Editors Yoshiyuki Suimon and Kazuki Miyamoto believe that bitcoin will help Japan with a Gross Domestic Product (GDP) at 0.3% in the first three months of 2018. By the end of 2017, cryptocurrency provided ¥ 12 trillion capitalization market, and if the trend continues earlier this year, which can be translated into raising Japanese consumption by anywhere from ¥ 0.2 to ¥ 0.4 billion, they explain, which refers to no phenomenon as bitcoin effect.

Japan’s Bitcoin Effect as 0.3% of GDP

Yoshiyuki Suimon and Kazuki Miyamoto of Nomura offer a slightly different Japanese relationship with bitcoin. Nomura is one of the largest investment banks in the world and is known to have mathematically funded strategies for the use of financial research.

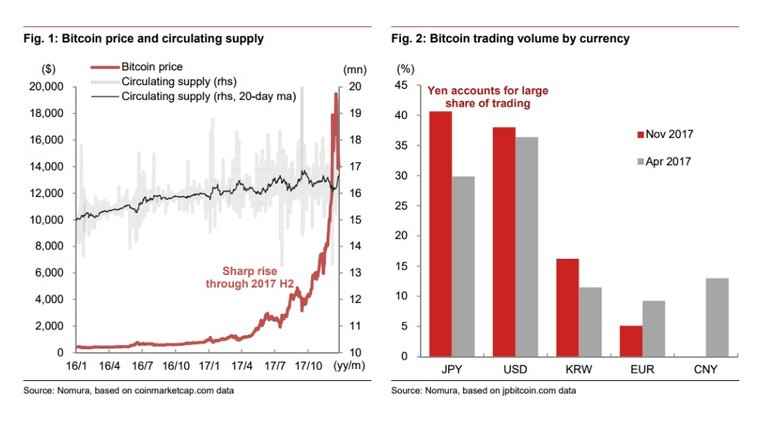

The usual reporting is similar to a recent study placed by Deutsche Bank AG. Of these, bank notes believe they believe that "retail investors are shifting from foreign exchange trade to leveraged cryptocurrency trading," analyst Masao Muraki has quoted by Bloomberg. And in fact, both studies offer a Nikkei which tells Japan that it requires half of the foreign trade exchanges in the world, and thus it seems natural that a global currency such as bitcoin is gaining at least 40 percent participation in Japan, and climb, in the last part of this year.

The deeper, real-world case is hidden within those numbers. Japanese buyers and business retailers also benefit from the country's crypto craze. Suimon and Mr. Miyamoto have a positive thing happening in wealth. A famous example of history took place in the late 60s of the United States after a double-digit tax increase. Most economists rely on consumer spending to be slow, a belt approval in response. However, due to the extremely high market increase, common Americans are 'felt' more wealthy, and spent accordingly.

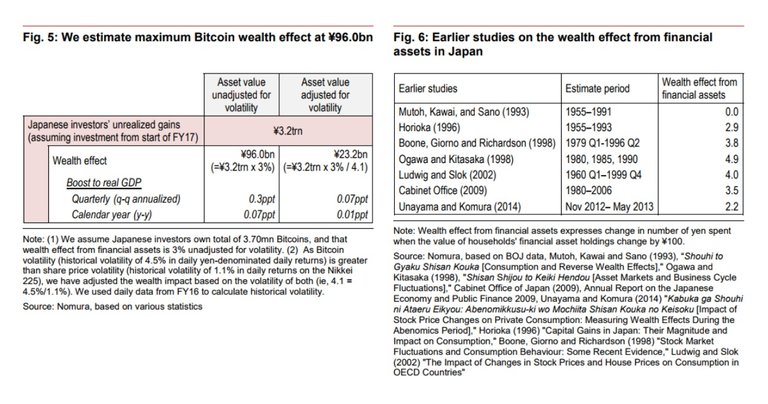

The final three months of 2017 could bring the country's GDP by 0.3% higher (GDP is a measure of all final goods and services made) in early 2018, according to Nomura analysts. These have been pegged as a formula as follows: each asset limit of ¥ 10 billion will result in an increase of ¥ 0.2 to ¥ 0.4 billion.

¥96 Billion in Personal Consumption

This Spring of 2017 saw the country's bitcoin relative, as the Service Charge Act allowed crypto trading. Yen follows. By doing the Chinese government that the Yuan has no strength in the cryptos, the land of the rising sun is full of that vacuum. And by the end of last year, the world's most popular cryptocurrency reached ¥ 12 trillion on the market cap, delivering bitcoin effects.

The two analysts believe the island nation is sitting at ¥ 5.1 trillion in digital assets. And even if wealth does not "eat straight" on the street, the kind of wealth will "boost $ 96 billion in personal consumption," according to Value Walk.

"Cryptocurrencies will provide different benefits for different people," says Professor of Arizona State University's Value Walking Geoffrey Smith. "Some are like setting up an institution and can be reached with a utility coin offered by major banks while others can appreciate the ability to transfer money from a geographical region to the next good,"

As long as Bitcoin holders who raise their assets at the end of the year will boost consumer spending from the beginning of the year remains visible, but we must keep in mind the likelihood that spending extends to the expected as a result of this factor.

It seems something different about the wealth accumulated by crypto. That can lead to an important world economy to grow 0.3% is a sign of what's going on is more than imaginary. All of this is according to Value Walk.

Upvote, Comment and Resteem

A great and good news from Japan... You can visit he profile of @hiroyamagishi He is half Filipino...

Wow really? I hope it will be the same here in tge Philippines...