Dogecoin was initially rumored to be a Crypto Joke

Dogecoin is a cryptocurrency which has a picture of a dog on it. The logo has the picture of a Shibe photoshopped onto a coin.

A lot of cryptocurrencies have been created since the birth of bitcoin. These alternate crypto coins conducted serious campaigns and were motivated to gain significance in terms of popularity when compared to bitcoin. In terms of promotional campaigns, Dogecoin was completely different to these alternate coins. Developed by Jackson Palmer in 2013, it was based on an internet meme that was popular at the time. Billy Markus, a gaming software engineer at IBM, said that creating Dogecoin was no different from a ‘find and replace task’

It’s quite uncanny if you come to think about it. Who would have thought that a coin which was perceived as a joke in the crypto-community, would eventually gain so much popularity?

In its early days, Dogecoin was acknowledged by the hodling community as it was easy to use, cheap to buy, had an unlimited supply and had a very small block size of about one minute.

Problems Associated with Dogecoin

- The Dogecoin community began to lose faith in the coin when the founder, Jack Palmer, deserted the project. With Palmer leaving, the purpose of the coin seemed vague.

- No enhancements have been made to the coin over the last few years. In the world of cryptocurrencies, developments are added to the coins nearly every week. Ripple and TRON make products and partnerships almost every other week.

- The coin’s value has been struggling to keep up with inflation rates, and investors are steadily pulling their money back from this cryptocurrency.

- Dogecoin is no longer being talked about in renowned blockchain forums and subreddits. Coins more recent to Dogecoin; like Reddcoin using the ‘Proof-of-Stake velocity’ algorithm, and Karma using the ‘X11 Hashing’ algorithm – have gained momentum.

All these factors make Dogecoin less stable, less secure and less widely accepted.

Why is Dogecoin alive, notwithstanding the reproaches and the setbacks?

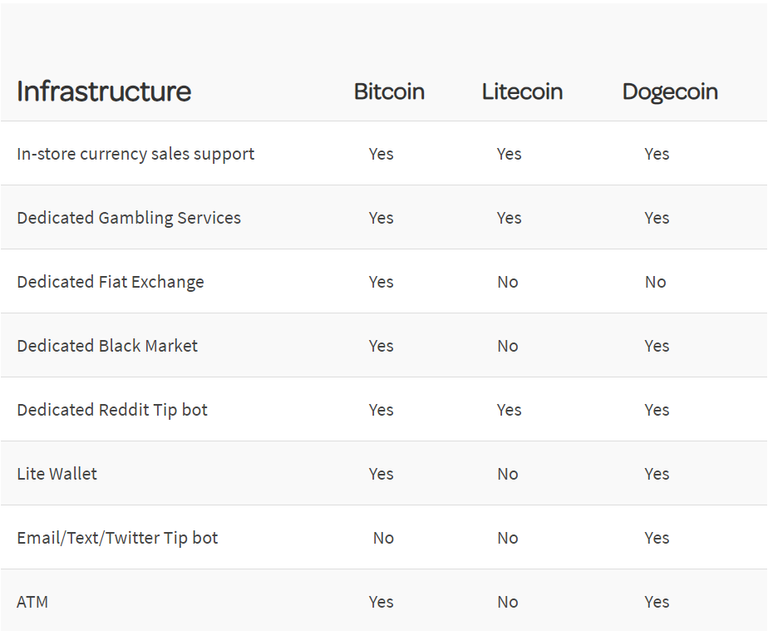

- Dogecoin does have a decent infrastructure when compared to its peers.

- Low Transfer Fees

Transactions involving Dogecoin have insignificant fees. This is the result of the direct interactions between network miners and other operators. Even third-party online exchanges make the processes feasible with extremely low fees.

- Mining Paybacks

The mining feature is one of the most rewarding attributes of Dogecoin. It allows users to process Dogecoins for the community with the help of mining programs. The payout could be as astronomical as 50,000 coins per solved block.

- No Settlement Delay

Dogecoin doesn’t involve any third-party or block for payments. It simply operates as a large database of property rights. This makes it relatively cheap, and more efficient than most conventional asset transfer processes.

- Fewer Chances of Fraud

Dogecoin uses a ‘push system’ as opposed to the outdated ‘pull systems’ used by credit cards. What this means is that the user won’t have to give a vendor his or her full credit line, rather – one can use it just like bank notes or credit. Thought it doesn’t have a titanic presence in mainstream financial transactions, it has become a handy tool for online transactions, particularly within specific communities and establishments.

Closing Remarks

Unlike Bitcoin, Dogecoin is an inflationary cryptocurrency. It has a high inflation rate, as well as an extremely large and uncapped coin supply. Churchill once said, “The further you look into the past, the further you can see into the future.” The same can be observed in regards to all underwritten ICOs. Most of them make imprecise statements as to what their tech can do, while some of them state that they are “what Bitcoin could have been”. Most times, all of them crash.

I personally don’t believe in investing in anything which started out as a joke but, surely, the coin isn’t dead. It is almost impracticable to comment with certainty what the future of a particular coin will be. All that one can do is try and understand the potential value of a coin in the short and long run, centered around parameters such as community strength, market capitalization, trading volume, developer activity and other 101 variables which could affect the coin.

This article was originally written by Nilesh Agrawal, a Guest Author at Bank of Hodlers.

We at Bank of Hodlers is organizing and Airdrop for all you Hodlers out there.

Be a part of the greatest Crypto community ever by joining our Telegram community here - http://www.t.me/bankofhodlers!

You got a 16.71% upvote from @brupvoter courtesy of @thathodler!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://blog.bankofhodlers.com/why-does-dogecoin-still-exist/

Congratulations @thathodler! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPThis post was upvoted by 1 accounts and @interfecto thanks to @thathodler

@interfecto: Selling the cheapest upvotes on Steemit for just 0.001 SBD each! Send any amount 0.001-0.1 SBD with your postlink as memo to @interfecto to buy instant upvotes!