Hi traders, lat's talk Bitcoin.

Bitcoin.

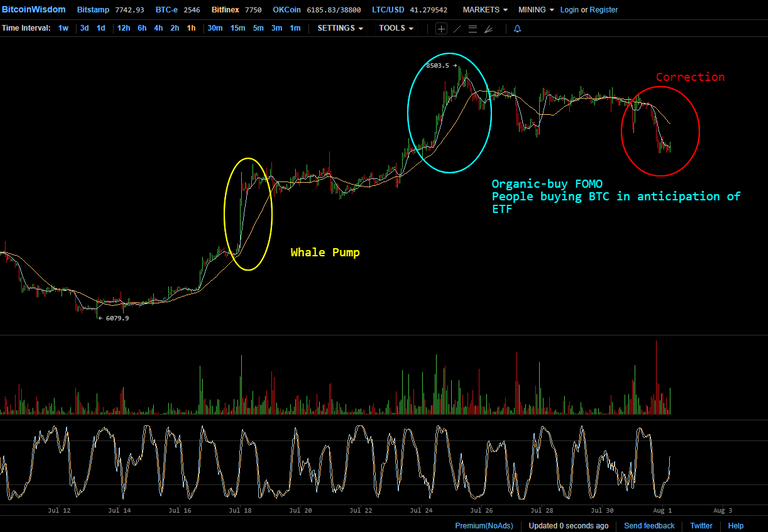

- Bitcoin had a healthy correction following an unsuccessful FOMO-rally around the CBOE ETF news, notice the difference in quality between a pump (straight vertical candle) and organic buying (jagged price action).

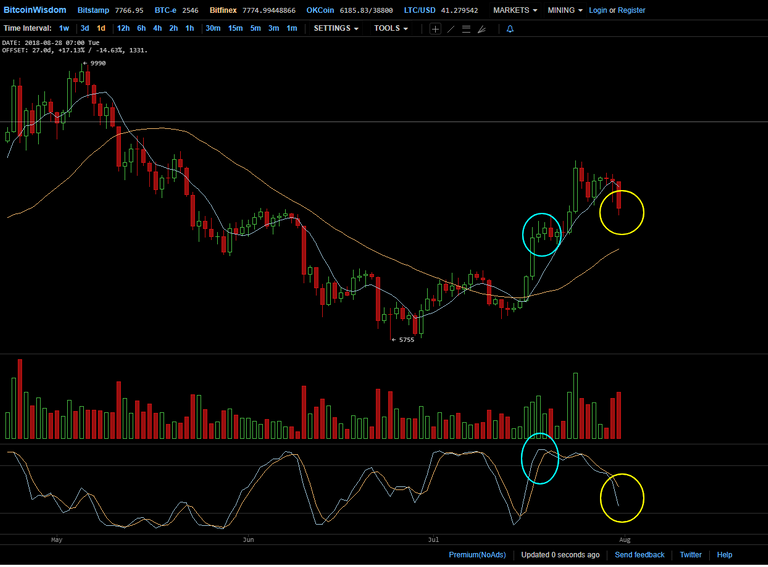

- We now have a bullish divergence on the daily which suggest that a small bounce could be in play, possibly to retest the $8000 level as resistance.

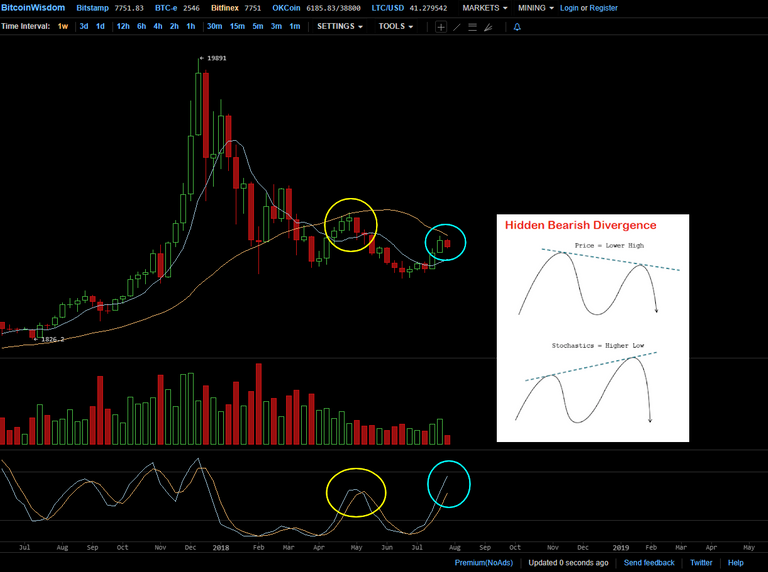

- However I do believe we're due for more correction towards the end of the week because of a visible exhaustion of the buyers on the largest time frame, notice the bearish divergence that is forming, just like we predicted.

Ultimately this market is running on hopes that the CBOE's ETF will be approved which, in my view, is unlikely given that the Winklevoss' ETF just got rejected by the SEC on the grounds of market manipulation for which we now have ample evidence of.

On top of that the FAFT (which the money-laundering watchdog of the G20) is meant to give its recommendations for the global regulation of crypto in October, to which all the G20 members have already pledged to implement.

So here you have it folks, as I mentioned I am quite pessimistic on the outcome of both these events so I have started to reduce my positions and hedge into cash in order to place myself in a win-win situation, come a bigger bear I'll have plenty of ammo to buy any dip, comes the bull and i'll also be able to ride the waves up.

Until then,

FØx.

Thanks FØx! Its nice to get a well balanced opinion. Just out of curiosity, did you see VanEck's response to the SEC decision regarding the Gemini ETF rejection? I don't know if it will assuage the SEC's fears about a Bitcoin ETF, but it would be interesting to see if the SEC buys VanEck and SolidX's explanation of how their ETF is different. Secondly, I was just wondering what kinds of Technical Analysis you find the most useful for making decisions about crypto trading. Thanks!

As for trading, I like using the weekly time frame + Stochastic RSI and Volume profile on trading view for the smaller time frame. Hope this helps :)Hi @karazaa, thanks for the kind words. No I have not heard his response but I'll make sure to look it up. Personally I think the fundamental problem is the market itself, not how a financial product is structured but it's up to SEC at the end of the day.

Thanks @tradealert!

Here is a link to the letter if that helps! https://www.sec.gov/divisions/investment/van-eck-associates-innovation-cryptocurrency.pdf

Great!

Would love to know more.

More is coming :)

Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.Congratulations! This post has been upvoted from the communal account, @minnowsupport, by tradealert from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Great post buddy....

I am new in steemit and please follow me and support me

Posted using Partiko Android

Thanks for stopping by, I'll go have a look for sure :)

Nice post ... keep sharing...!!!

Thanks man :)