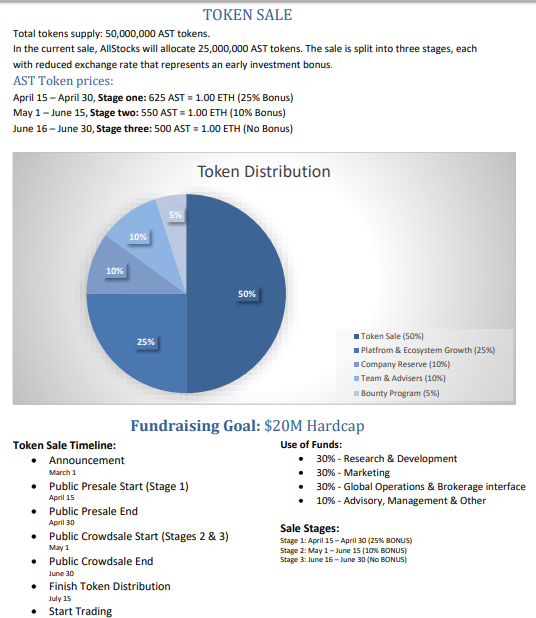

** The allstocks team has given chance to investors to take part in their crowdfunding event to help in the achievement of their set goals with the crypto community.**

**BELOW IS A FULL DESCRIPTION OF THE EVENT.

USEFUL INFORMATION

WEBSITE

WHITEPAPER

FACEBOOK

TWITTER

INSTAGRAM

YOUTUBE

REDDIT

TELEGRAM

LINKEDIN

PINTEREST

bitcointalk writer: sieemma

Finally, an exchange to combine both the stocks and cryptocurrency market is live. Thanks to the allstocks team. Never stop working hard. I know there are other stock exchanges trying to add crypto to their exchanges but I expect yours to be the first anyway.

Great work done @sieemma. Keep it up with the good works. The project looks promising as well. Will have a careful look at it.