Spending the day without hearing something about Cryptocurrencies or Bitcoin is getting somewhat tricky. Anywhere you go be it your workplace, pub or a family dinner someone is set to start a crypto discussion: one side thinks it’s all a scam, the other one calls it the greatest invention since sliced bread with a remaining pack of cautious yet enthusiastic oddballs stuck somewhere in the middle.

|| HYPE / hʌɪp/ (noun) — extravagant or intensive publicity or promotion.||

It does not require to be an evil genius to grasp the potential which the blockchain technology might unchain (no pun intended). However, there’s a large gap to bridge in order to make the potential manifest. But as someone has wisely said: “If there is a will, there is a way”. For now, let me extrapolate a bit and address the question “Is the Crypto HYPE real?”

First, I need some sort of a way to define real. For this, I’ll be using the Multitrait-Multimethod (MTMM) construct validation technique by Cambell and Fiske developed in late ‘60s . MTMM states that if one can prove a construct using multiple and unrelated measurement systems then the probability of it being real escalates with each additional measurement system. Put plainly, it is similar to blockchain consensus protocol with each measurement system acting as a node. If a significant amount of “nodes” agree on the concept — the construct should be perceived as valid. Let’s see whether we can find some converging HYPE factors.

→ Flagman

It seems logical to start the investigation from the roots. The largest cryptocurrency Bitcoin has just celebrated its 9th birthday and is not planning on going anywhere. Currently being valued at around $12,000 USD, crypto ‘patient zero’ has enjoyed 1,470% rise in 2017.

What is more, Bitcoin has been declared dead by mainstream media for more than 230 times but is still alive and kicking. Check the full list here. What doesn’t kill you, really makes you stronger and apparently, more expensive. Patient zero has passed the Hype check-up. It’s real.

→ Teammates

What Bitcoin started, many lined up to follow. The Crypto team currently counts over 1,400 Cryptocurrencies and Crypto tokens listed in Coinmarketcap.com — from Dentacoin, a token-based initiative to improve dental care worldwide, DogeCoin, a cryptocurrency started by internet trolls as a joke, to even things like SpankChain — a blockchain solution for the adult industry.

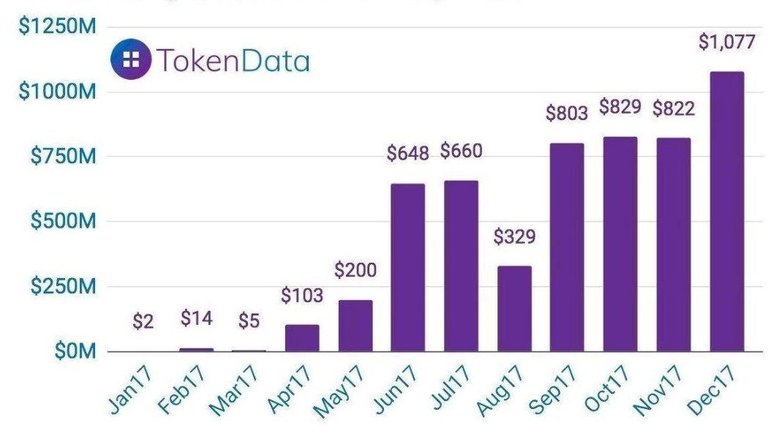

Cryptocurrency market grew drastically in 2017 from being valued at $18 billion in January to an impressive $590 billion in December 31st. From what it’s worth the ICO trend does not seem to slow down either and will likely continue in the upcoming future. Crypto team roster is getting longer and stronger but only looks won’t suffice: they will have to prove themselves in court. Ball is life and Crypto team is currently on HYPE.

→ Fear of Missing out (FoMo)

This well-crafted phrase is echoing about in Twitter and Reddit threads, is tossed around in Telegram pump & dump groups. Let’s not forget mainstream media covering early adopters making fortunes and Winklevoss twins becoming first Bitcoin billionaires late last year.

It seems the FoMo is getting so extreme that largest Crypto exchanges like Bittrex and Coinbase cannot handle trading volumes and have suspended the registration of new accounts.

Waiting queues are getting longer than during the release of a new Iphone. At least you don’t have to camp in a tent on a curb beside an Apple store waiting to get the next best thing. Demand curve is not being met by supply in the market and that’s an obvious trigger for further market growth.

The other thing facilitating these cash inflows is the ease of participating in the Crypto economy. From now on any individual with an internet connection and some basic literacy skills can become a Crypto investor.

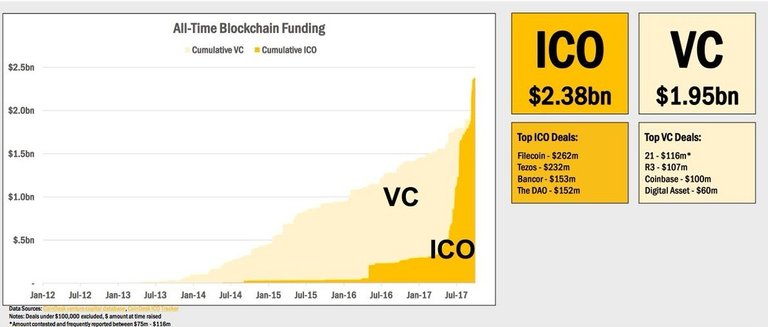

Sounds fancy, but it’s not. What was previously the industry of Venture Capital funds, is now opening its gates to society at large. Cumulative ICO investment into blockchain has overcame VC funds during Q3 of 2017. With more and more startups choosing tokenization as an effective source of fundraising and Crypto newcomers flooding the market, the tendency is likely to continue. ICOs are here to stay and flourish.

A recent study in South Korea found that more than 30% of local office workers have Cryptocurrency holdings. One might argue that Koreans are the most advanced country in Crypto adoption but 30% is just unheard of. It is not a fraction of naive lunatics living on the fringe anymore. It’s getting big. This is especially relevant during times with 0% interest rates and cheap fiat money.

I mean my local bank offered me 0.2% annual interest rate on a 6-month terminated deposit meanwhile my colleague is lending his Cryptocurrency for 0.2% per day. Go figure. There is less and less incentive to save through traditional means and you only need to see your investment double in a few days for you to become a believer. Spillover effect is going to flow from country to country and will enforce the demand with an even greater vigor.

Ari Paul, partner of BlockTower Capital, a Cryptocurrency firm engaged in portfolio management, predicted the number of people involved in Crypto to triple by the end of 2018 and constitute 3% of the global population. That would come to somewhere around 230–280 million crypto users. That’s 5 South Koreas. Is it a coincidence that FIVE rhymes with HYPE? Don’t think so.

→ CryptoNationalism

We are at this curious state of Crypto evolution when governments are scrambling for tickets to board the HYPE train. Regulators are keen on finding ways to tax Crypto gains and some nations are even contemplating to issue State-backed digital coins for varying reasons. For example, Estonia wants to further its e-residency programme and attract entrepreneurs to the economy by providing legislative and accountability benefits, Russia is creating the CryptoRuble to bypass international sanctions and Venezuela’s eccentric president Maduro is about to launch “Petro” — wait for it… — oil/gas/gold & diamond-backed Cryptocurrency to stabilize country’s foreign exchange reserves. Individuals, companies, institutional investors and now even governments are stepping into the ecosystem.

Critics will jump in front of the train and exclaim that cryptocurrencies are all about decentralization, giving power back to the people and governments should not interfere. I am not here to disagree, but the point of HYPE being real is illustrated perfectly, won’t you concur? When national governments are considering innovation it usually means that money, labor, and resources are going to be thrown into space.

→ No top without Pop

Say what you want but a phenomenon is considered underground until the Pop culture steps in. For mainstream adoption to overtake the market we need some celebrity action. I’d say we are already there or just coming to the threshold.

We got Snoop Dogg coming to ICO parties and football superstar Leo Messi joining a blockchain smartphone project as an ambassador. There is even a cryptocurrency girl band in Japan (where else, if not Japan) and if you want to attend any of their concerts you will have to pay for the ticket using Crypto. If a band of Japanese schoolgirls using Mexican wrestling masks denominated in Cryptocurrencies does not persuade you, probably nothing will.

Aforementioned 5 areas seem to be converging towards the same direction. The MTMM method would have me define the HYPE as real. Digital currencies are gaining more awareness and increasing number of people are joining the community every day. It’s refreshing to see an industry that is expanding so rapidly during times of global economic stagnation. I will be there among the oddballs enjoying the ride because there are no brakes on the HYPE train. You should too.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@ORCA_Alliance/2018-is-the-crypto-hype-real-8affad6d83ea