The between time Budget went back and forth, bringing no news at all for digital currency in India, to the failure of the crypto network. Between time money serve Piyush Goyal, while showing the Interim Budget 2019, didn't deliver the issues identifying with digital money in India.

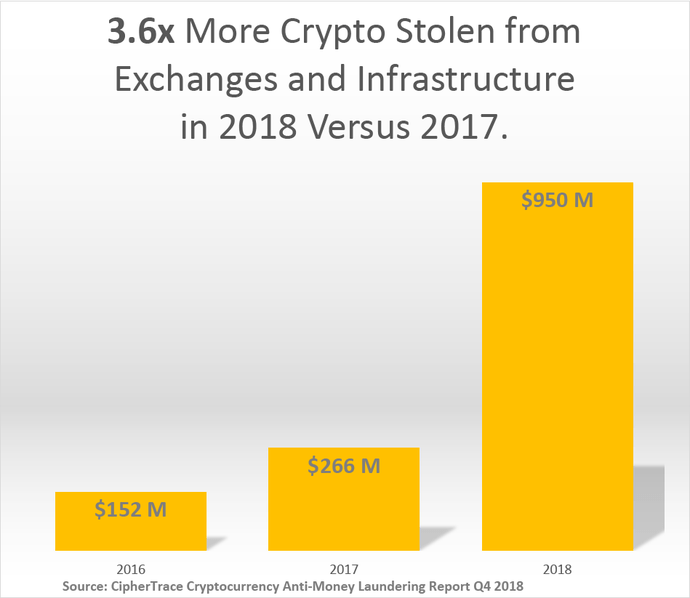

Notwithstanding Bitcoin's execution in 2018, crypto wrongdoing hit a record high, as per CipherTrace's new Cryptocurrency Anti-Money Laundering Report.

The report said that $1.7 Bn in digital currency was stolen and misled in 2018 — a sensational ascent in criminal movement regardless of a droop in the market.

Robbery from digital money trades represented most of the criminal movement: more than $950 Mn was stolen by programmers in 2018 — 3.6 occasions more than in 2017.

Over these burglaries, the exploration additionally demonstrated that financial specialists and trade clients lost in any event $725 Mn in digital money in 2018 to leave tricks, for example, false ICOs, fake trade hacks, and Ponzi plans.

The best 10 slanting crypto dangers, giving significant risk knowledge to anybody managing digital currency are:

SIM swapping: A fraud method that assumes control over an injured individual's cell phone to take accreditations and break into wallets or trade records to take digital currency.

Crypto tidying: another type of blockchain spam that dissolves the beneficiary's notoriety by sending digital currency from known cash blenders.

Approval avoidance: Nation expresses that utilization digital currencies to bypass sanctions and that has been advanced by the Iranian and Venezuelan governments.

Cutting edge crypto blenders: Money laundering administrations that guarantee to trade spoiled tokens for crisply mined crypto, in any case, as a general rule, purify digital currency through trades.

Shadow cash administration organizations (MSBs): Unlicensed MSBs that bank cryptographic money without the information of host monetary establishments, along these lines presenting banks to obscure hazard.

Datacenter-scale crypto-jacking: Takeover assaults that dig for digital currency at a monstrous scale and that have been found in server farms, including AWS.

Lightning Network exchanges: Enabling unknown bitcoin exchanges by going "off-chain" and now scaling to $2,150,000.

Decentralized stable coins: Stabilized tokens that can be intended for use as difficult to-follow private coins.

Email coercion and bomb dangers: Mass-modified phishing email crusades by digital scoundrels utilizing old passwords and life partner names and that request bitcoin. Bomb danger coercion tricks spiked in December.

Crypto looting ransomware: New malware conveyed by digital scoundrels that purges cryptographic money wallets and takes private keys while holding client information prisoner.

Iran's Central Bank Issues Draft Crypto Rules, Reverses Ban

As conjectured since a year ago, the Central Bank of Iran has discharged an early draft of its controls on cryptographic forms of money, switching a past boycott, yet at the same time forcing limitations on the utilization of the advanced cash inside the Islamic Republic, announced Aljazeera.

In a declaration made amid a yearly two-day Banking and Payments meeting, the Central Bank of the Islamic Republic of Iran likewise reported the suspension of the current prohibition on cryptographic forms of money with constrained limitations. For example, digital forms of money, for example, Bitcoin can be utilized just for worldwide installments and not inside the nation.

Iran is additionally in a procedure of building up its own cryptographic money and right now considers it to be the best fit course to maintain a strategic distance from US sanctions.

In the mean time, as per The New York Times, the United States Treasury has forced approvals and issued alerts to advanced commercial centers that purchase and offer Bitcoin and to organizations that offer PCs used to process Bitcoin exchanges. The US Treasury has coordinated that they ought not give administrations to Iranians.

Crypto wallets and trades are presently blocking purchase and-offer highlights for IPs having a place with Iran.

Malaysia To Regulate Crypto and ICOs

Subsequent to getting a gesture from Malaysian account serve YB Tuan Lim Guan Eng, the Securities Commission Malaysia has reported plans to direct the offering and exchanging of advanced resources, for example, cryptographic forms of money and ICOs.

The Commission has said that it will before long discharge rules that will build up the criteria for deciding fit and legitimacy of guarantors and trade administrators, exposure benchmarks and best practices in value revelation, exchanging tenets and customer resource insurance.

Those managing in cryptographic forms of money will be required to set up hostile to tax evasion and counter-psychological warfare financing (AML/CFT) guidelines, cybersecurity, and business coherence measures.

The important administrative system is relied upon to be propelled by end-Q1 2019.

In the interim, elsewhere in the world, the world's driving stock trade, Nasdaq, New York, is offering its restrictive reconnaissance innovation to seven cryptographic money trades, including Gemini and SBI Virtual Currency.

Be that as it may, as indicated by Nasdaq authorities, the screening procedure isn't simple and incorporates plan of action, KYC/AML, and trade administration and controls.

Hello @varunbanger! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko