Definition

A Ponzi scheme is a fraudulent investment operation, promising high rates of return with little risk to investors. Such as scams which generate returns for prior investors by acquiring new ones, following a pyramid scheme, rather than from legitimate business activities. The subjects that engage in a Ponzi scheme which focuses all of their activities into attracting new clients to make them invested. This new income is used to pay original investors their returns, marked as a profit from a legitimate transaction. Ponzi schemes rely on a consistent flow of money from new investors to continue. When it becomes difficult to recruit new investors or when a large numbers of investors ask to cash out, the scheme falls apart.

Characteristics

Ponzi scheme allows those who enter in early stages to achieve high short-term returns. However, it continually requires new victims willing to pay for their shares. Earnings coming from exclusively through shares paid by new investors and not from productive or financial activities. The system is naturally destined to end up with losses for most of the participants, because the "invested" money does not give any real income or interest, being simply confiscated by the first ones involved in the scheme that will use them initially to fulfill the promises. Often, high returns encourage investors to leave their money within the scheme, so the operator does not actually have to pay very much interest to investors. Promoters also try to minimize withdrawals by offering new plans to investors where money cannot be withdrawn for a certain period of time in exchange for higher returns.

If a few investors do wish to withdraw their money in accordance with the terms allowed, their requests are usually promptly processed, which gives the illusion to all other investors that the fund is solvent, or financially solid, but when at the same time it is requested to leave the system by a number of members able to cause a lack of liquidity, the castle crumble.

Red Flags

- High “guaranteed” returns

Ponzi schemes usually offer abnormally high “guaranteed” returns out of normality per year (or even per month). However, there is no such thing as guaranteed returns in this world, there is always a degree of risk to every investment.

- Vague business model

Investment processes provide unclear details which could be deemed confidential. Even if they do explain how they make the money, the business model is usually overly complex and hard for a normal individual to understand.

- Investment products are usually foreign

Investment products are usually based in places far away from where they raise funds.

- Sales personnel have attractive commissions

Promoters are usually highly motivated to involve new person because their commissions are very lucrative.

- Advertised as “risk-free”

All investments come with a degree of risk, there is no such thing as a risk-free investment.

History

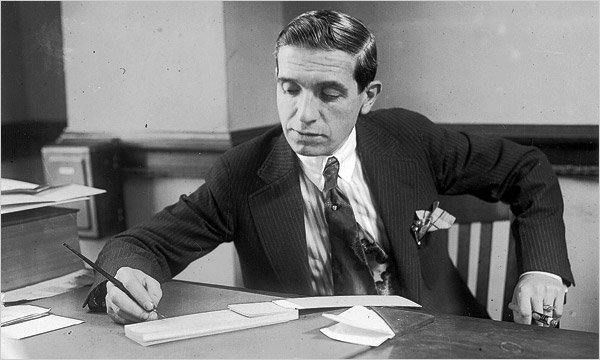

"Ponzi" originated from the first man to use the scheme on a large scale: Charles Ponzi. He was a charismatic Italian immigrant who, in 1919 and 1920, coaxed thousands of people into shelling out millions of dollars — including a staggering $1 million in a single three-hour period — to buy postage stamps using international reply coupons.

Charles Ponzi in 1920 while still working as a businessman in his Boston offices.

His claim was to be performing arbitrage with international postal reply coupons (IRC), used to purchase postage stamps. Ponzi claimed that he would have money sent to agents abroad, where they would purchase the coupons, those would then be sent to the United States and redeemed for stamps of higher value; through this process, it guaranteed to double the investments made in 90 days.

He collected more than $8 million from about 30,000 investors, in just seven months, before the scheme collapsed. The fall begins with a creditor who sued Ponzi's company, who says he lent money at the beginning of the activity, the media spotlight leads the press to investigate. The Boston Post investigation reveals that the company earns an average of 250,000 USD per day by speculating on stamps, in order to reach that level of investments,160 million coupons would have needed to be issued, but there were only 27,000 in circulation.

Investors started asking for money back, it's the end, Mr. Ponzi declares bankruptcy with a debt of $ 7 million. Charles Ponzi was arrested on August 12, 1920, and charged with 86 counts of mail fraud. Owing an estimated $7 million, he pleaded guilty to mail fraud, and subsequently spent 14 years in prison. He was deported and spent the rest of his life vainly seeking ways to restitute the losses of his investors until he died in Rio de Janeiro, Brazil, on January 18, 1949.

Thanks for the info. Especially for the historical facts. It's surprising what one can achieve by simply knowing how to sell a product, even if the product is worthless.