Monster Products Inc. - which was still producing the famous Beats helmets a few years ago - has informed the gendarme of the American stock market that it intends to launch an Initial Coin Offering.

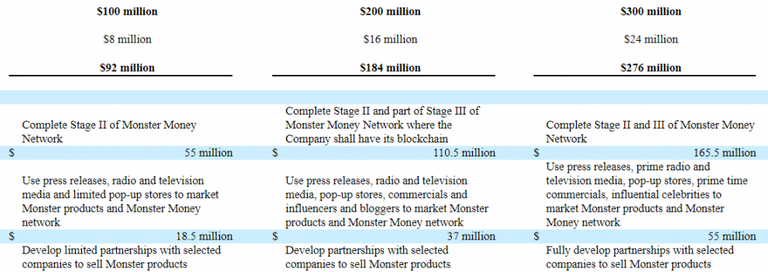

As reported in a document sent to the Securities and Exchange Commission (SEC) on May 25, Monster aims to raise $ 300 million by offering "Monster Money" tokens (MMNY). The company, in the grip of serious financial difficulties for several years, intends to rely on this pactole to develop its e-commerce platform, the "Monster Money Network".

Internet users will be able to find all of its products and services - but also potentially the products of its partners - and obtain them for Monster Money tokens or fiduciary currencies.

This network should be developed in three stages. The platform will initially consist of a basic payment system, with "Monster Money Wallets" that will transfer the MMNY tokens. The company will then propose a private platform "off-chain", "on which micro-transactions can be carried out with very little or no fees", which will be backed by a blockchain payment platform.

Finally, Monster hopes to deploy a fully functional blockchain network that will be part of the company's core businesses, such as supply chain management, payroll services, marketing or accounting.

This transition to an e-commerce platform based on blockchain technology could be a last attempt at recovery for society, while facing huge losses.

Monster - formerly known as Monster Cable - has lost a significant share of its revenue since the end of its partnership with Beats Electronics in 2012. Two years later, it was bought by Apple for $ 3 billion. Since the divorce, Monster and Beats have engaged in a stormy court battle: Monster estimates that Beats owes him about $ 100 million, while Beats claims $ 95 million.

The project is ambitious, but Monster - which was founded in 1978 - seems to firmly believe that it can become, in the long term, a giant of e-commerce:

"We believe that Amazon, Ebay and Alibaba will be among the main competitors of our new Monster Money Network," said the company.

This ICO - which is likely, as Monster has acknowledged, to constitute a securities offer under US law - will allow it to distribute between 300 and 500 million MMNY tokens, at a fixed price of 1 dollar. The corners that will not find takers will be placed in a wallet controlled by the company.

If this fundraising was successful, it would be one of the major ICOs in history. While the amounts raised would be greater than that obtained last year by Filecoin ($ 257 million), Monster would still be far behind EOS and Telegram, who respectively managed to raise $ 4.2 billion and $ 1.7 billion.