Today we discuss why ETH’s price has stalled and is showing signs of a breakdown.

I see two reasons why ETH’s price is showing signs of bearishness against fiat money (meanwhile ETH/BTC is remarkably stable): the enthusiasm for ETH in Asia may be winding down and the ICO bubble may be about to pop.

ETH losing price momentum in Asia:

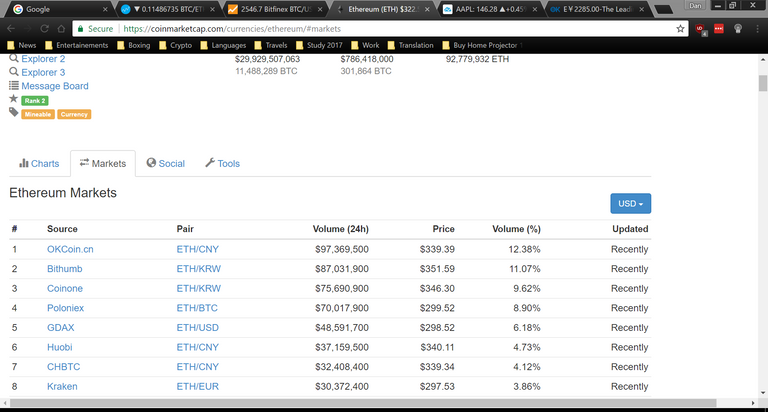

A quick look at Coinmarketcap.com reveals that Okcoin.cn, one of the biggest Chinese exchange, is currently the main market mover of ETH, followed by the Korean exchange Bithumb.

Looking at these markets, you can also see that ETH is selling in Asia at a considerable premium compared with the USD market, a fact we shall explore later on.

The consequence of China being the main market mover is that technical analysis against fiat should be done against the Yuan.

Unfortunately, neither Coinigy nor TradingView have Okcoin’s ETH/CNY charts and Okcoin’s own website is a buggy disaster so I went for the ETH/CNY chart on Yunbi which has similar price to Okcoin’s.

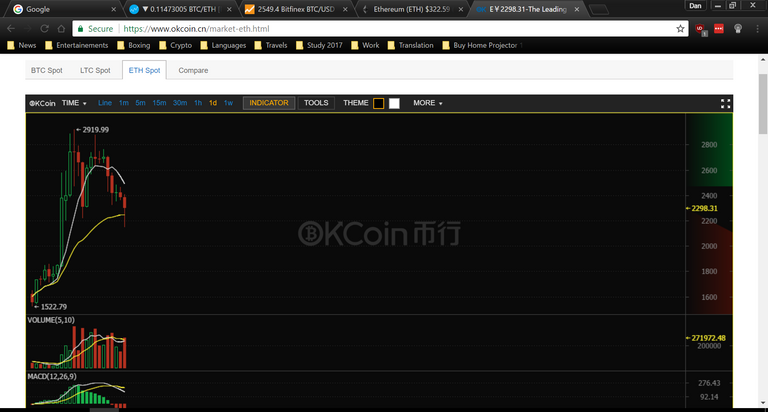

The second problem I had is that because ETH has only been listed recently on Chinese and Korean exchanges, technical analysis on their chart is very limited but here's the chart anyways:

As you can see Chinese charts show a sharp increase in price since the introduction of Ethereum and a break down of the immediate trend-line with a possible support at the 1600 CNY area.

The chart reminds me very much of these pump and dump patterns that form on tokens whenever they get added to a new exchange which could partly explain why the market has stalled: simply the enthusiasm for ETH is weaning off and Asian traders have started to dump their bags.

It is also possible that many Asian traders did arbitrage by buying large amount of ETH on USD/EUR markets only to dump them at a premium on Asian markets.

Besides losing steam in Asia, ETH bear trend might be exacerbated by a deflation of the ICO bubble.

The ICO bubble may pop soon:

These past few months have seen an explosion in the number of ICOs on the Ethereum network. Ambitious start-ups in need of funding have used the public's enthusiasm for ETH to amass enormous sums of money resulting in a considerable increase in ETH price since so much of it has been taken out of the market.

Now these start-ups are in the middle of a Mexican standoff: who will shoot first? Who will dump their bags first?

The GDAX flash crash was just a taste of what a ETH dump can look like and whoever dumped their ETH on GDAX (the most liquid ETH/USD market!!) drove the price down to $0.1 dollar simply by selling about 45k of ETH.

Now imagine what would happen if Bancor, who owns over 200k, decided to dump just half of their ETH bags. How do you think the price would react to this?

As an investor, you should definitely be worried about ETH, as a trader, my advice is:

- Set very low orders of the books of the most liquid ETH/Fiat exchanges (Bitfinex, Kraken and GDAX). One day you might get lucky and scoop up some cheap ETH at a $1.

- DO NOT MARGIN TRADE

Please, follow and comment if you liked the content.

Dan @ tradealert

Ethereum is loosing momentum indeed. They have technical and architectural issues. People are leaving them because of it. I believe Stratis can do what Ethereum can and even better. They have sidechains for example. I've written a few posts about this.

Coming back to China, I think the Chinese will go nuts for their own 'Ethereum': NEO. Formerly known as Antshares.

Very valid point about NEO, might be worth investing some coins in it when the price hits accumulation

If you are interest in stratis, these may interest you: https://steemit.com/cryptocurrency/@valderrama/will-stratis-overtake-ethereum

And to follow up I wrote a more 'provocative' post: https://steemit.com/cryptocurrency/@valderrama/stratis-will-beat-ethereum-in-2018

Will have a look at these, thanks for sharing

You're welcome my fellow Steemian.

ICOs are just using ethereum.

Depends, some of them accept Bitcoin or other cryptocurrenies (TenX accepted a bunch), ETC is having its first ICO soon as well

I wrote a post about my own view on the whole bubble thing. My point is very simple, if each one of us do not make their part, we can ruin the party. If we get enough bad examples out on the street we'll sure piss off a bunch of regulators and traditional investors, and that will likely limit the whole of crypto and blockchain economy's growth. Also, don't miss out on the CFA Institute's view on the ICO Bubble.

Very good point, regulators intervention could spell troubles for the sphere but we need order in OCOs, that's why I support projects like Cofound.it.

Thanks for sharing the article!

You mention some very good points, thanks for sharing!

Thanks for reading!

I had also the idea of just placing for fun a very low order ;-) These exchanges are are not regulated like a stockexchange where the trading of a rapidly dropping stock would be postponed if it reaches, lets say -20%. On a cryptoexchange is no such safety measure. So dramatic crashes can occur. I think these exchanges will look what to do with this issue...

So till then, if many people would place lower buying orders, because they see an opportunity, it could create a "safetylayer" on the exchanges so crashes might be featherd and not so extreme. Topic: selfregulation of markets by opportunity ? What do you think ?

Right now ETH markets are VERY illiquid, so your low orders would still be filled in the case of a massive dump, I would definitely keep these low orders on the books, just in case