Today there are thousands of different Cryptocurrencies available, with a bewildering list of names and purposes. When looking at the market, how do you know what the future potential of a currency is before making an investment?

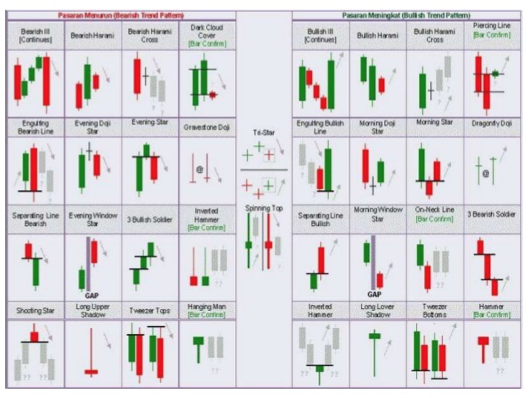

There are different schools of thought on this, but the two main ones are Technical Analysis and Fundamental Investing. With Technical Analysis (TA), investors believe that any factors that can affect the value of the coin are already baked into the price. Investors using TA take no account of news or upcoming changes to the coin and only focus on predicting future movements based upon past behavior. They are looking for price patterns and look for upper and lower lines of resistance and specific trading signals.

Fundamental Investing on the other hand focuses on trying to work out the true value of currency based upon a number of factors. These factors vary for different investors and each has their own way of valuing coins. For me there are three important factors in determining the value of a cryptocurrency.

Utility

A cryptocurrency will have value if it serves a purpose and there is a real need in the marketplace for the utility it provides. There are many coins and tokens that only exist as a store of value and are no different to hundreds of other currencies on the market. A prime example of a cryptocurrency with utility is Ethereum. Ethereum provides a blockchain for other currencies that use the token, and smart contracts that the currency provides to either create other cryptocurrencies (tokens) or provide a function (for example the CryptoKitties game).

Another example of a utility cryptocurrency is the STEEM token itself. It powers the community that runs this website and users with higher STEEM power have more influence over the ecosystem and the rewards of using the system.

Scarcity

The value of a cryptocurrency is directly related to how many coins are in circulation and how many coins will ever be in circulation. If a cryptocurrency has a utility value, then the function will drive demand and the fewer the number of coins in circulation, the higher the value of the individual coins.

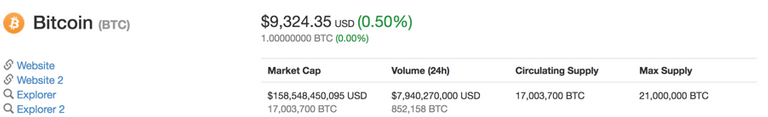

Let’s compare the supply information for two coins in the top 5, Bitcoin and Ripple. Using CoinMarketCap.com, the supply details for Bitcoin are as follows:

Currently there are 17 million Bitcoins in circulation with a maximum ever supply of 21 million. The block reward miners get for mining bitcoin reduces every 210,000 blocks, or approximately every 4 years. The first Bitcoin block reward was 50 BTC and the current block reward is 12.5 BTC. The last Bitcoin to be mined when we reach the 21 million figure will be around the year 2140. Bitcoin has been specifically engineered to cause deflation in the market with a reducing supply matching increased demand which can only drive the price higher.

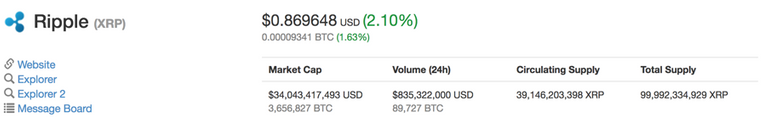

In comparison, the figures for Ripple (XRP) are as follows:

Currently there are almost 40 billion XRP coins in circulation, even though it has been on the market for 3 years less than Bitcoin. The current circulating supply of Ripple is 2302x higher than Bitcoin and when the total supply reaches the market, it will be 4761x higher. Also, because less than 40% of the maximum supply is on the market today, those future coins will cause inflation of the market and a relative decrease in the value of individual coins.

Perceived Value

Perceived Value is a harder quality to nail down than the other two and relates to how the market values the currency based on a number of other factors. For me the most important qualities that affect perceived value are:

• The Roadmap: What does the future look like for the coin?

• The Team: How capable and experienced are the team running the project?

• Partnerships: What partnerships has the team established to help it be successful?

• Investment: What funding does the project have to help deliver on its goals?

• Marketing: How well does the project market itself?

• Past Success: How successful have the project or team been before?

• Professionalism: How professional does the website look?

• Brand: Has the project got a strong brand identity?

• Potential: How far in the journey has the project left to run?

In a future article I will publish my current portfolio. It is heavily focused on top 50 coins but there are some obscure selections in there from my early forays into the market.

If you enjoyed reading the article and would like to see more like, please comment, upvote and resteem it. Thanks

Nice to read. I like burniski’s framework and nvt ratio and of course relativ value with a catalyst.

I don't trade, but steem seems to have good utility. We just need more vendors to accept it.

I completely agree. Steam has one of the best utility models I have seen. A lot of people describe it as a social media platform but for me, it is a paid version of StackExchange and Tumblr.

Utility is king in my opinion, and that is why I am betting on EOS...

Agreed. I’ve gone big on EOS too.

Right on, the utility is definitely vital to understand of any cryptocurrency! Great share @steddyman

Thanks. The utility can also be the hardest thing to discern about a currency too.

YES! especially when at anytime competitors can come up with something better! ): That's why I believe it's good to diversify the investments haha. @steddyman

Always a good idea to diversify and also constantly re-evaluate your portfolio to ensure they are still good value.

Agreed! @steddyman

Coins mentioned in post: