A fork in sciences, specifically software development ensues when an original project is taken and modified.

In decentralised trustless monetary communities like crypto, the implications could be profound. There are two categories of forks in decentralised systems. A scenario where users in a decentralised community aren’t able to participate on a network due to an upgrade is considered a Hard Fork. A soft fork permits all previous users to continue participating on the network in the same old way even with the upgrade running.

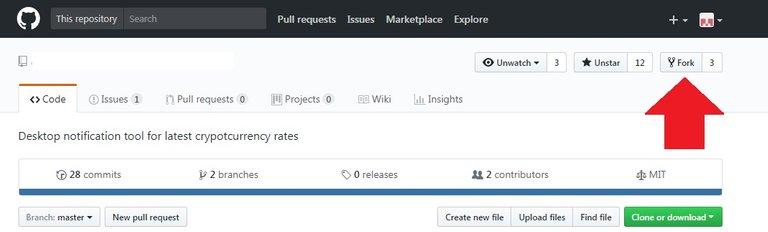

If the last three lines isn't clear enough, the next three paragraphs would do a better job.

Here’s a scenario, Fossil fuel automobile owners twenty years ago wouldn’t have had any issues with what kind of fueling station they drove into. Almost all engines on the road where fossil fuel-driven. Now, Peter (for instance) ran a gas station for a while. Statistics has shown him that more cars now run on battery. He pulls down his gas station and sets up an car battery recharging and maintenance facility. Yes he might have a new class of clients but he certainly would lose relevance to the old ones. This we might consider as a hardfork. Old users aren’t able to use his services.

Paul’s station on the other hand offers hydrogen fuel, fossil fuel as well as battery charging and maintenance services. He could be patronized by all categories even in a city with cars that run on only fossil fuel. This we might consider a soft fork. Though Paul has made an upgrade to his menu, all autos could still use one of his services.

They both have upgraded, but not every auto owner, so even if Peters facility is closer to our apartment, since we use a internal combustion engine, his upgrade is irrelevant to us. This is a perfect picture of what happens in a fork.

Image Source

In the centralized systems, we could just go to an authourity if we feel unsatisfied about a service. Where everyone is his own boss (like Bitcoin), a group of users might decide to change the rules. If there is overwhelming consensus, the rule might be implemented on the network itself. If not, this might result in a new asset class only recognized by the forking community.

Series of events in Bitcoin space particularly has brought about new concepts to fork.

User-Activated Soft Fork, UASF

This idea came about as a result of miner’s reluctance to signal overwhelming support for SegWit. In Bitcoin, a full node is also responsible for validating transactions and not only a mining node. So on August 1st, blocks that weren't signaling Segwit would be invalidated by validating nodes. Miners mine blocks and get fees, full nodes promote concession by propagating the state of the network including most recent longest chain mined. They have they have the wherewithal to drop mined blocks not signaling SegWit. This compelled miners to start signaling SegWit blocks. This was what happened on August 1, 2017.

Miner-Activated Soft Fork, MASF

This would have been the case if miners had supported SegWit with 95%+ consensus within the given time frame. Miners would support the update and it would quietly locked in without a chain split or any network disruption.

Image source

A Hard Fork would be a scenario where the network splits as a result of Minority of validating nodes (less than 51%) and the miners disagreeing on a set of new rules. The forking party could either be the users (User Activated Hard Fork) or the miners (Miner Activated Hard Fork).

Congratulations @tokenizer! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP