Additional — How did the Bitcoin really come into being?

On it’s own right, the development of Blockchain is quite possibly this century’s invention la amaze.

Not only is it wondrful. But the Blockchain looks poised to becoming a major underlying technology for banks, logistics, cyber-security, and so on.

On top of the Blockchain, developers and budding start-ups create their own tokens, and this currency, unique to the firms brings across value to the coins. After all, aren’t they based on the 21st century’s most important milestone, The Blockchain ?

Well, they are. But just as invention la amaze & wondrful make no sense in the English language, a random token/coin merely based on the blockchain doesn’t necessarily have to hold value or be the next bitcoin.

My dad told me in Kindergarten — “It’s not about merely using the Alphabet, it is about how you use it which gives meaning and value to your words.”

I guess my dad’s teaching can apply to the world of Blockchain and Bitcoin, and Shitcoins.

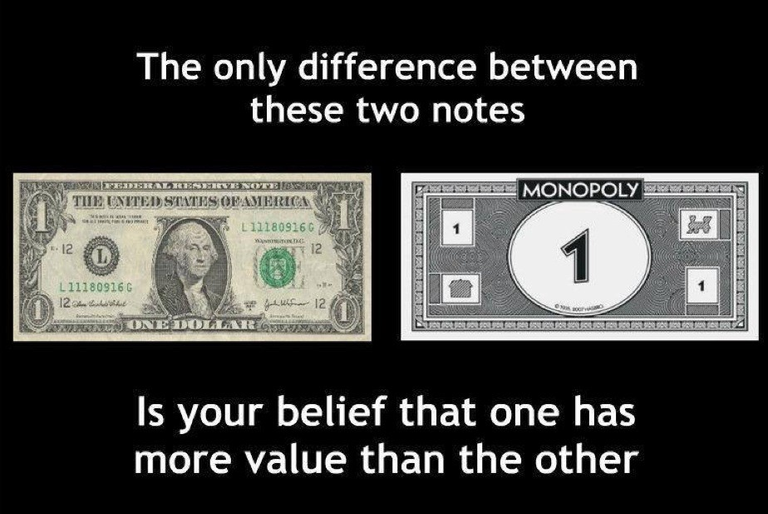

The two most exchanged things in this world are Wisdom and Value. Wisdom is gained by observation and learning. You can also exchange your wisdom, but the other person may not take it a similar manner, or your intended manner. Hence, exchange of wisdom is not uniform. It is subject to the other person’s perception of it.

But Value can be both learnt and exchanged. And the beauty is, it is worth exactly the same in the other person’s hands. Value is exchanged uniformly. And this understanding lead to money being an exchange of value, not wisdom.

(Someone from r/iamverysmart will comment that a Ferrari is worth less to a billionaire than a pauper. True. And you should probably read Cosmopolitan instead of Hackernoon. Intangible value is what I talk about. Not your shiny Teslas or latest Nikes.)

Over the years Governments went from paying salt (where do you think the word salary comes from ?) to having a barter system, to exchanging rocks and pebbles, to gold, and then finally, Fiat Paper. A.k.a Modern Money. Eventually, there came credit and debit cards, and the advent of electronic money.

Herein lay a small issue. To pay Ms.Suzi for the highly quality Scottish cotton sweater, someone in Spain had to trust a bank, a centralized organisation controlled by the government who issues Fiat Money based on a promise to pay the bearer a sum of equivalent money.

A promise ?!

Government communities can create their own fiat-like currencies, called ‘mutual credit systems’. However, the strict definition of fiat might not include such systems. The key point, though, is that the unit-of-account is declared and is informational (i.e. non tangible) and is not directly associated with a fixed quantity of specific commodities or services.

What if the government has borrowed too much money and is deeply in debt (does this sound familiar to anyone?) and it finally comes to realize it cannot pay.

Simple. They print more money.

As this goes out into circulation, you have the situation of more dollars, euros, etc. chasing the same amount of goods and services. Simple economic theory teaches that such a situation will lead to higher prices also known as inflation.

Remember that a currency is not backed by anything intrinsic. Therefore, the value is basically what the government tells you it is. Now apparently the value of fiat money is also, at least loosely, determined by the manipulations of traders in the currency markets.

Then in 2008, a person or persons called Satoshi Nakamoto came ahead and built Bitcoin. A decentralized, limited supply, globally transferable form of money.

So what is Bitcoin ?

Simply put, a digital file that makes use of the general ledger called a Blockchain, and lists every transaction that ever happened in that network.

Completely transparent and available for the public to view.

Bitcoin is the first example of a growing category of money known as cryptocurrency in which open-source software solves complex mathematical calculations to mine more Bitcoins.

No one “mints” this currency, they solve cryptographic algorithms using hardware and electricity to get the representation of one unit of value, typically called a “coin”.

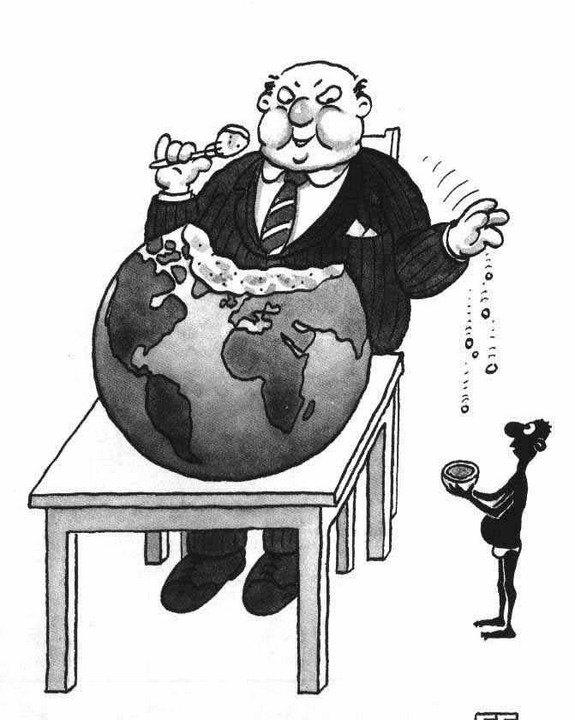

So now you know what Fiat is. And you know what Bitcoin is. And you know that the Media is feeding you lies about “digital currencies”. Hell, most of the world’s money is held digitally. Oh and, that media you believe in, is controlled by people in power. Greedy people in power.

Bitcoin’s secret sauce is its consensus mechanism, which allows people to agree on a canonical order of transactions, thereby preventing double-spending and fraud, through a combination of cryptography and economic incentives based on game theory — all without needing a third party or middleman, like a bank. Even if participants don’t trust one another, they can rely on the shared ledger they create through the transaction dance of their software. You don’t need honor among thieves — you just need a blockchain.

And no term at present is more hyped, and more poorly understood.

So where is the problem ? All this seems to be revolutionary and globe changing. What’s “ The Problem with Crypto” ?

I bet that 70% of the Bitcoin experts out there can’t explain Blockchain properly. YouTube and Instagram celebrities, Newspapers, Media outlets, all f**king giving out the wrong information, spreading rumors, or even the general public, failing to do research on their own and choosing to outright reject a technology.

The problem, sir, is that the core technology ( Blockchain) and it’s true purpose is either not used, misused, or used for namesake in the general market.

Alt-coins and Shitcoins

Lots of money attracts people. And even lots of money attracts greedy, scheming people.

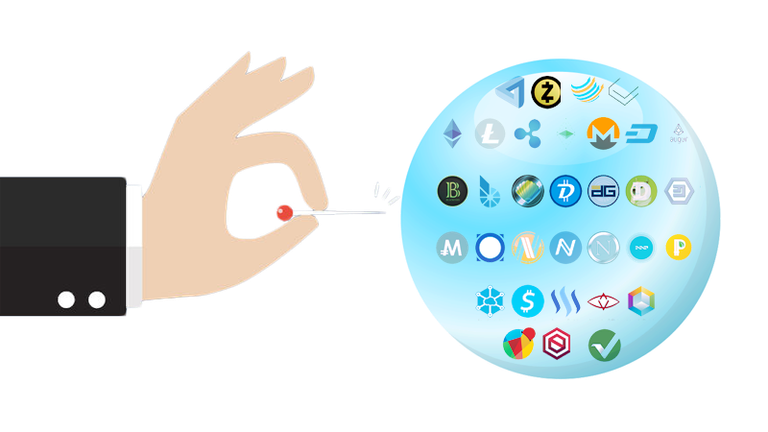

The meteoric rise of BTC has spiraled into 1500 other cryptocurrencies, and many more which aren’t even listed, each led by bright teams who promise to solve global issues. The general public stands below with their empty bowls held high. Hoping to catch the next big wave to ride and earn a lot of money and retire early.

What started as a bold movement is now crowded with get-rich-quick ICO’s, fly-by-night cryptos, fake authority figures like Ian Balina and John McAfee, and college freshmen calling themselves “investors”.

Thousands of start-ups have come up their own tokens/coins, claim to operate on the blockchain, claim to solve the globe’s problems, and promise to do things 4–5 years down the line.

Just like a mattress infested with bed-bugs, start-up alt coins are now competing for attention.

I consider them as operating on the pyramid scheme business model, but in a more figurative sense of the word.

The few good ones (designed to last through some adoption and trade) have developers, serious investors, and almost everyone involved in this level has a long term commitment to be a part of it. Bitcoin is certainly the grand daddy. So are Monero, Ethereum, NEO, QTUM, and the like.

The other group, wherein the majority lies, is a lot of sold dreams, over-promised expectations, and the idea of getting rich quick if that particular token was bought. Mostly speculation investment. The majority stakeholders are PR firms, Marketing teams, “Influencers” (I hate them), and over-zealous Reddit trolls. Barring a small handful, most of the coins not in the top 20 are part of this group, and that makes over 90% of the cryptos trading today.

The rush for buying tokens/coins which have no working product, main-net, poor teams, etc seems to have reached zenith, but just like every poorly researched purchase, the mad rush is fueled by stupidity.

“Wait didn’t you write a guide for making money off crypto ?”

Well, if you are getting into serious Crypto Trading, none of all this matters. The banks are shallow, and so am I, along with all the traders I know. Emotions have no place in the market. Making money by taking advantage of the market is what the best traders do, not by getting emotionally stuck on one coin/stock/equity/commodity.

All that strictly matters for short term trading is a good PR team, and continuous assessment of the general consensus for that coin. What this means is that if you see all web forums, subreddits, and media news of a particular coin, you maybe could ride that wave, take profits, and move on to the next such coin.

Typical trader move.

“Fucking Bankers.”

Years after Bitcoin’s development in 2008, cryptocurrencies seemed to align with a unified and clear vision — Develop and deliver a technological alternative to Cash that operates at a peer-to-peer level, which does away with trust for the corrupt banking and financial system ( by means of decentralization), and build an ecosystem of “trust”, which runs the aforementioned system.

The unknown developers of Bitcoin had, in my opinion, hoped to drive awareness and adoption of their vision using the power of community, and thereby innovating and advancing with this view.

I don’t think they wanted to be the best, or even strive to be the best, else we would see the faces of BTC’s creators plastered on every wall you know of.

They simply showed you it was possible and required.

Initially, the community was vibrant and hyper focused on the technologies behind the coins i.e they believed in what Cryptocurrencies could do and how an individual could truly make a difference.

In fact, an early adopter went ahead and created “Dogecoin”, the internet’s favorite meme coin which was never meant to be taken seriously. But the founder created it for a very different reason than what the internet does tell you — that of driving awareness of blockchain, crypto, and using the power of the community to drive innovation.

Yes, Dogecoin was much more than a meme coin.

And Dogecoin succeeded like no coin could. In the following years, the community used it as an easy-to-approach, “fun” crypto currency to drive awareness about the very idea and thus attracted the best minds to work behind the scenes on crypto. Year on year, developers teamed up to create better, faster, and more secure cryptocurrencies, as well as finding other areas of interest where blockchain could be used. Governments took interest in this initiative, regulated the market, and encouraged a small level of cryptocurrencies to be bought and used by the public. Dogecoin drove awareness like nothing else, and is worshiped by developers around the world as the Talisman which ended a common man’s problems.

Good ending, right ?

But, that’s not quite what happened.

As the word about crypto went around, the term attracted a lot of get-rich-quick, “to the moon”, “lambo when” people. Scammers and the like included too. Dumb money flowed into the dumber coins. Everyday a new company slapped shiny words to it’s whitepaper and hype did the rest. Few eople were using cryptocurrencies to smell an opportunity and then selling courses of their success stories. It was like throwing blood in a shark tank. And the sharks weren’t smart. They were very, very greedy.

And a couple of years later, the market took a turn.

Vitalik Buterin, you may know him as the creator of Ethereum, discovered a new brilliant new way of using the blockchain. While until now the term was used for the transfer of money, Ethereum showed a process where you could transfer, well, just about anything. He also allowed for other developers to build dApps, or Decentralized Applications, on the Ethereum network, to further build a meaningful, cohesive, value-adding ecosystem.

At the same time, confidence in Bitcoin was shaken: hacks and scams dominated the news cycle, and merchant adoption failed to grow at forecasted rates. Despite these events, huge sums of venture capital continued to pour into fresh cryptocurrency companies backed only by buzzword-laden websites and lacking any discernible business model.

Unfortunately, the introduction of Ethereum also meant a 1000 different ways (read tokens)the get-rich-quick people could get their hands on. And 1000 different ways the snake oil developers could now use to earn money.

You see earlier the crypto market was limited to being an alternative to cash. And there’s only so many Cash based coins that could come onto the scene.

With Ethereum. Things become widely simple. Terribly simple. All you had to do is create a B-plan no one understood, throw in buzzwords that gave people boners, and shove it down the throats of unsuspecting, naive people.

Within two more years, the space was largely run by opportunists who wanted to have the wealth of Bill Gates overnight. The more such people came on to this scene, the lesser the underlying technology was evolved. The technical issues we face now have existed since THAT time, and there were only few developers working on solving these issues.

Over the following two years, I monitored the space from afar. What I noticed was a shift away from developing the core technology powering these networks to churning out shiny new projects that shoehorned in “blockchain” wherever possible.

— Jackson Palmer, Dogecoin Creator.

A POOR MAN’S CRYPTO FRENZY

There is a popular saying in financial markets along the lines of, “When your taxi driver is telling you to buy stock, you know it’s time to sell.” Basically, when a stranger with (presumably) little experience in the stock market is giving you tips, it’s an indication that the market is too popular for its own good.

Only a few years after Vitalik’s brainchild, Ethereum, brought in the technology to create a smart contract ecosystem, did we start seeing new trends in the cryptocurrency market.

And nothing is perhaps more trendy, or more frenzied, than the ICO.

An ICO, or Initial Coin Offering, is a promise sold to the small fish to participate in a coin’s first sales, even before it hits the exchanges.

In 2017, thousands of fledgling companies collectively raised over one billion dollars (there’s an ICO which raised $700 million !!!). The premise was simple - you find out a company which is currently offering a “pre-sale” or ICO. In exchange for virtual “tokens”, you send BTC or ETH to the wallet address provided and they release the tokens after a few days. Once the coin is listed on an exchange, the buyers would trade immediately, often on a very large profit.

The result was that a lot of new, dumb money flowed into the market by easy-money hopefuls.

In essence, to implement an ICO, a startup creates a large number of some brand-new kind of altcoin out of thin air and sells many of them to speculators.

There are a number of variations on the specifics, including how many of the altcoins the founders retain and what can be done with extra ones left over after the ICO.

The startup then supposedly uses the real money they get from selling the fake Monopoly money they just printed up to get a blockchain-related business off the ground (unless they’re complete scammers, of course, which many are).

Then something magical happens, and everyone who bought the altcoins at the ICO sells them for a profit. Just what magical occurrence imbues such worthless bits of, well, bits, depends upon the business model of the startup — but one thing the investors don’t get is an ownership stake in the company.

At least you can play Monopoly with real Monopoly money. However, with ICO-generated coinage, there is rarely even a speculative market, because there are simply too many ICOs with too many new altcoins.

Want to put a hotel on Park Place? You’re out of luck. All that new altcoin isn’t worth the paper it’s printed on — if there were paper, which there isn’t.

Welcome to the world of crazy magical internet money.

To top it all up, companies bring on board social media personalities as “advisors”, sign up six figure deals with them behind the scenes, and then the personality proceeds to advertise the coin on his social media channels. The Naive public meticulously follows and jumps into this suggestion. Since the market was on an uptrend, the coins did rise in value and give profits to many, which refuels the mad rush and makes the influencer look like a Crypto God (Ian Balina I am looking at you) who is helping them make money. Month by Month, the god keeps signing under the table contracts, makes his money, the company sell the tokens, make their money, and the buyers lap it all up, making their money by selling it later on too.

Win win for all right ?

If the universe gives you easy, quick money. It will take that back quick and easy too. And this time, with interest.

— Me to myself years ago.

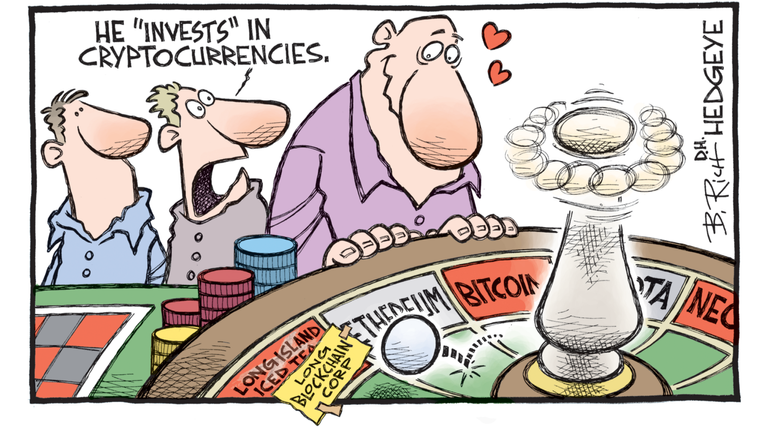

The crazy valuation of many an Altcoin is the result of market mania that has resulted in inexperienced investors buying up low-priced assets on a whim, hoping that they will follow Bitcoin’s meteoric trajectory.

This irrational enthusiasm, coupled with large players manipulating largely unregulated markets, has resulted in a weekly cycle of rallies and crashes across just about every crypto asset.

Even the Reddit communities, which were created with the intent to discuss coin technologies, PoW’s, and to keep a check on the proceedings are now reduced to a very pathetic, shameful state of USD price fixations and over-zealous coin price speculation.

It’s great to see mainstream excitement about cryptocurrency, but the continued focus on price and potential to “get rich quick” distracts from the laudable goals that projects like Bitcoin set out with. Even more importantly, the underlying technology is still facing technical challenges related to scaling that need to be addressed.

It proves to be expensive if we choose to send money using the Bitcoin network. An average of $4 is charged for using the network, substaintially lesser than last month, when it costed $50 to do so. At the same time, a token that touts itself as “the blockchain solution for the global dental industry” has just surpassed a $1 billion market cap.

Something isn’t right here.

FOMO-driven, amateur Investors are rushing to invest in the next “blockchain for x” ICO hoping for a 1000 percent return,hoping to become crypto rich like their favorite YouTube or Instagram stars. At the same time, merchant adoption of Bitcoin is reportedly decreasing to its lowest level in years. Recently, major players like Microsoft and video game marketplace Steam removed the option to pay in Bitcoin from their online stores.

Ironically, Bitcoin was launched on the premise of being “Anti-Establishment”. Keeping this in mind, we are increasingly seeing money being poured into the industry by institutional investors, Wall Street banks and traders, and even the launch of Bitcoin futures ( which is basically betting on whether Bitcoin’s price will go up or down ).

This begs to ask the question. Weren’t corrupt financial systems supposed to be out of this ?

Given the immense price increases and media hype, there’s a tendency to see 2017 as the best year for cryptocurrencies yet, but I would argue the opposite. In many ways, 2017 marked the year that cryptocurrency stopped being about technologically innovative peer-to-peer cash and instead essentially became a new, unregulated penny stock market.

All due to greed and FOMO and investors who knew nothing about what they are really buying.

2017 was also the year that the very institutions Bitcoin originally sought to dismantle have begun to co-opt it for profit.

“Game over for cryptocurrencies ?”

No one can predict or conclude an endgame for cryptocurrencies. It’s difficult to predict how much the current crypto bubble will inflate, or when it’ll burst (not if). A Bubble ? Yes, A bubble. With the amount of shitcoins on the market and nothing being done on the underlying technologies, a lot of this market is going to do down. A lot of coins are going to go bust. A lot of them will be going to zero.

The burning question on my mind is this: Once the cryptocurrency price bubble pops and takes all the hype with it, will the community be able to recover the energy it needs to build real, innovative technology once again?

Over the past year we’ve seen the collective market cap of all cryptocurrency assets balloon to more than $800 billion USD, largely because of speculative trading. Everyday, it seems there is a fresh news article about the 20 year-old who became a millionaire in Bitcoin.

Take the case of Dogecoin, an awareness turned memecoin, which hasn’t had a software update since 2014, exceed $2 BILLION in market cap in December.

Gosh.

In a hotly competitive sector where customers demand faster transactions and lower costs, the rewards of building the best blockchain mousetrap could be vast — the penalties for missing out, proportionately painful.

Cause in the end, that is what matters, making the customers and partnerships happy. Not making you, the average Joe, the noob investor happy.

All this greed and naivety is exactly what causes a “Bubble”.

THE ALTCOIN BUBBLE.

One can’t deny the fact that it is possible to make money on alt-coins. But that’s just gambling. And people who create new alt-coins are in same position as people who build casinos. It is a business, but it is the entertainment sector, not in ‘real economy’ or ‘financial’ sectors as some people are trying to pretend.

Very few cryptocurrencies are actually very serious, and these are the ones no one is really talking about.

Heard of OmiseGo ? Verge ? Achain ? Ontology ?

Okay. What about Telcoin ? QTUM ? DATA ? Golem ? Factom?

The teams behind these are working on some real good technologies, signing real good partnerships, and in the case of Telcoin, trying to make a huge social difference.

Keeping aside all the flak it receives — Bitcoin is one of few cryptocurrencies which is actually serious. It isn’t perfect, but attacking Bitcoin is very hard, so transactions worth millions of dollars can be confirmed in matter of hours.

I don’t know if the same can be said of the other popular Altcoins.

Many useless altcoins which gathered a lot of money during ICOs for nothing and huge amount of pumps and dumps are the real problem. They could be the cause of a huge crypto “depression” in a year or two for sure.

Now before you get me all wrong. I am not trying to scare anyone off cryptos. I believe strongly in blockchain and crypto, and if you have reached till here, I’d say : Welcome to the ground floor of a developing building !

My problem is, and what I am bringing to your attention is that most of the leading “altcoins” are not really even trying to be “coins” per se.

They are blockchain-based businesses exploring an exciting new blue ocean for entrepreneurs.

How many businesses do you see on the NASDAQ?

Are any of them claiming that they are the only business that needs to exist?

Congrats, you just answered.

Sooner or later many shitcompanies with their shitprenuers and shitcoins will go bust. Do not be the person caught in the midst of the dump and end up with a glorified bag of digital peanuts.

Conduct your research well, and do the right thing, invest in the right technologies with real world use cases and real value.

Not an over-glorified shitshow.

I know you may be frustrated, and if you are a first time crypto investor, confused with what to do next.

Fret not, I have written down a guide for you to not get lost. Free of cost, no affiliate links, no marketing of any sort.

Cheers and Thank you for reading.