Masternodes (MNs) are the hot ticket in alt-coins right now. They don’t require large amounts of upfront costs in equipment and electricity like Proof-of-Work (PoW) coins. They are a step up from plain ole staking coins. Every project I hear about lately is the next PIVX.

It’s not a bad thing. Personally, I love it. PoW is too resource heavy to get us closer to mass adoption. Proof-of-Stake (PoS) and MNs are most likely the future of cryptocurrency. A lot of people recognize that and it is reflected in the amount of MN coins you have been seeing developed lately.

Besides Dev Team desertions, all of the common requirements apply when looking at MN coins and wondering if you should invest. Is the team present? Are they listed by name? Does it have a White Paper? What about a Roadmap? An active, growing community? And the list goes on, and on, until we get to one last thing-

“What is the ROI?”

Return on Investment. How quickly will I get my investment back? Of course this is important! Why wouldn’t it be? And the higher it is, the better the project, right?

Wrong.

In traditional investments, if you saw an ROI of 15% for the year, it was a really, really good year. 10% was a win and coming out even in a down market was just fine. Compounded over 30 years and you would have a nice nest egg that would provide for you comfortably until the day you die.

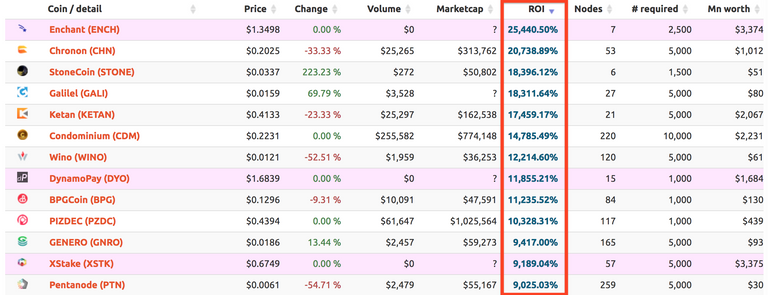

Cryptocurrency is a weird place. ROI is measured in days, not years. If you check popular sites like masternodes.online (MNO), you’ll see an easy to read breakdown of all the MN coins listed and their information. Price, supply, # of nodes, node collateral, cost of a node, and annual ROI.

The ROI can range from a few percentage points to well into the tens of thousands of percent. ROI is, with all things being equal, a snapshot measurement of your return on investment over the next 365 days.

Now, why on Earth would I invest in something that is only going to give me 10% a year when I can get 30,000% in a year? Because, there is a 99% chance you’ll never make it to 100%.

Let me explain it to you in a step by step manner.

A development team creates a MN coin. They do a pre-sale or ICO for initial investors. The team is excited about their project so they apply for an exchange (like Crypto-Bridge or Graviex) as well as a MN listing site (the aforementioned MNO).

With so few nodes on the network, their ROI is through the roof. Outside investors see this on MNO and FOMO into the coin, pushing the price of the coin higher.

Now we’re really building up a head of steam. More investors get in on the action. Looking to get in on making some quick cash. The early investors choose between selling some coins to get their money back and setting up more MNs. Most choose the latter, with dollar signs in their eyes.

The team is excited, they created a successful coin. The investors are excited because they are doubling their holdings every day. There is money being made all around so more investors climb on board.

But, when the team was setting up the coin, no one stopped and asked what the implications of all these new coins being minted would be…

Hyperinflation

The price plateaus. Early investors sell their newly minted mountain of coins to avoid losses.

The price dips. More investors sell to make sure they aren’t in the red.

The team doesn’t know what is wrong. They scramble to ensure everyone that it is just a bump in the road and we will soon be back to making money.

They won’t.

They failed to justify how releasing so many coins into circulation each day was good for the project. Unless the use case or utility for the coin was just out of this world fantastic, nothing was going to stop this from being the beginning of the end for the coin.

The team tries to save it. Someone smarter than them points out their hyperinflation problem. They change the reward structure to be ‘more sustainable.’ But the damage is done. Supply is too high and your demand has moved on to greener pastures.

Most teams just jump ship. We see it everyday.

Does anyone else recognize this structure from the past? This is Bitconnect. Now it is just smaller, compact, happening in weeks instead of over a year.

The prospect of huge returns causes us to abandon our logic. Early investors make great money. Later investors think they will too. But the truth is, it’s too late for you. Your money is already gone.

The project will die. A community takeover will be attempted. But no one else knows how to code so it is useless. You can keep collecting rewards at basement prices. You might get your money back eventually.

Just because you were chasing that ROI. Now it might be a year or never before you see it.

Conclusion

There are good projects out there. Sometimes the ROI means nothing bad. Just an anomaly as the project gets its feet underneath it. Usually those numbers quickly settle into the 100-500% range for Annual ROI and slowly decrease as more investors buy and set up MNs.

These are the types of projects you want to find. Sustainable growth. Strong purpose for existing. An actionable roadmap of the future. An active team. A growing community.

At the end of the day, the new rule for masternode investing is ‘wait and see.' Coins always dip when they hit an exchange anyway. Do not FOMO into a coin because of the ROI. You are already too late. Do not chase. When we chase dollar signs, we end up losing all our dollars, I mean Bitcoin.

Do not abandon your logic. Do not give in to the quick buck. Scams, flash in the pan projects; both continue to block the way for the mass adoption of cryptocurrency.

Yet again, we are getting in our own way.

I see and I have experienced that of which you write. I have been there, done that and see that what your saying is true. Good article. I will resteem this one.