Once bitcoin’s price went below its 2017 peak, the naysayers came out of the woodworks.

This cycle is different, the models are broken, the charts don’t work anymore, and a global depression will crush everything.

Sure.

“It can get worse” is always a great way to think about the downturns in this market. That way, your mind can focus on what other shoes might fall, what will push the market down, and what will make your situation worse.

Certainly, that covers broken data models and abrupt changes in human behavior, not just the cliche Tether implosion or FTX contagion.

Let’s not get so wrapped up in despair that we neglect to acknowledge the truth: if bitcoin’s price stays above $15,500, we’re already in a bull market.

Poppycock and balderdash!

Don’t get mad at me. I don’t make the rules. I don’t even like using the terms “bull” and “bear” to describe this market, but others do. As such, I must oblige.

Strictly speaking, bull markets start when prices go up. As long as bitcoin’s price stays above $15,500, it is “up” (by definition).

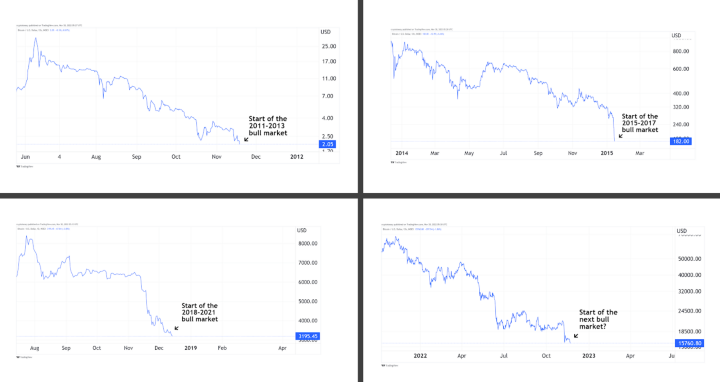

In fact, all bull markets start like this, when the price seems destined to go lower. See for yourself:

On-chain metrics, observable human behaviors, price action, and technical indicators match what we’ve seen at previous market bottoms.

As with previous bottoms, these signs can last months, with bitcoin’s price going sideways or bleeding out for just as long. The process can take a while to play out.

So...the bottom’s in?

No. The bottom is $0. It’s always $0.

Even if bitcoin’s price stays above $15,500 for the next year, people will tell you it’ll go lower. Recession, Tether, regulators, etc.

Despite everything that’s happened, they’ll tell you it can get worse.

They’re right.

We’ve had a lot of turmoil in 2022.

Guess what? Not as bad as it could’ve been. It can always get worse!

Just ask the US stock market (before investors see next quarter’s earnings and employment data).

Yet, Tether still exists. Many exchanges are still solvent. Digital Currency Group still makes money. Protocols still work.

Stop looking for bottoms

That can change in an instant. Especially now, when the conditions are rife for just such an outcome.

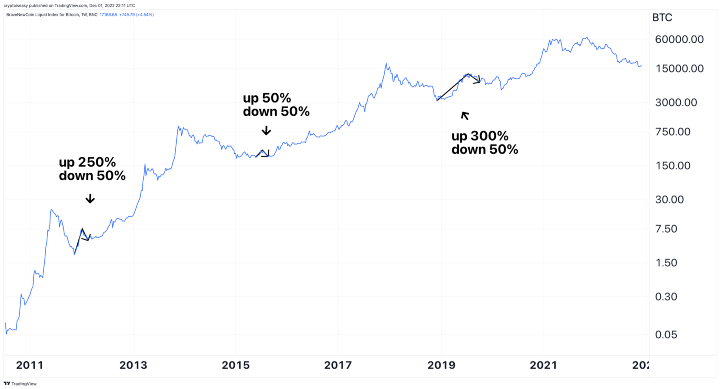

It’ll take years for everybody to agree that the bottom’s in, and even then nobody will know for sure. This chart shows you what people said from 2018 to 2021 — a bull market that nobody realized was happening until the end of 2020.

Once everybody agrees it’s a bull market, you might have the same risks as you do today. Tether might still exist. Many exchanges might still be solvent. Digital Currency Group might still make money. Protocols might still work.

And, in the future, like now, it can all change in an instant. You think the coast is clear, and you still get demolished by a Mack truck.

For that reason, I follow my plan. Sometimes you’re up, sometimes you’re down, and either way, you outpace most traders and people who dollar cost average.

If the end is near, here’s how it ends

At the end of previous generational bottoms, we saw a big boom, then a big crash. Like so:

Whenever it comes, I would expect today’s generational bottom will end in a similar way: a big upswing for 2–4 months, then a big downswing for 2–4 months, and then largely sideways action for a few months after that.

With so much supply in the hands of people who really want it and so few sellers left in the market, even a modest rise in the inflow of new money will drive prices very high, very quickly. Then the last stragglers will cash out and crash the market, but not enough to send bitcoin’s price lower than $15,500.

“It’s different this time” crowd should remember that in 2011, Europe had a debt crisis. In 2015, China’s stock market crashed and it devalued its currency. In 2018, the Fed raised interest rates and the US stock market dropped 20%.

Bitcoin’s price went up anyway.

You will know in hindsight

For all we know, we’re already in a bull market and we don’t even know it.

That seems crazy, but this is a crazy market. Bitcoin’s price goes up 100–300% in bear markets and down 30–50% in bull markets.

What will you do if bitcoin’s price never goes lower than it is today? At what price will you buy back into the market? What’s your sign that the worst is over? What if Tether never implodes? What if all of the crypto firms restructure or recover without further bankruptcies?

If you’re really that concerned, hedge with a short position. Lots of exchanges let you do this. I find BitOffer’s BTC3R product very easy to use, but you have plenty of options.

While you lose money when prices go up, you get to keep your crypto. When prices go down, you make money and don’t have to sell your crypto.

Learn how to do this.

(But not from me. I don’t trade and I manage risk with my portfolio strategy, not derivatives.)

It’s better to make a bad bet than sell your crypto or sit on your hands waiting for some price or signal that never comes.

This post is also available as an NFT on Mirror.

Mark Helfman publishes the Crypto is Easy newsletter. He is also the author of three books and a top bitcoin writer on Medium and Hacker Noon.

Learn more about him in his bio and connect with him on Superpeer.