A major update coming out this Tuesday regarding some new partnerships and tokenomics update for the project. There is a lot of important information included so spare the time and have a read. It will serve you well. So without further ado let’s start, shall we?

Shaking hands with Tomochain, start working together

ORCA Alliance, an Open Banking platform for technology-led personal finance pivots and relocates development plans to Tomochain. A technologically-advanced blockchain infrastructure fulfills multiple needs that ORCA can utilize during development.

Tomochain’s infrastructure has few-second transaction confirmation times with minimal fees allowing ORCA to benefit from its high throughput system. A key function of ORCA’s token is to act as a vehicle that authenticates transactions between different service terminals through APIs allowing information exchange.

The users at the same time will be able to enjoy the efficiencies of fast and reliable performance manifested through sending and receiving financial information through the network’s internal gateways.

To celebrate the partnership ORCA is going to be accepting TOMO tokens during their token sale offering an extra 5% bonus as an incentive for contributions made in the partner’s native currency.

Ensuring connection: Long Vuong, co-founder of NEM blockchain and CEO of Tomochain joins ORCA Alliance for an advisory role

Long Vuong is an established technology architect in the Asian market, considered to be a crypto celebrity in certain regions. He is the former CEO of CityMe, a consumer app for vendor rating and discount facilitation.

Moreover, L. Vuong acted as a product lead and managed 5 senior engineers to program NEM blockchain as a part of his Ph.D. candidacy in the University of Massachusetts. NEM has a market capitalization just south of $1.6 billion.

Given the substantial weight of Mr. Vuong’s persona, we’re going to attribute a separate featured interview about him and how will he contribute to ORCA in further readings.

Amplify Capital backing up ORCA

Amplifi Capital, a blockchain-oriented fund partaking in blockchain-disruptor projects is jumping on board the ORCA express and will act as a strategic contributor to our platform development. Besides monetary support, Amplifi also has competence in helping to foster partnerships and help establish business partnerships.

Amplifi has already backed blockchain projects such as The Key, Matrix Chain, ICON, Red Pulse, Nucleus Vision and others.

Tokenomics and sale update: Gearing up for August 6th

As you’re well aware right now ORCA is launching it’s token sale on August 6th. After discussing with our strategy advisors and backers, we have revamped our project tokenomics to better follow development plans.

Sale infrastructure update

ICO will be held in two rounds: 1st round (Aug 6th — Aug 12th) & 2nd round (Aug 27th — Sep 6th)

20% bonus will be available for people who passed the KYC for the first 48h. If you haven’t yet — go and finish whitelisting: www.orcaalliance.euAccepted currencies: (ETH|BTC|TOMO)

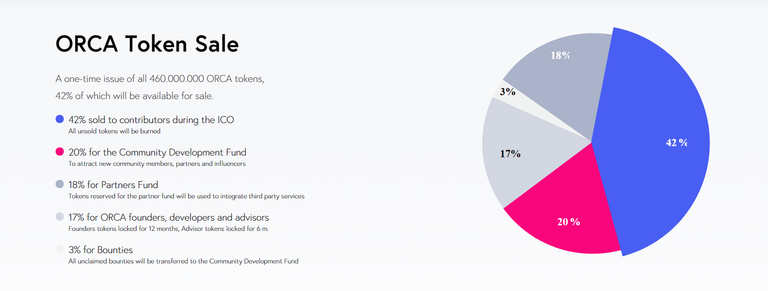

Token distribution changes: Partner collaboration fund

We’re introducing a new category in our token distribution area to include a partner fund. Tokens reserved for the partner fund will be used to integrate third-party protocols into the ORCA system. As we are building a marketplace for dApps, financial services, and payment terminals, project demands an allocation of ORCA tokens for that specific purpose.

Updated token allocation structure:

3% Bounty

17% TEAM/Advisors/Founders (Locked for 12 months)

20% Community Fund

18% Partners / 3rd-party service integration Fund

42% Available for purchase ($9,800,000 USD)

Community fund and user acquisition reward system

20% of ORCA tokens generated are attributed to the community fund. These tokens will be given away to community members an incentive to join and start using the platform. They will have a referral system to initiate operations themselves and invite their friends to participate too.

Congratulate on joining — receipt of $15 worth of ORCA tokens to start using services listed on the platform, start connecting wallets, exchanges and other financial accounts through API key generation.

Bring a friend initiative — you must already know this. Get a fellow to join the platform and start using it and get yourself a bunch of tokens to be used inside the infrastructure.

Community fund tokens will only be functional within ORCA’s ecosystem and will not be allowed to be withdrawn from the platform.

Once used, community fund tokens will be burned and never brought back to facilitate operations. The aim of the community.

Security update: measures for keeping your accounts, passwords and data safe

We all know that security in the crypto space is a topic №1. Therefore, we are giving you an update to showcase what measures does ORCA platform implement in order to protect valuable information.

Even our system architect, CTO anyone else will not have access to your account. The platform layer is fully-compliant with OWASP requirements, we encode client API keys through the user’s master password about which we maintain no records.

Bad things tend to happen once in a while but we are taking action and thinking even about the worst case scenario. In the unlikely event that someone steals the database and gets a hold of the master password, there will be no way to decrypt account information thanks to AWS CloudHSM infrastructure we are utilizing when building the platform.

To ensure secure logins from the user side, we will employ a 2FA method and all platform modules will be layered through SSL protocol. All back-end microservices are hidden up and away in a VPC (Virtual Private Cloud) making them DDOS and Bruteforce attack-resistant.

All account data and transaction histories are depersonalized and accessible only after inputting the master password. If the password is lost, the data cannot be reached, downloaded or retrieved in any other way. It will require a set-up of a new account each time a distracted user loses control or memory of his master password.

For banking services, user authentications and verification will employ international standards widely approved and used by traditional service providers. One of which is a fraud activity detection which analyses user data points to find patterns of irregular actions: uncommon location, frequent payments to new vendors, unidentified supplier, large order values and others which will immediately trigger security notification alerts.

What is more, a failsafe system is being developed as we speak.

This auxiliary safety mechanism system will transition all executed operations to the pipeline and will require additional confirmation for full activation. This will enable to retract fraudulent/unwanted operations before they are final.

Liquidity protocol for smooth inter-token actions

As ORCA integrates various third-parties into its dApp store for financial services, the uninterrupted transition between service-native tokens and ORCA tokens is among top priorities.

In order to save ORCA users from hustling through different exchanges in search of the third party service providers’ tokens, we’ve developed a user-friendly solution — ORCA liquidity protocol. This will cure headaches for ORCA users and will allow bypassing the need for how to convert held crypto tokens to ORCAs and back. Our infrastructure will take care of that.

To sum up, thanks to an ERC-777 standard, ORCA token can be used both as a validation and as a utility/payment token. ORCA Token solves both security and user acquisition challenges and acts as a vital part of the platform ecosystem.

We launch our token sale on August 6th — head to www.orcaalliance.eu to save your bonus. You must finish the KYC to successfully whitelist and be eligible for 20% bonus. It will be available only during the first 48 hours of the crowdsale.

Have any questions? Engage directly with the team in ORCA Telegram.

Twitter | Facebook | Instagram| Reddit | LinkedIn | Website | Github |