This article does not contain investment advice or recommendations. Every investment and trading move involves risk, so you should conduct your own research when making a decision.

Even before the major Bitcoin ( BTC ) run up in December of 2017, there have been a staggering trend of younger investors making Cryptocurrency their choice of investment. Bitcoin have turn teenagers into overnight millionaires. But what are the driving factors for the growth of this new investment Market.

*1. Low Barrier to Entry

Can you start trading or investing in the stock market with $500 in 2018? How many trades can you make before being eaten up by $30 broker fees? How about a starting capital of $2000 or $5000, how far would that get you?

The answer is not very. Your deploy-able strategies are limited at best. If a person starts with only $500 in the stock market and the action cost of buying and selling was $60 total. That trader would be paying more than 10% of his or her capital in commissions for a successful trade! Ouch.

“But I’m not a trader, I am in it for the long term.” Ah an investor I see.

Well, how many shares of a blue chip stock can you buy with $500, $2000 or even $5000? Are you able to create enough portfolio diversification?

If the answer was no, then what now?

Save money on a $2,500 salary till a $20,000 capital is accumulated? Take out a loan?

The former is a slow and long process, while the latter is just plain risky!

With cryptocurrencies, the disadvantageous of having a tiny starting capital is greatly diminished. An investor can spend $500 to buy a fraction of a blue chip coin. For example, instead of 1 whole Bitcoin or Ethereum , an investor can purchase 0.02 Bitcoin ( BTC ) or 0.7 Ethereum ( ETH ). The commission fees associated with exchanges are lower and calculated as a percentage of total order placed. Huobi Pro charges 0.2%, Binance 0.1% and Bittrex 0.25%.

With these factors, retail investors are empowered to deploy the same strategies as investors with more capital. Portfolio diversification is possible and blue chip coins are within investment reach.

*2. Massive gains

We have all heard of the bitcoin millioniare. That lucky teenager who invested money into bitcoin and became financially wealthy overnight.

In Cryptocurrencies, it is neither uncommon for a coin’s value to spike up 100% in a single day nor is it a rarity for a coin to increase 10 times its value in a few short months.

True. The inherent volatility and speculation that causes these price spikes are a double edged sword. But compared to traditional markets, a person can achieve financial goals with very little money and in a drastically shorter time. In Crypto, coins can yield massive gains over a year or 2.

Take ripple ( XRP ) for example:

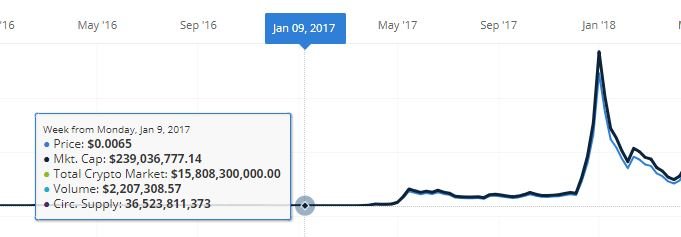

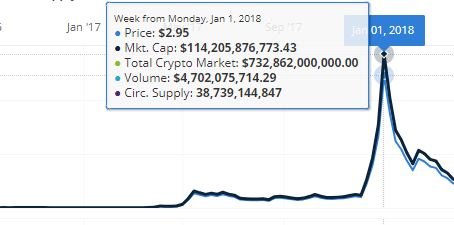

On 9 January of 2017, XRP was priced at $0.0065. This was a fraction of a cent. After a year it soared to a staggering $2.95.

Another example would be Neo (Formerly known as antshares):

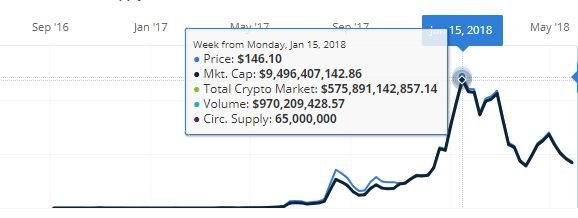

on 9 January of 2017, neo was priced at $0.1219. After a year it soared to a staggering $146.10.

</center.>

</center.>

Both of these coins (XRP and Neo), increased by more than 1000% in a year!

Given the disposition of millennials to err on the impatient side, these quick and drastic gains are very attractive. Investing and trading in cryptocurrencies, while being highly volatile, fits the stereotypical millennials expectations. Invest with a little. The earn big and fast.

The actual process of investing and trading cryptocurrencies are obviously more complex than HODL-ing and as desctibed above, but there is no denying the potential rewards from the Crypto Game.

*3. Plugged in.

It is a well known fact that millennials are glued to social media and their devices. This behavioral trend gives millennials an edge over less tech savvy counterparts when it comes down to receiving timely information.

Crypto in its current stage at this point of wirting (2018), still has a long way to go in terms of infastructure building.

unlike traditional markets, the cryptocurrency space is marked by uncertainty and lack sufficient support structures and services. Exchanges can get hacked, regulations banning crypto are implemented and lifted in rapid successions. Lets not mention the various dramas surrounding ICOs.

In such uncertainty, information moves rapidly and is most credible when it is derived from the source. Therein, lies the importance of being in tuned with social media platforms such as twitter, Facebook and telegram. The teams behind projects communicate with the community through these channels. By being plugged in, millennials have a closer feel to the pulse of the market.

In addition, the actual process of setting up Crypto related accounts, linking different platforms and sending digital assets can be daunting to those unaccustomed to using tech.

However, does this mean that only millennials and Gen X are suited to enter Crypto?

Absolutely not.

As Cryptocurrencies get wider adoption and mainstream adoption, the infrastructural improvements will follow to facilitate increasing demand. At that stage, the Crypto trading process will likely become more streamlined. Given the rising popularity of Crypto, it seems likely that that day will come sooner rather than later.

Congratulations @taister! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!