EOS is a unique and exciting blockchain. Running off the DPOS (Delegated Proof of Stake) consensus engine. EOS is fast, scalable, and underrated for its performance today. If you have EOS, don’t be intimidated to actually use it!

While becoming a block producer and actually earning new EOS via DPOS system is likely impractical, EOS’s recent REX (Resource Exchange) makes borrowing or leasing out your EOS resources (EOS token is a claim to resources as transactions are free) as easy as ever!

With REX, anybody can stake their EOS and earn APR basically risk free. While the APR rates are currently not that high, as more and more platforms build on EOS and grow the demand for EOS resources, staking rates are likely to go up. And if you have EOS you plan on keeping for a long time, why not put them to work and grow your holdings?

EOS Resources and how it works

One of the main issues in EOSIO based blockchains today is the cost of using the network and CPU resources.

The CEO of EOS, Daniel Larimer presented a solution that can lower the capital costs of CPU resources and EOS network usage. As EOS is new and not that widely used yet besides by cryptocurrency enthusiast, there are a lot of people with EOS resources that don’t need them today.

So the next obvious step was to create a rental market for those who want to rent their unused CPU time / bandwidth. This of course requires price discovery and liquidity. A rental market should be able to provide resources that are available for a low, reasonable price.

This market will give Token holders the option to lend their EOS at a fee in exchange for some loss of liquidity for the duration of the loan. Therefore providing zero risk of losing capital to the lenders.

How will the Tokens for Lending work?

There’s a Resource Exchange(REX) that allows you to convert your EOS tokens for REX tokens at the current book value of the Resource Exchange and/or convert your REX tokens back to EOS at book value, anytime you like.

The REX tokens’ book value will increase due to fees from various network operations, such as; fees generated when lending the EOS, fees earned for renting CPU and NET resources, RAM trading, name auctions and any other resources that the EOSIO chain provides. Accrued rewards from all possible sources, can generate an amount effective enough to be offered as a reward for holding EOS for at least 30 days (the rental period).

Additionally, Staked EOS or/ SEOS tokens is created every time an EOS is contributed to the books of REX. Using one system, SEOS can be further converted into the delegated EOS for CPU resources over a 30 day period.

How can this lower the costs of resources?

The current allocation model in the EOS network is built in such a way that using the network for a month costs exactly the same as having the right to use the network forever (minus the proceeds of selling 30 days later).

The issue about this allocation model is that, 30 days of interval with the possible market volatility can either double the amount or lose half of it. Therefore, renting out CPU resources heads the traders not being exposed to the EOS’s price volatility and will have the advantage of EOS’s cheap price.

This model incentivizes participants in the governance of the EOS network and by doing so, lessens exposure to EOS price volatility. This will surely create a huge demand for buying and holding EOS tokens.

How to Stake your EOS

It’s time for the “How?”, now that you better understand the “Why?” for EOS staking.

The process is actually made very easy and EOS Authority has made a very easy website and guide for staking your EOS on the REX. I will briefly summarize so you know what to expect

-

Step 1: Get a wallet

Scatter is EOS’s main wallet interface and has become widely accepted as a way to use and interact with EOS platforms. So the first step is to download scatter and get your EOS onto your wallet. Follow Scatter’s guides to making a secure wallet and make sure not to share your private key with anyone.

-

Step 2: Login to Rex

Once you have Scatter installed simply go to a REX homepage. We recommend accessing through https://eosauthority.com/rex/.

Once there go to “Add account” and enable pop-ups and other activity on your website as your EOS scatter wallet will take over from there. Remember to be logged into Scatter before doing this step.

-

Step 3: Voting and Other Prerequisites

If you want to Utilize EOS’s REX, there are some prerequisites you will have to complete such as voting for block producers.

Scatter and the website will walk you through this process with general ease. My suggestion if you don’t know who to vote for is just to delegate your EOS voting to a trustworthy delegate. This will be the wallet and website recommendation as well.

-

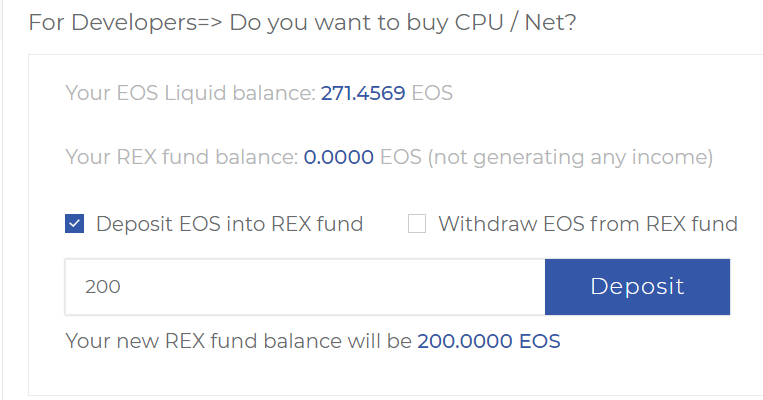

Step 4: Deposit into REX

On the “Borrow CPU/Net” tab go to deposit into REX. Choose the amount of liquid EOs you want to eventually stake and click deposit. I recommend keeping a little liquid EOS in case you need to stake it later for more network resources for your own wallet activities.

-

Step 5: Stake to Savings Account

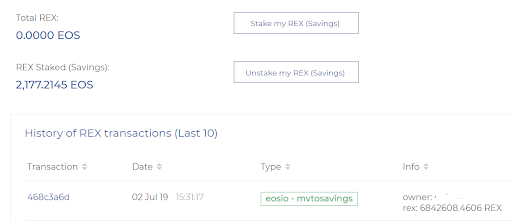

Once you have REX tokens (takes about 1 min after deposit) you are ready to stake. On the “Get/Sell REX” tab go down to savings and select “Stake my REX (savings)”. Simply deposit your REX tokens here and you are done and will now be collecting interest as people borrow EOS resources from the general fund and pay back interest (which you get a chunk of).

-

Step 6: Watch your EOS Grow

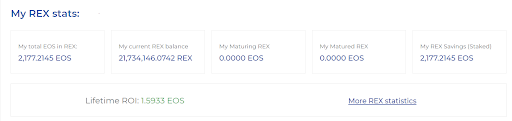

You are able to unstake your EOS at anytime once its staked. Otherwise you can view your earnings and progress on the main dashboard page.

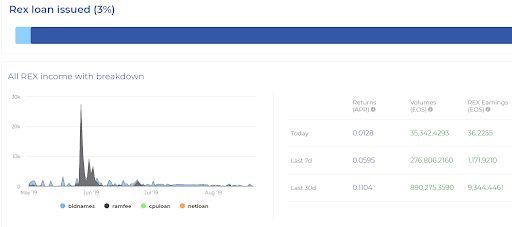

You can also view overall statistics about REX via the “REX statistics” tab. Currently as not much borrowing is going on the APR is under 1%, but something is better than nothing.