I am Steeming about this!

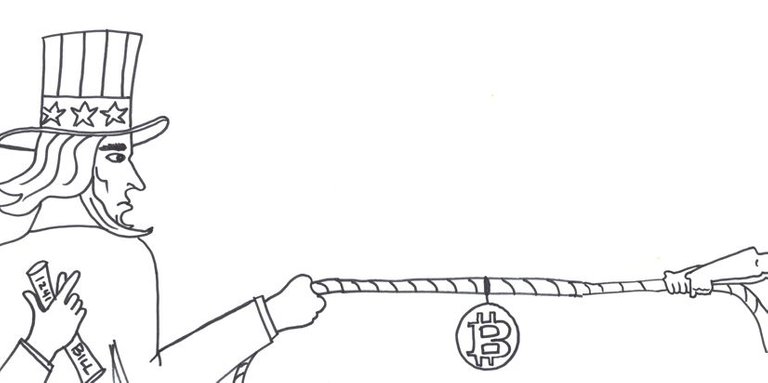

The New Senate Bill S. 1241 introduced May 24th 2017, “Combating Money Laundering, Terrorist Financing is now ‘in committee’ in the US Senate. The short-term implications of have negatively impacted the cryptocurrency market. The Bill includes a ‘Civil Asset Forfeiture’ clause which is a huge overreach, and eliminates any due process with regards to the government seizing assets. The US Government is using ‘money laundering and terrorist financing’ title as a scare tactic, with all eyes on the money. Considering less than 1,000 Coinbase customers reported capital gains in 2015, the IRS and politicians alike, have their eyes on the money. This Bill will give them what they want: the power to take the money.

Is the party over? Just wait for the after-party! If we take a longer view on the possible regulation of cryptocurrencies, there is a silver-lining. If this Senate Bill 1241 passes both houses and is signed into law, this Regulation of the cryptocurrency markets can have the unintended consequence of legitimization of the cryptocurrencies still standing when the dust settles. This requires taking a longer ‘wait and see’ approach to see which cryptocurrencies can survive. One potential unintended consequence should this bill become law is that it may make cryptocurrencies like Bitcoin and Ethereum more valuable. That is reflected in the current market uncertainty, where the push between party on and panic is palpable.

Sort: Trending