is going to be made before Bitcoin CBOe near month futures expiration date on the 26th of January.

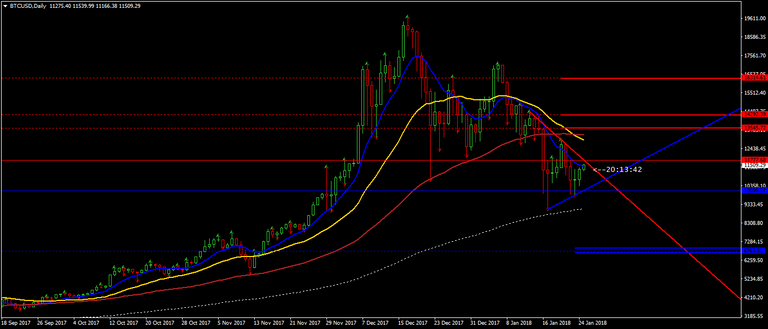

If we go to medieval times when BTC was priced @ $163 (11th of January 2015) and then come back to the 17th of December 2017 when BTC achieved all time high of $19704 (SimpleFX pricing) the middle between these 2 extremes is going to be (163 + 19704)/2 = $9933.5.

50% is a pretty strong Fibonacci level and that's where in case of Bitcoin we have been bouncing from since the 16th of January. Plus $10K is a very psychologically strong number. In other words, at this stage we are witnessing a locally established pretty strong support and now comes the time to test the opposite site - i.e. resistance provided by the joint together 34 (yellow) and 89 (brown) days WMAs.

The upside trigger level ($11778) is set to be crossed in my view and I expect BTC to continue to at least to 89 days WMA (currently @ $13160) with possible overshoots to 13545 or even to $14292.

The key question that I can't answer is whether or not on the 26th of January the near month BTC futures are going to be dumped as previously or rolled over. And therefore whether or not we will see a daily close above 89 days WMA with following continuation to the top volatility implied target of $16315. If we do, then the entire technical outlook will change.

https://www.mql5.com/en/charts/8215764/btcusd-d1-simplefx-ltd

All major ALT coins are positively correlated to BTC and will follow its path.

BCH

https://www.mql5.com/en/charts/8215774/bchusd-d1-simplefx-ltd

DASH

https://www.mql5.com/en/charts/8215809/dash-d1-ava-trade-ltd

ETH

https://www.mql5.com/en/charts/8215821/ethusd-d1-simplefx-ltd

ETC

https://www.mql5.com/en/charts/8215827/etcusd-d1-simplefx-ltd

LTC

https://www.mql5.com/en/charts/8215833/ltcusd-d1-simplefx-ltd

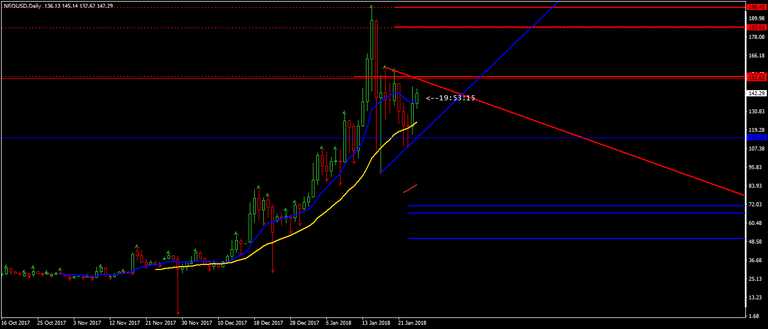

NEO

https://www.mql5.com/en/charts/8215840/neousd-d1-ava-trade-ltd

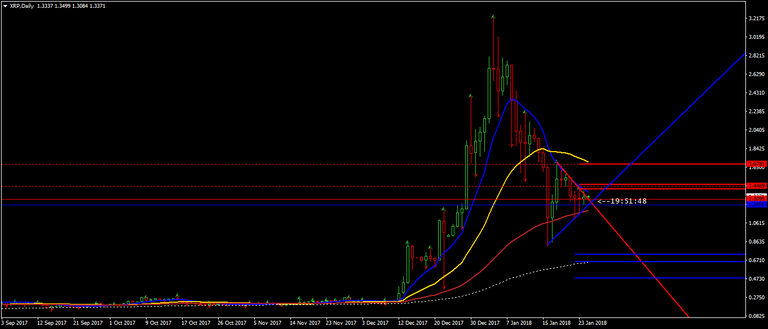

XRP

fly above arround 9500 for a while and then go to 30k and drop to 20-25

Good Day Sir. I hope all is well.

So i guess a half hearted attempt was made to move BTC up with the anticipation of the futures ending. Lackluster at best.

Are you still bearish for the short term? I know several weeks back (if i remember correctly) you got out because wallstreet now had a way to manipulate with a futures market.

I've picked up a few alts over the past few days that I'm cost avg into, but have yet to pull the trigger with any more BTC. I've made some purchases a week or so ago in the 11k-14k range but have been holding off through the 9k dip, with the expectation of another move down. just wondering your opining of the market. (I dont really "daytrade" just try and buy the dip)

Do you pay attention to the "regular" markets at all. the US exchanges have been moving up well. do you think there could be or will be any correlation between the two (most likely industry specify). I'm just sourcing various information from different sources to try and formulate a future prediction/hypothesis.

So i guess in short, i'm asking for your opinion of the geo political land scape. I know this is rather a in-depth question, and your time is limited. so i would understand a brief answer or just enough info so see things from your perspective, i'm happy to do additional research on my own.

So in short, i'm betting on 100k for BTC by 2020, and as amazing as BlockChain is, what i see as the real tidal-wave of change is decentralization. Humankind has yet to understand what this means. I think the banking infrastructure will be the first to feel the effects. what happens after that, is what i'm trying to see.

I'm paying attention to and thinking about, Food and the scarcity of it and the large role that GMO's will have. defense industry, energy....

There's no such thing as the"regular market" anymore. It died back in 2008 together with investment banking. What we see today is a total manipulation of everything. Commodities, Stocks, bonds, mortgage backed securities, - you name it, - everything is being manipulated including popular perceptions and myths through the social media. We live in the smoke & mirrors invented reality.

The money masters will continue to pump up everything because they can not afford a social disorder. Especially they need the property and stock prices to be elevated. Because rising stocks and real estate bring an illusion of wealth for the population as well as they secure collateral base for the banking system. If collateral starts to depreciate the entire banking system will go belly up. Especially in Europe where banks operate with 100 + leverage.

So, the pumping of stock and property prices will continue by printing money out of thin air (regardless of what the talking heads say) and the only limitation to this exercise is confidence of the general population in the fiat money system. Because the more you print the less scarce money becomes and money immediately loses its purchasing power once its scarcity evaporates. So, what do you do?

As a matter of fact it is not a brainer. All you have to do is to create new avenues to absorb the excess dollars. The cryptocurrency market is a perfect inflation shock absorber.

tipping hat response. but only i don't know how to do the Gif.

http://www.sherv.net/hats.salute-emoticon-3006.html

Thanks for Sharing👍

If we r not able to cross 11777 in the next 12 hours, do you think we are heading to test 8800/- cheers srezz

Let’s see what happens

Thanks a lot for all the TA srezz.I have a general question regarding TA.

In your opinion is 55 EMA a good indicator of Support and resistance.

Can i use 55EMA on a daily chart ?

You can use anything as long as it brings you confidence. I use 13, 34 and 89 WMAs because they represent Fibonacci numbers and 89 / 34 = 34/13 = golden mean +1. Thus you have a system of dynamic support/resistance.

Thanks a lot Srezz , appreciate you taking the time.

my 2 cents - XRP will fail hard.

I can't tell if we are going to see a short term dump first before any upside, or a good swing upwards first. ETH seems like it just hovers in between 1010 and 1100 the past few days.