Open Banking is in play right now, and citizens all over European Union are about to feel its effects. The game is banking but the rulebook has been recently updated. The following segment will discuss how Open Banking came to the arena, and how it’s going to affect your experience when dealing with banks.

The Backstory

Open Banking is not a new concept by any means. The directive making this possible (in the EU) was voted in as early as 2015, is called the PSD2 and has already come into enforcement in January of this year.

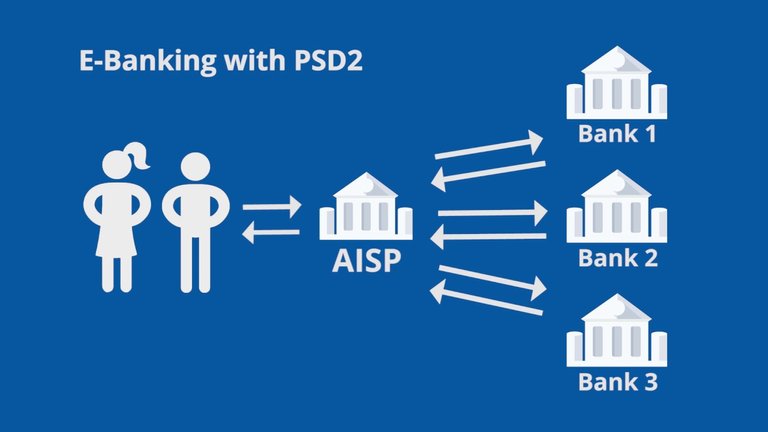

At its core, Open Banking enables users to access their data and banking services outside of particular banking application or webpage. Imagine you had to open your banking app and make manual transactions, list debtor/creditor information, verify the transaction everytime you bought something online.

Tedious, right? Well, App-Stores have a Buy Now button which bypasses that.

Similarly, Open Banking is bypassing the need to access your specific bank’s app or website to deposit, transfer or budget money. It even extends to things like opening a new account or switching providers — activities almost in all cases requiring a physical visit to the bank’s branch.

The PSD2 directive is simplifying everything that is banking related to all end-consumers, giving birth to an entirely new path to manage finances.

Running on Fumes: Banks will need to step up

So now that we have all these new ways to integrate banking services, and now that banks are required to grant access to all information via APIs, what does this mean for the banking industry exactly?

COMPETITION. It means competition.

FinTech startups will be able to improve the quality of banking services by bringing new ideas and innovation to the table. The aim of Open Banking is to make banking simpler, cheaper and easier for the end-consumers. Existing financial service providers are about to face an inflow of companies providing better banking solutions than what is available today.

Due to this, closed systems of single bank-provided applications and services may become obsolete. During this critical time for banks, many of their individual departments stand to lose or gain users depending on the strategies they’ll select and how fast they are to respond. Users will have a much easier time creating accounts with different banks, they will have complete market information and provider switching costs will become minimal.

On the user-side of things, the only requirements are 5 minutes of spare time and an internet connection. People will no longer have to physically be present at the bank and fill in the paperwork in order to become a client. If banks are not quick to react it may lead to a ‘mass migration’ of people from one provider to another.

The Fragmentation

This movement is likely to create a subdivision within banks, where certain banks are better at providing one service in comparison to others. For example, perhaps the payment processing division of Nordea might be faster, cheaper and more effective than that of Barclays, Lloyds Bank, and others. This will attract customers who need such services to Nordea, increasing their user base.

Thinking outside the box, it is also likely that individual providers will also make their way into the market. These will be providers which are able to serve customers with a single service and do it in such a way that it will abolish existing competitors. To use another example, a company startup may have their focus on payment initiation or lending, thus making these particular processes very cost-effective. Although people would already have accounts with one bank, nothing will stop them from switching to the best alternative.

Crossing the Crypto Bridge

So open banking is all the rage, but what else is? That’s right, cryptocurrency!

Despite the ‘bearish’ market trends which have been visible lately, the services and future potential which crypto projects provide cannot be ignored anymore. Judging from the attention cryptocurrencies and the blockchain tech is getting from all layers of the society — it’s not going anywhere anytime soon.

Bitcoin and other cryptocurrencies were originally intended to be used as a means of quick and efficient payment and transfer of value. Not that hard to recognize some similarities with Open Banking, is it? Blockchain concepts are all based on trustless networks where everyone owns a copy of a ‘ledger’ thus allowing a Peer-2-Peer system to take care of any discrepancies. As this industry grows, the focus is being shifted slightly, with each individual startup having its own primary goal whilst still making use of the relevant blockchain technology. Projects like Ethereum are making it easier for startups to enter the industry using the accessible ERC-20 blockchain.

And now it is clear that Open Banking is aiming to make it easier for startups to enter the banking industry. So just one question remains… “Who will be there to bridge the gap between banks & crypto?”

ORCA Platform

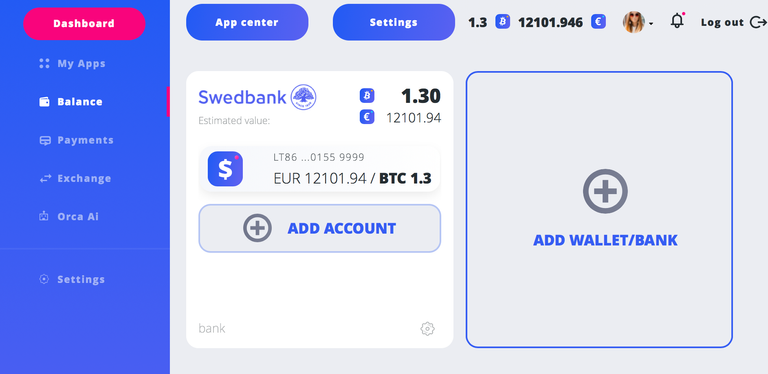

One of the European startups taking on the task is ORCA Alliance. ORCA is creating an Open Banking platform and has been eyeing this future roadmap for quite some time. Thus they are already a few steps ahead. Making perfect use of the PSD2 directive and Open Banking at just the right time, ORCA aims to provide customers with the best available services and making the user experience convenient.

On the banking and fiat side, ORCA will provide its users with options where they can choose which provider to use when processing payments, which provider to use when applying for loans, and which provider to use when depositing/withdrawing crypto.

On the crypto side, the platform will allow its users to select between largest exchanges such as Binance, Bittrex, Kraken when buying or selling. It will permit one to easily realize transactions and place orders on the market while benefitting from the cheapest available rates.

User interface dimension will be executed with an already overly-familiar “App-Center” framework which will list relevant offerings and will enable users to purchase dApps from cryptocurrency exchange providers and banking providers. You can see an MVP of our platform already on ORCA website.

The world of finance is getting more decentralized and informed. IT-based solutions are becoming serious competitiors for industry's dinosaurs. I believe that community-oriented initiatives and endeavors are going to come out on top delivering ease-of-use value to consumers, an area where conventional banks have been famously lacking in.

Hey @vizier, the markets are pretty crazy right now. Crypto is back to a weird space but I know long term it's still what we're all hoping it will be! Cheers

Be advised @vizier

The comment from @exxodus has been identified as being copy/pasted comment spam intended to trick their targets into upvoting them. Please, refrain from doing so. They have been reported to @steemcleaners and we are giving users a heads-up. We have identified 234 comments identifed as having a 75% similarity. If there were rewards on the spam, I have used up to a full weight downvote to neutralize them! Please, feel free to contact @anthonyadavisii if you have any questions about this process.