Introduction

This post is a simplified version of a paper including quantitative analysis that I wrote some time ago.

I posted a first summary of it on publish0X and I am now porting it to my new steemit account.

The goal of the document is to provide the reader with a kind of compass to assess blockchain implementations different from the usual two (bitcoin and ehtereum). By experimenting I have created a set of templates that I tend to follow and here I will present what I normally do taking the investor point of view: coin investor, entrepreneur or VC . I will not just write a set of guidelines but I will apply them to the stellar blockchain.

Blockchain assessment template

An investor, dealing with the analysis of a blockhain implementation should always focus on two main investment areas: the coin and the ecosystem. To assess a coin investment and quickly exclude scams or investment not matching the desired profile:

- Define the token type: utility, payment, asset or hybrid. The first step is to clarify its nature and this is often not written anywhere therefore the investor judgement plays a role.

- Qualified personal involved and targeted

- Clarify the market cap and the monetary supply policy (capped, with inflation, with mining or minting)

- Understand the narrative behind the company, consortium responsible of the implementation and operations. Provide references for relevant people involved (academics, developer, authorities in the open source community). This is quite complex as requires research, verification of sources, verification of how realistic are the future scenarios.

The last point is relevant both for token investment and for understanding the possible ecosystem evolution. Not always the narrative is clearly shared but a pattern can be identified:

Study the white paper (it must be provided if there was an ICO and should include the description of the technical protocol implementation)

Study the website content (it must give lots of information: investors, venture capitalists and scientific committee backing the company/consortium, technical documentation, community links)

Having understood how the blockchain implementation is positioning in the ecosystem and the narrative followed, additional information are needed to see how a successful outcome is realistic.Technical analysis of the code: in general we deal with open source companies at this stage of the technology as it seems the usual practise even for private blockchains. This should include the libraries and tools provided for developing eventual client applications.

Documentation available

Description, overview of the environment

Verification of the current status of the strategy to create the ecosystem (with the market participant).

Activity of the connected communities. Eventual meetups and international conferences organized

Companies involved in the ecosystem: possible profitability, business model chosen, advantage using the blockchain implementation. It is meaningful if some companies choose the technology even for application not directly planned by the society backing the blockchain implementation.

The stellar blockchain

The blockchain implementation I would like to focus on as an example on how to apply the blueprint described above is stellar. In a nutshell:

- it uses its own distributed protocol called SCP (stellar consensus protocol) to quickly process transactions (5 seconds)

- it addresses natively the remittance business allowing to skip the intermediate steps between the sender and receiver banks as normally happens.

- The most common use cases are involving markets providing currencies/tokens and the exchange of them fast and at minimal fees. The required fee is in the order of cents of dollars.

Token type

The native token is the lumen (XLM).

- it is not mined but minted

- it is an utility token which allows to participate to the mechanism of conversion from currency A to currency B as intermediate step: currencies can be tokens themselves. A is converted to XLM which is then converted back to B .

In order to avoid spam (usage of a service without any target ) in the network each account has to keep a fixed amount of lumens (2 lumens ) and in order to connect markets, called anchors (the exchanges providing the liquidity for the operations) needs to keep another fixed amount of 0.5 lumens for each connection (called trust line). - Every transaction implies a fee of 0.00001 lumens.

The team

I present the people involved in the foundation (SDF).

- Ceo: Denelle Dixon (former longtime Mozilla COO). Mozilla is one of the most known open source project, the organization behind the famous browser firefox

- Chief architect: Jed McCaleb (ripple founder, involved in cryptos since early years)

- Chief scientist: David Mezieres

- Many famous community members and innovators as Greg Stein (director at apache software foundation), Matt Mullenweg (founder of wordpress) to mention few.

We can conclude that the SDF is trying to leverage the open source experience in all dimensions enrolling people with relevant roles in the area. The technical part looks also fully covered.

Market cap and monetary supply

The market capitalization of the various cryptocurrencies is often very little to consider them safe from speculation and mechanism as market cornering or pump and dump. It is still not easy to find trade matcher which makes the market more liquid and more ‘reliable’. Hedging is basically not existent.

In addition crypto exchanges expose also to a strong counterparty risk. For this reason investing specifically in tokens is in general very risky and the market cap is a criterion to exclude a lot of the token investment. Note that:

- this is a kind of beginner criterion

- I have identified in other analysis coins which are very promising have a little market cap and are even not associated to a blockchain implementation but created on a pre existing chain.

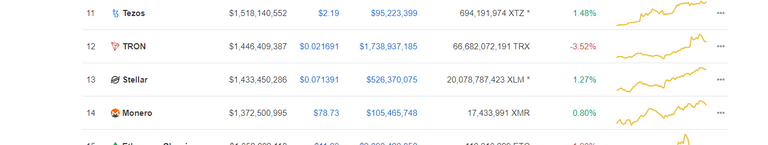

In our case: - Stellar lumens have a market cap at the moment around 1 bn: the strong volatility suggests to stick more to order of magnitude than to precise figures).

- The ‘monetary supply’ is provided minting (pre mining) coin. The ICO minted coins were not capped, as an inflation mechanism, just recently switched off, was also active and it is under the control of the SDF.

- Burning of tokens: recently (beginning of November 2019) stellar foundation announced and executed the burning of 50 bn lumens (approximatively 3bn USD at current market price) triggering an increase in price of the traded token.

- Inflation: recently (beginning of November 2019) the inflation mechanism has been disabled creating a situation, not necessary definitive, but described as quite realistic in the long term by the SDF, of limited but absolutely not scarce lumens supply.The figure below shows the market value.

image from coinmarketcapthe 7 February 2020

The choice of burning lumen and switching off inflation seem to proof the intention of SDF to keep stable the XLM price.

Investing in token

As anticipated, the paragraphs above allows to have a quite clear idea about lumens as an investment. Being credible that the lumen supply is limited and being the lumen the intermediate currency in every exchange from A to B, an investor should model the lumen asset size (capitalization) to support a liquid global market. This, in a scenario of strong expansion, of stellar could require a very high amount of XLM. This is quite a challenge. It is very instructive to check some of the available data in stellar port. The figures below shows the most active market by volume in stellar port:

stellar port

We can immediately note that not only there are currency markets but also asset ones. It is very instructive to check the market size in XLM as we immediately notice that some of the largest markets are not currencies: SLT (Smartlands is a worldwide Platform for tokenization of highly profitable assets by issuing asset-backed tokens (ABT). The Platform will establish an appropriate infrastructure for ABT offerings that protects investors from the major part of risks and offer a ready, secure and proven solution for companies), MOBI (token provided by the mobius network). This shows that stellar is not only an exchange among currencies and cryptocurrencies but also more in general among, theoretically, every kind of tokenized asset (provided the the token which can be issued in the stellar protocol are suitable in the digitalization process of the asset itself). It could be seen as a kind of forex of the digitalized asset where the xlm is the intermediate step of every transaction. A strong growth of such market should be backed by a certain amount of XLM (the lumen ticker). This alone would mean that the token could be a meaningful investment as it could worth much more than now. The challenge for a lumen investor is:

- provide some current static numbers like daily transactions, markets size and calculate potential transaction size per day.

- model the amount of lumens required to support such a global market considering the role of intermediate currency and the need of reserves.

- model scenarios with or without removal of lumen cap or with or without restoration of inflation.

Analyzing the ledger by setting up a validation node or calling offered services could help to implement the models I mentioned. I have done some works but I skip them for now as I have decided to tackle a different topic in the current paper.

Clearly, even if the lumen is not a token created for hoarding like for instance bitcoin it can also be an investment if there is strong expectation of growth for the exchange market where it is used as intermediate currency. The main question becomes: how realistic is a growth scenario? If we can support such a scenario some model can be triggered to assess various possible XLM sustainable valuations. To answer to this question we need to go through the remaining paragraph in this section. Actually, we have already seen that the narrative is a full growth one. Are the proof protocol and the implementation of client interfaces (technical part) as well as the contracts complexity supporting such growth narrative even more?

I would like before starting this argument to only make a specific statement: utility tokens like xlm, cisrculating in a capped amount and in an alive ecosystem tend to reach an equilibrium according to the economical theory. Such an equilibrium comes after the growth phase when the utility token is consolidating is function of pure mean of payment

The parallel with the BAT token is natural and the whitepaper of the BAT is giving a quantitative proofs of my statement above. See section 7.3 of the whitepaper

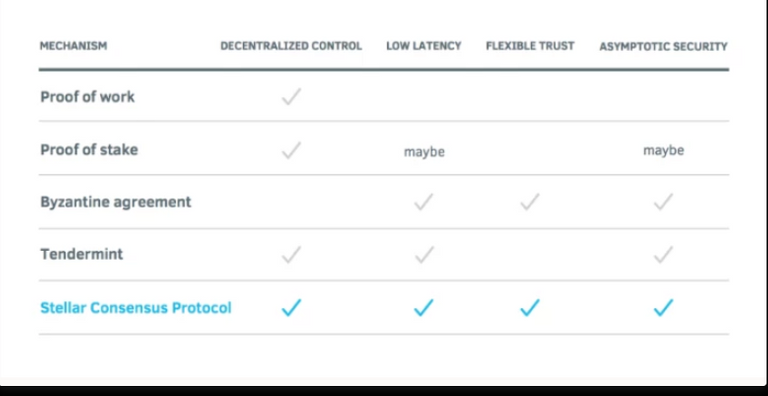

White paper, website, proof of X (protocol)

From white paper and website it is possible to collect information on the proof of X chosen. Here I summarize content from Stellar consensus algorithm and Stellar consensus whitepaper . The main content of the white paper is the explanation and mathematical proof of the consensus mechanism. Stellar doesn’t rely on computational expensive PoW or potentially low latency PoS. The main concepts in Stellar are: SCP (Stellar consensus Protocol) and FBA (Federated Bizantine Agreement). The Stellar Consensus Protocol (SCP) is a model suitable for worldwide consensus. SCP is the first provably safe consensus mechanism that simultaneously enjoys four key properties:

- decentralized control

- low latency

- flexible trust

- asymptotic security.

SCP is a construction for federated Byzantine agreement (FBA), a new approach to consensus. To tolerate Byzantine failure, SCP is designed not to require unanimous consent from the complete set of nodes for the system to reach agreement, and to tolerate nodes that lie or send incorrect messages. FBA brings open membership and decentralized control to Byzantine agreement. The key difference between a Byzantine agreement system and a federated Byzantine agreement system (FBAS) is that in FBA each node chooses its own quorum slices. The system-wide quorums result from these decisions by individual nodes. The main take, for this paper, is that the consensus mechanism allows and is thought to allow lower transaction costs and fast money movement across political and geographic boundaries in **a decentralized, scalable and asymptotically secure way.

from the stellar site

Technical analysis code (if open) and assessment of documentation

The stellar core is available as open source software and therefore easy accessible: it is hosted on github, written in C and quite sophisticated. Participating as committer requires high competences, which is normal for such kind of software. There are precise guidelines for committers and for running a wide battery of tests.

The horizon (the interface between clients and the core) code is also open source and hosted on github. It is written in go and use well known build and code sharing tools. github stellar contains over 60 projects related to the SDF provided ecosystem. Among them client implementation for Horizon, offering SDK in java, javascript and other languages. I have assessed the java client as code of high quality and easy usage. In docker is provided a quick start tool including horizon and core to perform quickly local test on a dev machine and see the various release in action. Kelp (a market maker software) and some wallets implementations are shared as open source.

The amount of code and knowledge, therefore of work made, is really impressive. The client allows to write the most disparate client code and the software shared can be a starting point for many productive implementations.

Advantage in tokenization

The creation of own tokens is easy on stellar: it is therefore a possible ideal chain for asset digitalization. What is important to notice is that not being Turing complete the completness of the tokens issued, for example, in ethereum is not matched. The question is: do we really need always such a complexity? We can already say that the answer is no. Sometime a Turing incomplete language is more safe and sufficient for the scope (bitcoin itself is Turing incomplete). Actually this is a business model pushed from SDF which propose to tokenize some assets directly in their platform and eventually creating anchors for tokens issued in other chains (erc-20 ethereum token like bat can be found, though with little volume). The steps to issue your own token could be: create issuing account, create distribution account, trust the issuing account, create tokens (fix amount), publish information about the token. The risk is to have scams: SDF has not addressed this as per my knowledge and researches done (I am happy to be contraddicted!).

The main take is that the simplicity of issuing a token supports the view of stellar as decentralized exchange of digital assets and the growth narrative. This could make a XLM token investment meaningful and could create interesting preconditions to position startups as profitable participant of a rich ecosystem.

Possible business applications leveraging stellar

At this stage the companies growing in the ecosystem are start up. Therefore no company with the size required to participate to the stock market is there for an investment from a retailer investor. Actually the few big players like IBM and Franklin Templeton are unaffected by their choice of using stellar and their involvement in such projects is mainly proofing that they are actively considering the potential of the blockchain. The possible investments come from the combination: entrepreneurs, venture capitalists and SDF contributing backing up a project. There are plenty of companies which could trigger the interest of investors like VCs. The ideal scenario is where SDF places an airdrop or a little financing and some VCs enters too. Stellar battles have been promoted to make people aware of the value of the ecosystem and making the interactions among the components frictionless.

Advantages, risks

The main advantages of stellar are: consensus that satisfies decentralized control, low latency, flexible trust, and asymptotic security. This is a big advantage as add speed and low energy cost to the equation compared to many competitors. A big community, good documentation, well backed growth policy create a fertile terrain for clients. The target business of handling digital goods exchange is huge and vastly untapped. Contract creation as well as issuing both a new token (ICO) and a non fungible token (this, with some constraints) are all handled in a very simple way.

The main risks for stellar are: the competition could step in being the market attractive and not presenting big moats. Some big players like facebook or telegram could leverage the enormous community to enter the digital asset market and steal relevant percentages. For example the keybase case has a telegram similar counterpart already implemented with TON (telegram open network) and GRAM (the telegram crypto). The blockchain implementations are many and for the most disparate usages: a blockchain thought for cross chain communication like polkadot, which is more sophisticated, could disrupt the business, by connecting different specialized blockchains in a performant way. Ethereum is still, even if very complex under some aspects, the home of the vast majorities of ICOs. Another big risk comes from possible scandals arising from anchors not reliable or wallets unsecure which could scare retailers from using the application in the ecosystem (anchors and wallets are still the backbone of the system).

Speculation against the underlying crypto and the traded ones. Extremely strong volatility on the XLM and the cryptos could be a deterrent for coin investors. Some scandals on a single crypto could create a problematic situation for stellar itself.

Conclusion

I have presented a very big overview of stellar as this was the precondition to see if makes sense to invest in lumens or setting up startups or just being an informed and agile user of the ecosystem. It was an excuse to put in action my template to assess blockchain implementations and through its application I have convinced myself and I hope my few patient readers that we can consider stellar a main player.

I would like to point the importance of analyzing now some projects based on stellar and the various way to exchange currencies through the stellar decentralized exchange (SDEX). These are topics that I would like to present in the next posts.

Hello,

Welcome to Steemit.

In order to prevent identity theft, identity deception and content theft, we encourage users to confirm their online identity. Users with an online identity that have websites or blogs, users who are creators of art and/or are celebrities of all kinds, are asked to verify themselves. Verified users tend to receive a better reception from the community.

In order to confirm your authorship of the content, please mention Steemit or add a hyperlink to Steemit in your blog:

https://www.publish0x.com/@HourImagination

You can remove this mention from your website, once we confirm the authorship.

Thank you.

More Info: Introducing Identity/Content Verification Reporting & Lookup

Congratulations @thehappyplayer! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.publish0x.com/cryptogalaxy/blockchain-assessment-template-applied-stellar-xlxdwz

the similar content is written by me in another platform and ported here. I have referenced it on top

!sc ban

Failed Authorship Verification.

Banned @thehappyplayer.