This article explains why the Ubinodes token is one of the best store of value available today.

Contents of this article:

- Functions and Features.

- What is Wealth, Money and Currency?

- What is Cryptocurrency ?

- What is Inflation ?

- What is Fractional Reserve ?

- What is a Derivative ?

- What is Price Discovery ?

- What is a Store of Value ?

- Gold and Silver.

- Can Banks stop Cryptocurrency ?

- What is the Ubinodes token ?

- The Ubinodes token as a Store of Value.

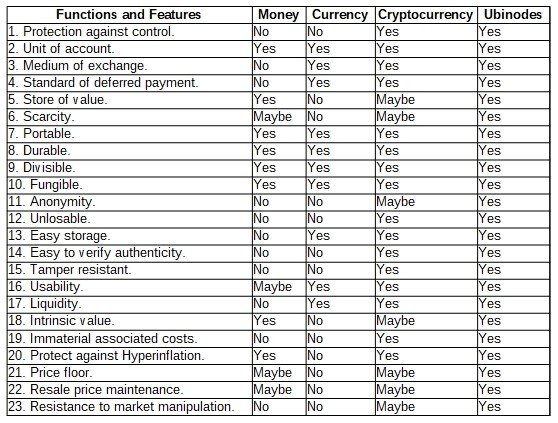

- Comparison.

- Notes.

1. Functions and Features.

Money and currency are two different things. They are differentiated by their functions and features.

- Control of the population: Does it protect against forms of controls? Can it be seized, frozen, intercepted, traced or otherwise used to control your behaviour, like putting conditions on payments etc. ?

- Unit of account: Does it have real use cases in the organization ?

- A medium of exchange: Can wealth be transferred in a permissionless, borderless, censorship-resistant manner? Commodity money is not used in international trades, we don't cover this academical definition.

- A standard of deferred payment: Can transactions be secured between parties within the organization ?

- Store of value: Does it protect your purchasing power over time?

- Scarcity: Is it in limited supply ? This determines if it is an inflationary or deflationary asset and if supply can be manipulated.

- Portability: Can you access it anywhere anytime ?

- Durability: Can it wear out, if so can it be replaced with an asset of the same face value (not more expensive) ?

- Divisibility: Is it readily made available in varying increments to improve its usability and liquidity ?

- Fungibility: Is the value of a unit entering your wallet in the exact same manner it exits ? Is anyone accepting your unit of account the same way as when coming from someone else ?

- Anonymity: Can it be traced back to you or used to spy on your activities ?

- Losableness: Can it be inadvertently lost?

- Storability: Are you able to store it yourself, at what cost and how securely ?

- Authenticity verification: Are you able to ensure the asset you receive is authentic or has been counterfeited, altered, forged, tampered with ?

- Tamper resistance: How difficult it is to tamper with ?

- Usability: For the user, is it easy to understand, use and adopt ?

- Liquidity: How quickly the asset can be bought or sold in the market without affecting the asset’s price.

- Intrinsic value: What is the underlying asset, where does its value come from ?

- Immaterial associated costs: Are the costs associated with using that asset significant or immaterial? Usual associated costs are transaction costs, cost of storage and cost of inflation.

- Hyperinflation: Does it protect against hyperinflation?

- Price floor: Can the logic of the free-market result in creating a price floor that protects the value?

- Resale price maintenance: Can the logic of the users result in creating a price maintenance that protects the value?

- Resistance to market manipulation: Is the value protected against market manipulation by financial institution?

2. What is Wealth, Money and Currency?

2.1 Wealth:

Wealth is an abundance of valuable resources or material possessions, “anything of value” which includes the sum of natural and physical assets. Wealth is never destroyed, it is merely transferred ! This means on the opposite side of every crisis there is a massive opportunity ! You need to decide what side of the wealth transfer you want to be on.

2.2 Money:

Money is intangible, it’s a concept, it’s an intermediary medium to exchange commodities. See note 14.1 for the functions and features of money.

2.3 Currency:

Currency is a tangible based on or intangible money. Currency is used as a physical representation of value that changes over time and varies from one country to the next. It is what brings money to life, what is traded in return for goods and services. These are coins and banknotes in circulation. Currency is simply paper. This paper money is a tool for trading your time. But since money is also handled digitally, on your bank account or credit card, electronic currency can also be intangible. See note 14.2 for the functions and features of currency.

3. What is a Cryptocurrency ?

It is more money than currency, however as Bitcoin’s whitepaper defined it as a peer-to-peer Electronic Cash System, the word cryptocurrency was used and hasn’t been changed to Cryptomoney since.

A cryptocurrency is a digital (or virtual) asset that uses cryptography for security. A cryptocurrency is difficult to tamper with because of this security feature, meaning you can’t duplicate a crypto-token, unlike a computer file. Meaning scarcity can create the value of a token if this one is deflationary. A cryptocurrency is deflationary when a finite number of tokens have or will ever be created.

It is not issued by any central authority, rendering it theoretically immune to government interference or manipulation. It is based on a technology that is neutral, permissionless, trustless, decentralized, censorship-resistant, open-source, borderless, persistent, tamper resistant, cryptographically secure and often anonymous. As long as the seed phrase is secured the wallet can be recovered from any computer.

See note 14.3 for the functions and features of Cryptocurrency.

3.1 Economics:

Governance is basically a set of institutions, norms, agreements and standards. It is what economists call shelling points, like basically the context people should use underlying tools and in what ways. In the real world, there are parliaments, constitutions, laws etc. On top of that, there are informal norms about the ways in which different things should be used.

These are social norms and in the crypto world it is the same thing, at the bottom level is the people’s ability to write software, miners ability to mine particular chains and at the higher levels there are developers discussing between themselves. Developers implementing software, coming up with mechanisms between themselves to agree on basically what the software changes should be made, what block they should activate at, under what conditions they should be agreed on. Users ultimately have the ability to rebel or refuse to accept a particular update. In addition, there are norms and expectations about what kinds of updates that should happen in general.

For example in Bitcoin, people cherish the 21 million limit. There's also the idea of decentralization, also that this thing is supposed to be a currency, you're not supposed to arbitrarily take money away from people, so basically if a user finds something distasteful and there is a norm against it. Then the user knows that a lot of other people find it distasteful as well and they also know that because there exists a meta level social objects called the norm, other users will also be interested in not accepting the update and so users are going to rebel and not install the software like in the case of Ethereum classic.

There are all kinds of biases, in the Wiki page for cognitive biases and there’s a full list of about sixty, including things like how we’ve changed the way we remember information because of the Google effect. We tend not to even bother to remember things that we can easily look up on Google and so the way that we interact with technology is actually changing our human thinking biases as well.

This is one of the reasons why the economics of crypto economics is so interesting because some people say that crypto economics is not going to work because people are not fully rational or people are not purely motivated by economic factors but what people don't see is that even though the key economic incentives are not the only thing that motivates people, they are a variety of things that motivates people.

There’s a difference in motivating people with economic incentives and being able to understand how they will behave in reaction to that incentive you know sometimes people can take completely irrational strategies.

Practically speaking, it's easier to predict the idea that people are more likely to take things that will make them more money than it is to predict that any specific bias is going to be very stable and robust across decades and across different cultures, the actors being people versus organizations versus robots. That's kind of probably one factor and another factor people miss is that it's not just about incentivizing people it's also about this idea that basically if you try to break Casper then you lose a lot of money and so even if you're an irrational actor if you have some particular amount of money well you can only do so much, there is a mathematical proof of an upper balance unlike the ratio between basically how much harm you can cause or how much money you can burn in order to achieve it and so like using basically economics as just a way of measuring actors in terms of the resources that they control is also just another aspect of this.

4. What is Inflation ?

4.1 TL;DR:

Inflation is a way of transferring wealth from the population to the owners of the money printing machine, the banks. Banks control governments, so they write the laws that keep the population enslaved. The Ubinodes token is a deflationary token, a finite number of tokens have been created and it is not possible to create more.

4.2 Definition:

Inflation is the rate at which the general level of prices for goods and services rises, while the purchasing power of the currency falls. Monetarism theorizes that inflation is related to the money supply of an economy. If the money supply is rapidly increased, prices spike and the value of currency fall.

5. What is Fractional Reserve ?

5.1 TL;DR:

Fractional reserve is creating inflation by artificially increasing the money supply, thus destroying the value of a currency. Cryptocurrency cannot be used in fractional reserve. Banks are scared to death by cryptocurrency because of fractional reserve. Once people realize the currency they have in their bank accounts can be seized at any time and its purchasing power is inexorably going to zero, they will move their wealth from banks to cryptocurrency, thus triggering the collapse of the banking sector through a domino effect.

5.2 Definition:

Fractional reserve banking is a banking system in which only a fraction of bank deposits are backed by actual cash on hand and are available for withdrawal. This is done to expand the economy by freeing up capital that can be loaned out to other parties. Banks are required to keep a certain amount of the cash depositors give them on hand available for withdrawal.

Here is how it works. If someone deposits $100, the bank (bank 1) can use that money to lend out to another party which can be a person or another bank (bank 2). The bank needs to keep only 10% of the amount lent out as a reserve. So for a $100 loan, the bank has to “back up” the loan with only $10. The term “fractional reserve” refers to the fraction of deposits held in reserve. Then with the initial $100, the bank will make 10 lines of $10 to be used as a fractional reserve for $100 loans each, making it a total of $1000 lent out. As we’ve seen above the party receiving the loan can be a bank, and as such can use that money to offer loans as well, while still benefiting from the fractional reserve mechanism. This means bank 2 can borrow $100 and lend out $1000 too. But now these $1000 are not backed up by $100 (10%) but by the initial $10 of the fractional reserve of bank 1.

Analysts reference an equation referred to as the multiplier equation when estimating the impact of the reserve requirement on the economy as a whole. The equation provides an estimate of the amount of money created with the fractional reserve system. The estimate is calculated by multiplying the initial deposit by one divided by the reserve requirement. So, using the example, the calculation is $500 million multiplied by one divided by 10%, or $5 billion. It should be noted that this is not how money is actually created. It is only a way to represent the possible impact of the fractional reserve system on the money supply, itself creating inflation.

6. What is a Derivative ?

6.1 TL;DR:

A derivative is a financial instrument used to manipulate prices. Futures contracts are the type of derivative used to manipulate prices of Bitcoin, gold and silver. The Ubinodes token is not traded on any futures contract, thus not subject to manipulation by future contracts. The Ubinodes token can be traded against fiat currencies and several other cryptocurrencies, not just Bitcoin alone.

6.2 Definition:

A derivative is a financial security with a value that is reliant upon or derived from an underlying asset or group of assets. The derivative itself is a contract between two or more parties based upon the asset or assets. Because a derivative is a category of security rather than a specific kind, there are several types of derivatives. Derivatives can be used for speculation in betting on the future price of an asset or in circumventing exchange rate issues.

Additionally, many derivatives are characterized by high leverage. Futures contracts are one of the most common types of derivatives. A futures contract is an agreement between two parties for the sale of an asset at an agreed upon price. The futures contract can be considered a sort of bet between the two parties.

6.3 Manipulation:

The Federal Reserve’s agents, the bullion banks (principally JPMorganChase, HSBC, and Scotia) sell uncovered shorts (“naked shorts”) on the Comex gold futures market to drive down an otherwise rising price of gold. By dumping so many uncovered short contracts into the futures market, an artificial increase in “paper gold” is created, and this increase in supply drives down the price.

This manipulation works because the hedge funds, the main purchasers of the short contracts, do not intend to take delivery of the gold represented by the contracts, settling instead in cash. This means that the banks who sold the uncovered contracts are never at risk from their inability to cover contracts in gold. At any given time, the amount of gold represented by the paper gold contracts (“open interest’) can exceed the actual amount of physical gold available for delivery.

In other words, the gold and silver futures markets are not a place where people buy and sell gold and silver. These markets are places where people speculate on price direction and where hedge funds use gold futures to hedge other bets according to the various mathematical formulas that they use. The fact that bullion prices are determined in this paper, speculative market, and not in real physical markets where people sell and acquire physical bullion, is the reason the bullion banks can drive down the price of gold and silver even though the demand for the physical metal is rising.

It works exactly the same with Bitcoin. In December 2017 two big Bitcoin futures appeared:

• CFE (Cboe Futures Exchange). Listed December 10, 2017.

• CME Group (Chicago Merchant Exchange). Listed December 17, 2017.

Strangely, Bitcoin crashed December 17, 2017.

7. What is Price Discovery ?

7.1 TL;DR:

Price discovery for the Ubinodes token occurs on a decentralized exchange, in a peer-to-peer fashion. It can not be manipulated by financial tools such as futures.

7.2 Definition:

Price discovery is the overall process, whether explicit or inferred, of setting the spot price of an asset or service, but most commonly the proper price of a security, commodity, or currency based on many factors. These include supply and demand, intangible factors such as investor risk attitudes, and the overall economic and geopolitical environment.

Simply put, it is where a buyer and a seller agree on a price and a transaction occurs. Basically, price discovery involves finding where supply and demand meet. In economics, the supply curve and the demand curve intersect at a single price, which then allows a transaction to occur. The shape of those curves is subject to many factors, from transaction size to background conditions of previous or future scarcity or abundance. Banks are manipulating price discovery mechanism using derivatives. They create bubbles, then burst the bubble, this is when the transfer of wealth occurs.

8. What is a Store of Value ?

A store of value is the function of an asset that can be saved, retrieved and exchanged at a later time, and be predictably useful when retrieved. More generally, a store of value is anything that retains purchasing power into the future.

A good Store of Value should:

• Retain its purchasing power over time.

• Be liquid enough when it needs to be sold.

• Can not be seized, frozen, intercepted, controlled, lost.

9. Gold and Silver.

Gold and silver in ancient times were currencies used as a medium of exchange. Then became a store of value. Banknotes were once a type of currency backed by gold and silver. In 1933, President Roosevelt and Congress began taking the US off the gold standard with a resolution nullifying the right of citizens to demand payment in gold for their currencies. People were also required to deliver all gold coin, gold bullion, and gold certificates owned by them to the Federal Reserve for a pre-set price.

In 1971, President Nixon announced the US was no longer in the business of converting dollars to gold at a fixed value, and the gold standard was abandoned completely. With the absence of a gold-backed dollar, US citizens inherited a fiat currency system backed by nothing but the trust in the government.

Money or “commodity money” can literally be any type of commodity, from seashells to stones, which can serve as a medium of exchange for goods, services, and payment of debts. Unlike government decrees and issued fiat currency, commodities have an intrinsic or “use value.” Before cryptocurrency, gold and silver were the optimum forms of money because of their properties. You can store a large amount of value in a very small area. Only gold and silver had maintained their purchasing power over the last 5000 years. This is because gold and silver are limited in quantity – there is only a finite amount of them on planet earth.

10. Can Banks stop Cryptocurrency ?

No. Cryptocurrency is based on the blockchain technology which is neutral, permissionless, trustless, decentralized, censorship-resistant, open-source, borderless, persistent, tamper resistant, cryptographically secure and often anonymous. You can take your country out of cryptocurrency but you can’t take cryptocurrency out of your country. A decentralized technology is like a starfish. If you cut its leg it will grow a new starfish.

When they tried to stop file sharing by taking down Megaupload, peer-to-peer sharing exploded and could never be stopped. You can’t stop new technology. Fax machines took over paper letters and emails took over fax machines. Digital streaming took over DVD sales. Cryptocurrency will take over the banking industry.

11. What is the Ubinodes token ?

The Ubinodes Token is our cryptocurrency used for transactions in our organization. The Ubinodes token is built on the Wavesplaform blockchain, which itself is derived from the source code of Bitcoin, improved upon to provide smart contracts and some other features.

11.1 Use cases:

Purchase any type of services businesses may need such as market research, website design, translation, accounting, customs clearance, storage management, recruitment, marketing campaigns etc. Buy physical goods during import/export projects. Keep wealth in security.

11.2 Underlying assets:

Intangible assets are made of the services defined above. Tangible assets are made of other cryptocurrencies and fiat currencies that have been used to purchase the Ubinodes token as well as all physical goods currently in transit and paid using the Ubinodes token.

See note 14.4 for the functions and features of the Ubinodes token.

11.3 Pairs.

The Ubinodes token can be traded against:

• Euros.

• USD.

• Turkish Lyra. (TRY)

• Waves.

• Bitcoin. (BTC)

• Etherum. (ETH)

• Litecoin. (LTC)

• Zcash. (ZEC) Anonymous.

• Bitcoin Cash. (BCH)

• Dash.

• Monero. (XMR) Anonymous.

12. The Ubinodes token as a Store of Value.

Intrinsic value is coming from the use cases and underlying assets. Now we’ll see how purchasing power is retained, if not increased over time.

12.1: Price-floor pegged to a currency basket.

As the Ubinodes network covers several countries, the demand for it is benchmarked by the exporter and importer relative to their local currency. No matter how the Ubinodes token is technically purchased, exchanged, OTC, whatever fiat or cryptocurrency, in the view of the holders, they’ll benchmark their Ubinodes according to their local currency and this will affect their behavior on the Ubinodes trading market.

We can therefore, assume that the Ubinodes token is pegged to a currency basket where no one controls it. The currency basket constantly evolves according to the organization’s activities, but as the Ubinodes token is pegged to a basket of fiat currencies instead of cryptocurrencies such as Bitcoin or Ethereum, this makes it a better option for investors and users when compared to other cryptocurrencies or fiat.

12.2: Resale price maintenance.

Exporters use the Ubinodes token to sell their physical goods. There are many advantages to this some of which are:

• It provides liquidity for the Ubinodes token.

• We can offer fiduciary services, as per the agreement.

• Instant and almost free international transactions.

• Possibly more stable than using other currencies, fiat or crypto, due to the price-floor pegged to a currency basket effect.

As the exporters and importers agree to use the Ubinodes token for their physical goods, this is introducing a resell price maintenance effect. This effect is self-maintained and comes from the system itself and not from any sort of grey agreement. Thus it can’t be used to control price instead it’s the opposite, it affects the price discovery mechanism.

The effect is: the exporter sells their goods for a price that matches his local currency and fixed at the date of the sales agreement with the importer. Then the importer buys the Ubinodes tokens in his local currency in order to transfer the corresponding value to the exporter. The exporter then receives the Ubinodes tokens once the goods are delivered, a witness or an oracle may be included in the contract to ensure all goes well between both parties. The Ubinodes tokens are released only when the importer receives the requested goods.

From the exporter’s perspective, the selling price of the Ubinodes tokens should be set so that the equivalent of local currency is fully recovered. The exporter is not going to sell the tokens at a loss. This, therefore, introduces a form of price maintenance where the value in fiat currency will be the same as it was when the importer bought them.

12.3: Resistance to market manipulation.

A speculative bubble is a spike in asset values within a particular industry, commodity, or asset class that is fueled by speculation as opposed to fundamentals of that asset class. A speculative bubble is usually caused by exaggerated expectations of future growth, price appreciation, or other events that could cause an increase in asset values. This speculation and resulting activity drives trading volumes higher, and as more investors rally around the heightened expectation, buyers outnumber sellers, pushing prices beyond what an objective analysis of intrinsic value would suggest.

This phenomenon is referred to as reflexivity. Reflexivity is the theory that a two-way feedback loop exists in which investors' perceptions affect that environment, which in turn changes investor perceptions. The reflexivity theory states that investors don't base their decisions on reality but their perceptions of reality. The actions that result from these perceptions have an impact on reality, or fundamentals, which then affects investors' perceptions and thus prices. The process is self-reinforcing and tends toward disequilibrium, causing prices to become increasingly detached from reality. The Ubinodes token is immune to such a phenomenon.

As the Ubinodes token will have been bought at a set date by the importer who has to transfer value to the exporter, the exporter has to wait several days or weeks till the requested goods are delivered and funds transferred from the fiduciary to its wallet and available for selling on an exchange. The exporter who has to sell part of its Ubinodes tokens, is on the one hand subject to the resale price maintenance effect and on the other hand subject to real-world expenses (s)he has to pay to get the production plant running. Therefore the exporter’s decisions are based on reality and business fundamentals and can’t be affected by a two-way feedback loop from the crypto market.

We can see that the Ubinodes token is one of the best Store of Value available today for anyone, whether individual or business, to store wealth.

13. Comparison.

14. Notes.

14.1 Functions and features of Money:

- No protection against control.

- It is a unit of account.

- It is not a medium of exchange as it can't be exchanged in a permissionless, borderless, censorship resistant manner. Commodity money is not used in international trades.

- It is not a standard of deferred payment.

- It is a store of value. Purchasing power depends on its underlying asset.

- Its scarcity depends on its underlying asset.

- It is portable.

- It is durable.

- It is divisible.

- It is fungible.

- It is not anonymous.

- It can get lost.

- Storage is difficult and expensive.

- Authenticity can be verified, but not easily.

- It is not tamper resistant.

- Usability depends on the underlying asset.

- It is not liquid.

- It has intrinsic value.

- The two intrinsic costs associated with money are transaction costs and the cost of storage.

- Can protect against hyperinflation.

- Can offer price floor protection.

- Can offer resale price maintenance protection.

- Does not offer resistance to market manipulation.

14.2 Functions and features of Currency:

- No protection against control.

- It is a unit of account.

- It is a medium of exchange.

- It is a standard of deferred payment.

- It is NOT a store of value. Purchasing power is inexorably going to zero due to inflation.

- It is not scarce.

- It is portable.

- It is durable.

- It is divisible.

- It is fungible.

- It is not anonymous.

- It can get lost.

- Storage is easy and inexpensive but unsecure.

- Authenticity can be verified, but not easily.

- It is not tamper resistant.

- It is easily and readily usable.

- It is highly liquid.

- It has NO intrinsic value.

- The two intrinsic costs associated with currency are transaction costs and the cost of inflation.

- Can't protect against hyperinflation. Quite the opposite in fact.

- Does not offer price floor protection.

- Does not offer resale price maintenance protection.

- Does not offer resistance to market manipulation.

14.3 Functions and features of Cryptocurrency:

- Protects against control. It cannot be seized, frozen, intercepted, traced.

- It is a unit of account.

- It is a medium of exchange.

- It is a standard of deferred payment.

- It can be a store of value. Purchasing power depends on:

• Scarcity.

• Use case(s).

• Underlying asset(s). - It can be scarce.

- It is portable.

- It is durable.

- It is divisible.

- It is fungible.

- It can be anonymous.

- It can not get lost.

- Storage is easy, inexpensive and secure.

- Authenticity is easily verified.

- It is tamper resistant.

- It is easily and readily usable.

- Liquidity depends on use cases. It can be as liquid as fiat currency.

- It can have intrinsic value.

- Intrinsic costs are so low that they can be considered null.

- Does protect against hyperinflation.

- Can offer price floor protection.

- Can offer resale price maintenance protection.

- Can offer resistance to market manipulation.

14.4 Functions and features of the Ubinodes Token:

- Protects against control. It cannot be seized, frozen, intercepted, traced.

- It is a unit of account.

- It is a medium of exchange.

- It is a standard of deferred payment.

- It is a store of value. The purchasing power of the Ubinodes token is constantly increasing as:

• It is a deflationary currency.

• Its use cases are constantly increasing.

• The value of the underlying assets are constantly increasing. - It is scarce.

- It is portable.

- It is durable.

- It is divisible.

- It is fungible.

- It is anonymous.

- It can not get lost.

- Storage is easy, inexpensive and secure.

- Authenticity is easily verified.

- It is tamper resistant.

- It is easily and readily usable.

- It is liquid.

- It HAS intrinsic value.

- Intrinsic costs are so low that they can be considered null.

- Does protect against hyperinflation.

- Does offer price floor protection.

- Does offer resale price maintenance protection.

- Does offer resistance to market manipulation.

Get better upvotes by bidding on me.

1 SP, 5 SP, 10 SP, custom amount

this description!This post has been upvoted for free by @nanobot with 5%! More profits? 100% Payout! Delegate some SteemPower to @nanobot: You like to bet and win 20x your bid? Have a look at @gtw and

📊📈Gerfin is the easiest place to buy, sell, and manage your cryptocurrency portfolio.

Follow our official website and social media pages below!

𝐎𝐟𝐟𝐢𝐜𝐢𝐚𝐥 𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://gerfin.eu