Nice video. Technicians often disagree as technical analysis is not 100% correct.

I'm going to offer a different alternative.

You point out correctly that BTC would have a long way to fall to get to it's 200 day ma.

However fundamentally we disagree, as you mention 10k btc would be a buying opportunity at those levels.

I would argue that assets/ stock indices/ commodities that fall after such a rise are better buys, but are ultimately underpinned by real value and business', I think BTC will be replaced by a better option. Whereas copper or the S&P500 are not going to be replaced.

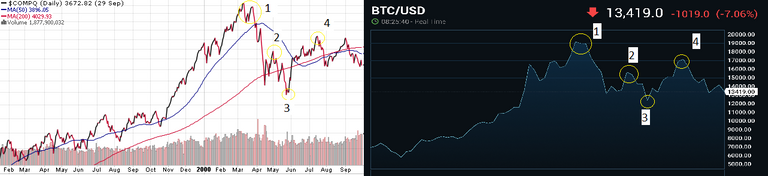

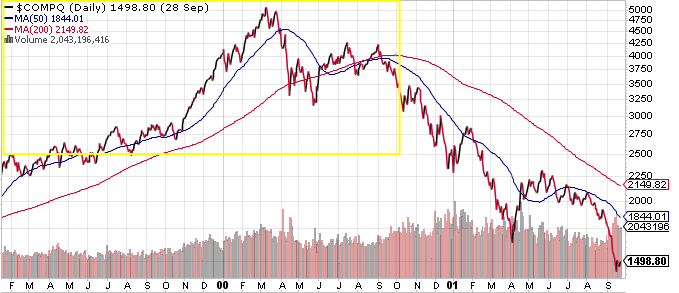

I think BTC's chart looks like the DOTCOM bubble. I point out the similarities in the chart above. However unlike the Nasdaq, if BTC falls that far..

It's not coming back.

Still true