Hi traders, here's 4 key lessons which I have learned crypto-trading throughout the year 2017. Hopefully these will help you achieve financial success in 2018.

Lesson 1: Less (trading) is more (profit).

If 2017 taught us, crypto-enthusiasts, anything it's that patience is key;

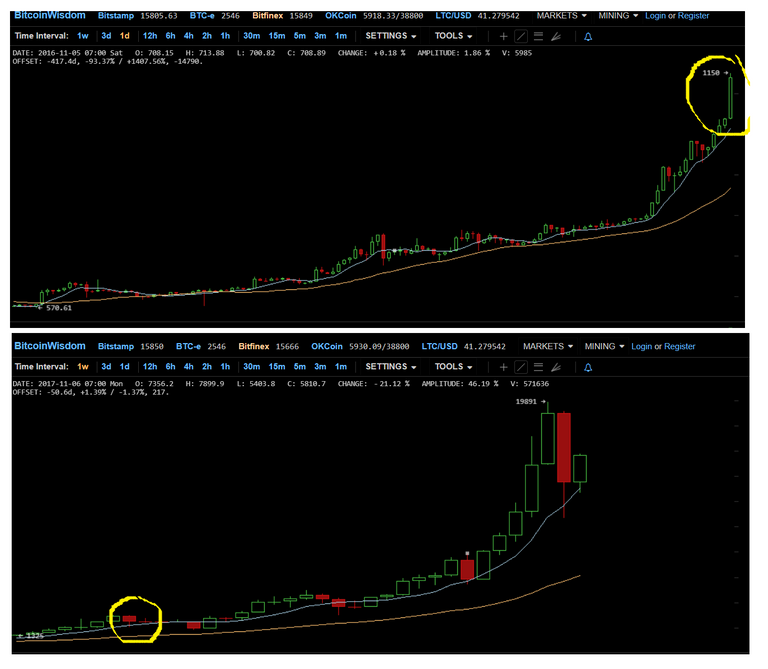

Chart are deceiving and today's parabolic moves might look like insignificant bumps in three years. So it’s important to cut out the daily price action noise and focus on the bigger picture;

February 2017: It's a bubble!:

...oops, never mind.

Trade to accumulate the coins you like and hold for a minimum of 6 month to a year before taking any profit;

Define your selling target in advance and incrementally scale out of your trade at your targets. Remember, never go all out of a trade because bull trends can last much longer than one might expect so don’t try to pick tops and always keep some coins as long-term investment (put those coins on a hardware wallet and forget about them for a year);

Stop wasting time anxiously checking coinmarketcap.com every five minutes, instead, use that time to research other projects and to participate in the communities which form around the projects you love. Token economy is all about community so by taking a more pro-active role in those projects you will also contribute to the success of your investment.

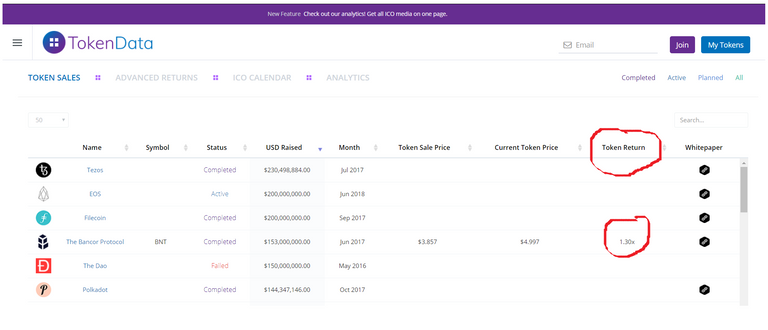

Lesson 2: Use TokenData and Coinmarket-cap to find the best altcoin deals.

- Most ICO tokens sell off rapidly once they are listed on an exchange. Rapid sell-offs can drag a token's price much below its initial ICO value and give you a considerable edge over the market. TokenData.io has a very useful feature which compares current price to ICO price, use it to hunt for tokens that trade below ICO price;

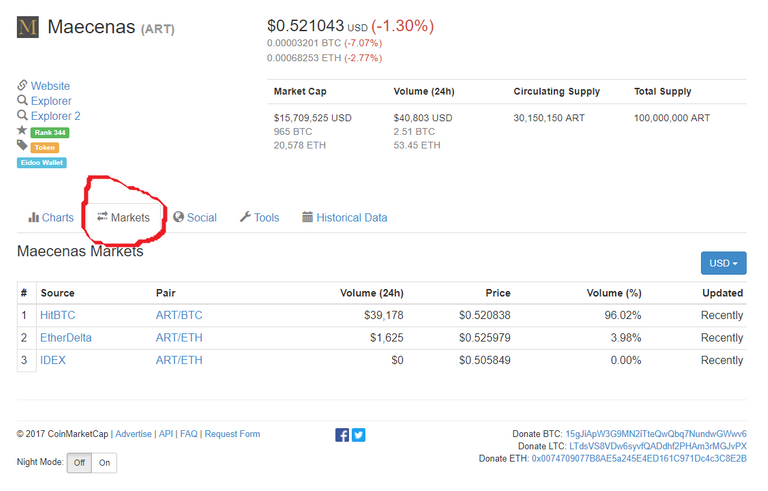

- Once you’ve spotted your prey on TokenData use (the infamous) Coinmarketcap.com to take a look at the price-action:

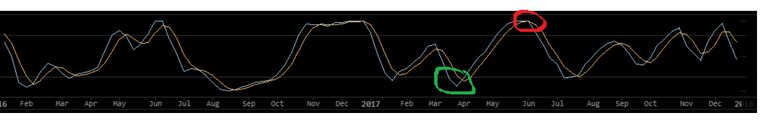

Pro-tip1: use the CHARTS/ALL tool to make sure the price is in accumulation relative to BTC (yellow trendline is flat, possibly a bit bearish);

Pro-tip 2: use the MARKET tab to determine how many exchanges have listed the coin on your buy-list. The fewer the exchanges the better because coins gain value as they are added to more exchanges.

Lesson 3. Use BitcoinWisdom.com to trade bitcoin.

- BitcoinWisdom.com (BW) is the best charting tool for trading bitcoin.

it’s reliable: most professional traders use it, which creates structure in the market, which is why bitcoin is so predictable to trade;

it’s free... need I say more?;

it’s powerful and features: lines, Fibonacci retracements levels and my favorite: the stochastic RSI indicator;

Pro-tip: use the stochastic RSI to trade larger market cycles. Buy crypto when it is oversold (both lines bottom out, blue line crosses under the orange line), sell crypto when it is overbought (both lines top out, blue line crosses over the orange line). Easy-peasy.

Lesson 4. Take responsibility for your trades.

In trading like in life, your actions have consequences. In trading though, those consequences are magnified and immediate. In Trading in the Zone Mark Douglas observes that most traders fail to take responsibility for their losses but instead blame exterior forces for their failure... the market... the exchanges.... YouTube... the whales... Roger Ver...

Is this starting to sound familiar?

Trading is absolute freedom of choice and as such you have no-one else to blame for your losses then yourself, just like you have no-one else to congratulate but yourself for your gains. These are two sides of the same coin and the realities of trading. Failing to take responsibility for ill-advised trading decisions only weakens one as a trader because it bars one from reflecting on one's errors and thus hinders the learning curve that trading is.

Remember: It's not a sprint...it's a marathon.

Cheers and see you next year :)

I read your post, it's really good information and thanks for share with us....

Thanks @khanrony, feel free to re-steem and follow my blog if you liked this post 😊

GREAT THANKS

My pleasure :)

Thanks again for this excellent information. Have you had a chance to view some of the trading tips and materials from jsnip4 on youtube with a guest called Trader Boss? Also quite insightful.

Will definitely have a look at it, thanks for stopping by @contemplate :)

Great advice..as per usual!

Cheers :)

Hey @scalerman, would you like to join our online trading community, we are on Discord, you can email me at [email protected] and I'll send you an invite. We're small and we like it this way but I'd love to have you on-board :)

Cheers!

Hey @Dan. Thanks so much for the invite! I'd love to join you guys! Not real experienced with Discord but I'll email you and we'll go from there...and happy new year! 👍

great tips. mahalo from hawaii.

Thanks Mahalo from Hawaii ;)

word from Hawaii, I am an idiot sometimes LOLhi @kaneseyeonthesky, just realized "Mahalo" is a