How to buy a cryptocurrency futures contract

Learn how to buy a futures contract such as stocks, bonds and cryptocurrencies on the Truztar 'blockchain' platform.

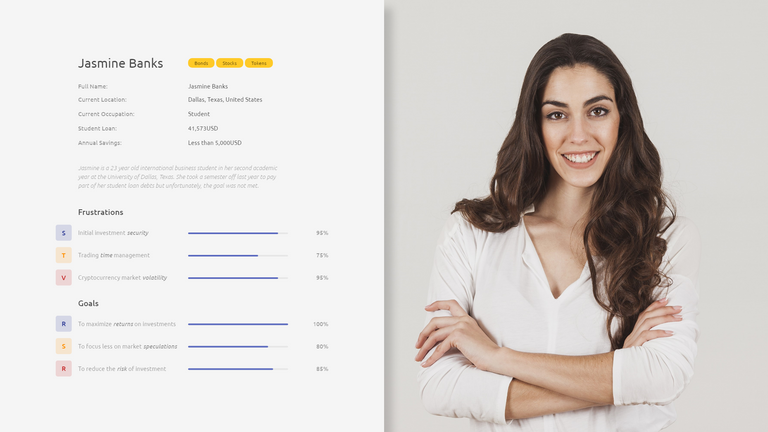

User Persona with Scenario and Use Cases

Jasmine is a 23 year old international business student in her second academic year at the University of Dallas, Texas. She took a semester off last year to pay part of her student loan debts but unfortunately, the goal was not met. Currently sitting on a student loan debt of around $40,000USD with less than $5,000USD in her savings account.

Should Jasmine choose to trade digital currency the traditional way, she might not be able to accomplish her due to the market volatility. Instead, she can trade, hedge and invest in the cryptocurrency futures contracts provided by Truztar.

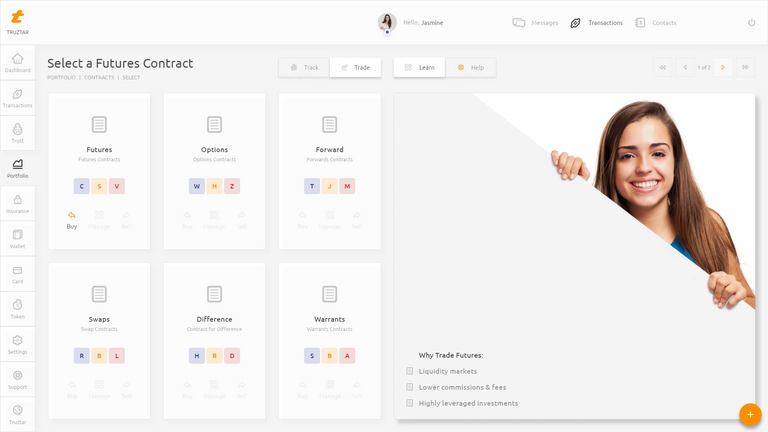

(I) Select a Futures Contract

Take advantage of higher leverage with lower risk by trading futures with Truztar. Contracts are derivatives which are financial instruments that derive their value from stocks, tokens, bonds and etcetera.

As Truztar provides various types of contracts from futures, options, forwards, swaps, difference and warrants, choosing the right one has never been easier. To choose a contract, a user needs to be logged into their Truztar account and navigate to their portfolio section via their dashboard.

A list of derivatives or contracts will be listed and one can be selected along with what action 'either buy or sell' to perform.

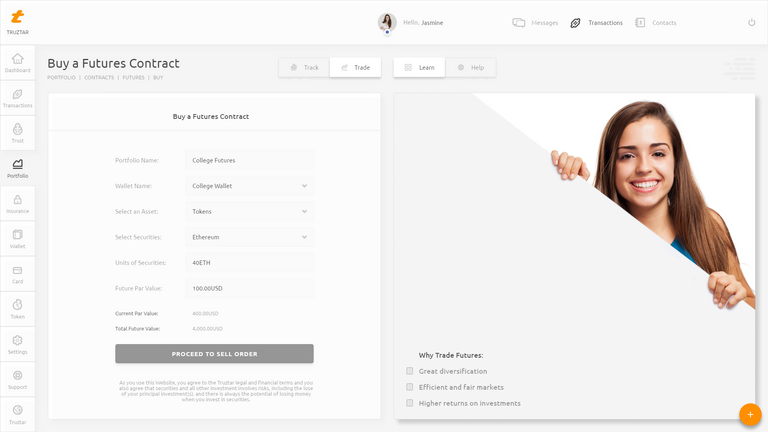

(II) Buy a Futures Contract

Creating a contract is as easy as you'd never thought. It only takes roughly a minute to do so. Once you decide on which contract you'd like to trade, the next step is to register such contract using the 'buy a contract' form.

Once an investor has decided on which contracts to trade, a click on either the buy icon / link on the contracts module will navigate the investor to a form page where such investor needs to complete the form in order to start trading.

In this use cases, we'd be looking at the buy contracts where Jasmine can trade digital currency in the future.

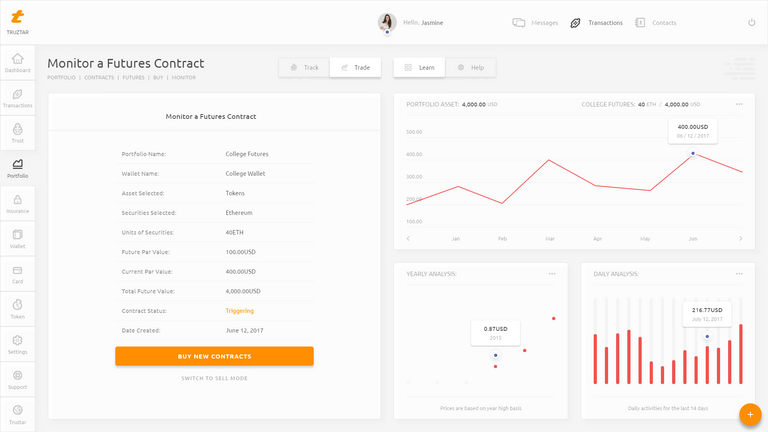

(III) Monitor a Futures Contract

Various charts are provided in multiple designs to make monitoring your contracts more easier. The contract monitoring page helps you manage and track all your contracts, be it futures, options, swaps, warrants, etc.

Upon the successful creation of a contract, an investor can easily manage and monitor their contracts in one spot. By default, the status of a new contracts will be triggering until when the future par value declared by an investor is met and the status will automatically be changed from triggering to triggered.

Various charts will be provided to help the investor monitor the contracts analysis from daily 'live' to monthly to yearly performance and insights.

Good effort

Congratulations @truadmin! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPSTOP